Time Magazine 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

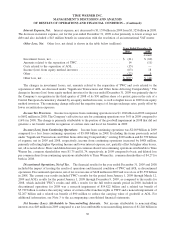

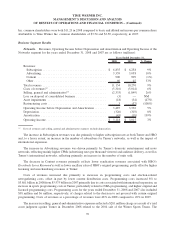

included a fourth quarter $104 million write-down to the net realizable value relating to a program licensed by

Turner from Warner Bros. that the Company is attempting to re-license to a third party. The write-down of this

licensed program was partially offset by $27 million of intercompany profits that have been eliminated in

consolidation, resulting in a net charge to Time Warner of $77 million. Costs of revenues as a percentage of

revenues were 48% in both 2009 and 2008.

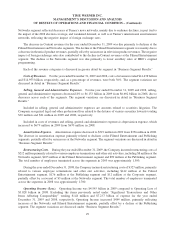

The decrease in selling, general and administrative expenses for the year ended December 31, 2009 reflected a

$281 million charge in 2008 as a result of a trial court judgment against Turner related to the 2004 sale of the Atlanta

Hawks and Thrashers franchises (the “Winter Sports Teams”). Excluding the impact of this charge, selling, general

and administrative expenses increased slightly due to increased costs associated with the consolidation of HBO

LAG, partially offset by lower marketing expenses.

As previously noted under “Significant Transactions and Other Items Affecting Comparability,” the 2009

results included a $52 million noncash impairment of intangible assets related to Turner’s interest in a general

entertainment network in India. The 2008 results included an $18 million noncash impairment of GameTap, an

online video game business, and a $3 million loss on the sale of GameTap. In addition, the 2009 results included

restructuring costs of $8 million at HBO primarily related to severance, and the 2008 results included a $3 million

reversal of 2007 restructuring charges related to senior management changes at HBO due to changes in estimates.

Operating Income before Depreciation and Amortization increased primarily due to an increase in revenues.

Operating Income increased primarily due to the increase in Operating Income before Depreciation and

Amortization, partly offset by higher amortization expense primarily related to the consolidation of HBO LAG.

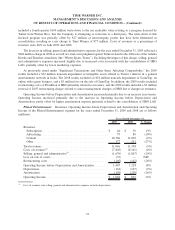

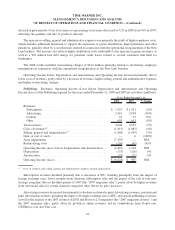

Filmed Entertainment. Revenues, Operating Income before Depreciation and Amortization and Operating

Income of the Filmed Entertainment segment for the years ended December 31, 2009 and 2008 are as follows

(millions):

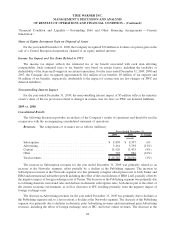

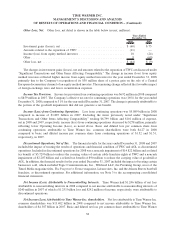

2009 2008 % Change

Years Ended December 31,

Revenues:

Subscription ...................................... $ 44 $ 39 13%

Advertising ....................................... 79 88 (10%)

Content ......................................... 10,766 11,030 (2%)

Other ........................................... 177 241 (27%)

Total revenues ...................................... 11,066 11,398 (3%)

Costs of revenues

(a)

.................................. (7,805) (8,161) (4%)

Selling, general and administrative

(a)

...................... (1,676) (1,867) (10%)

Loss on sale of assets ................................. (33) — NM

Restructuring costs ................................... (105) (142) (26%)

Operating Income before Depreciation and Amortization ....... 1,447 1,228 18%

Depreciation ........................................ (164) (167) (2%)

Amortization ....................................... (199) (238) (16%)

Operating Income .................................... $ 1,084 $ 823 32%

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

32

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)