Time Magazine 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On March 10, 2009, Anderson News L.L.C. and Anderson Services L.L.C. (collectively, “Anderson News”)

filed an antitrust lawsuit in the U.S. District Court for the Southern District of New York against several magazine

publishers, distributors and wholesalers, including Time Inc. and one of its subsidiaries, Time/Warner Retail

Sales & Marketing, Inc. Plaintiffs allege that defendants violated Section 1 of the Sherman Antitrust Act by

engaging in an antitrust conspiracy against Anderson News, as well as other related state law claims. Plaintiffs are

seeking unspecified monetary damages. On December 14, 2009, defendants filed motions to dismiss the complaint.

The Company intends to defend against this lawsuit vigorously.

On January 17, 2002, former AOL Community Leader volunteers filed a class action lawsuit in the U.S. District

Court for the Southern District of New York against the Company, AOL and AOL Community, Inc. under the

Employee Retirement Income Security Act of 1974. The complaint was later amended to name the Administrative

Committees of the Company and AOL. While the Company has reported on this case in its notes to financial

statements and still intends to defend against this lawsuit vigorously, following the separation of AOL from the

Company in December 2009, the Company does not view the remaining claims brought against the Company or its

Administrative Committee to be material. As a result, the Company does not intend to include disclosure regarding

this matter in its future notes to financial statements.

From time to time, the Company receives notices from third parties claiming that it infringes their intellectual

property rights. Claims of intellectual property infringement could require Time Warner to enter into royalty or

licensing agreements on unfavorable terms, incur substantial monetary liability or be enjoined preliminarily or

permanently from further use of the intellectual property in question. In addition, certain agreements entered into by

the Company may require the Company to indemnify the other party for certain third-party intellectual property

infringement claims, which could increase the Company’s damages and its costs of defending against such claims.

Even if the claims are without merit, defending against the claims can be time-consuming and costly.

The costs and other effects of pending or future litigation, governmental investigations, legal and administrative

cases and proceedings (whether civil or criminal), settlements, judgments and investigations, claims and changes in

those matters (including those matters described above), and developments or assertions by or against the Company

relating to intellectual property rights and intellectual property licenses, could have a material adverse effect on the

Company’s business, financial condition and operating results.

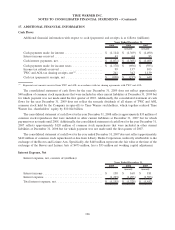

16. RELATED PARTY TRANSACTIONS

The Company has entered into certain transactions in the ordinary course of business with unconsolidated

investees accounted for under the equity method of accounting. These transactions have been executed on terms

comparable to those of transactions with unrelated third parties and primarily include the licensing of broadcast

rights to The CW for film and television product by the Filmed Entertainment segment and the licensing of rights to

carry cable television programming provided by the Networks segment.

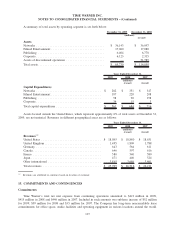

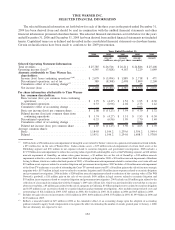

Income (expense) resulting from transactions with related parties consists of (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Revenues ............................................. $ 261 $ 389 $ 329

Costs of revenues ....................................... (10) (8) (35)

Selling, general and administrative .......................... (17) (12) (10)

125

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)