Time Magazine 2009 Annual Report Download - page 47

Download and view the complete annual report

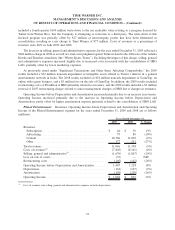

Please find page 47 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Subscription revenues declined primarily due to softening domestic newsstand sales and declines in domestic

subscription sales, both due in part to the effect of the current economic environment, as well as decreases at IPC

resulting primarily from the negative impact of foreign exchange rates.

Advertising revenues decreased primarily due to declines in domestic print Advertising revenues and

international print Advertising revenues, including the effect of foreign exchange rates at IPC, and lower

online revenues. These declines primarily reflect the current weak economic conditions and increased

competition for advertising dollars.

Other revenues decreased due primarily to decreases at the non-magazine businesses, including Southern

Living At Home, which was sold during the third quarter of 2009, and Synapse.

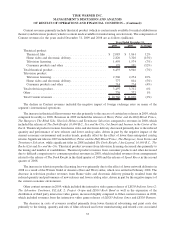

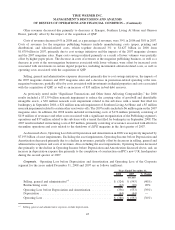

Costs of revenues decreased 21%, and, as a percentage of revenues, was 39% in both 2009 and 2008. Costs of

revenues for the magazine and online businesses include manufacturing costs (paper, printing and distribution) and

editorial-related costs, which together decreased 19% to $1.310 billion in 2009 from $1.627 billion in 2008,

primarily due to cost savings initiatives, lower printing and paper costs related to a decline in volume and lower

costs at IPC due primarily to the effect of foreign exchange rates. In addition, costs of revenues at the non-magazine

businesses declined as a result of lower revenues.

Selling, general and administrative expenses decreased due to cost savings initiatives, a decrease at IPC due

primarily to the effect of foreign exchange rates, lower marketing expenses, the effect of the sale of Southern Living

At Home and lower bad debt reserves related to newsstand wholesalers, partly offset by higher pension expense and

costs associated with the acquisition of QSP.

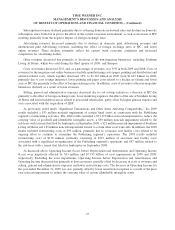

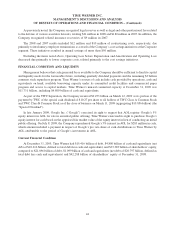

As previously noted under “Significant Transactions and Other Items Affecting Comparability,” the 2009

results included a $33 million noncash impairment of certain fixed assets in connection with the Publishing

segment’s restructuring activities. The 2008 results included a $7.139 billion noncash impairment to reduce the

carrying value of goodwill and identifiable intangible assets, a $30 million noncash impairment related to the

sub-lease with a tenant that filed for bankruptcy in September 2008, a $21 million noncash impairment of Southern

Living At Home and a $5 million noncash impairment related to certain other asset write-offs. In addition, the 2009

results included restructuring costs of $99 million, primarily due to severance and facility costs related to an

ongoing effort to continue to streamline the Publishing segment’s operations. The 2008 results included

restructuring costs of $176 million, primarily consisting of $119 million of severance and facility costs

associated with a significant reorganization of the Publishing segment’s operations and $57 million related to

the sub-lease with a tenant that filed for bankruptcy in September 2008.

As discussed above, Operating Income (Loss) before Depreciation and Amortization and Operating Income

(Loss) were negatively affected by $33 million and $7.195 billion of asset impairments in 2009 and 2008,

respectively. Excluding the asset impairments, Operating Income before Depreciation and Amortization and

Operating Income decreased due primarily to lower revenues, partially offset by decreases in costs of revenues and

selling, general and administrative expenses and lower restructuring costs. The decrease in Operating Income for

the year ended December 31, 2009 was also partially offset by lower amortization expense as a result of the prior

year noncash impairment to reduce the carrying value of certain identifiable intangible assets.

35

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)