Time Magazine 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

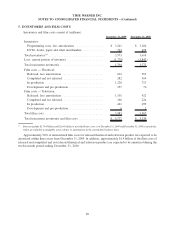

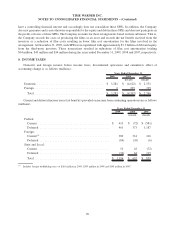

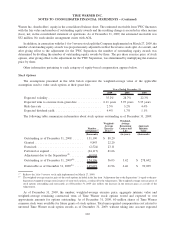

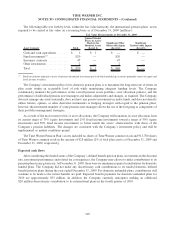

Changes in the Company’s uncertain income tax positions, excluding the related accrual for interest and

penalties, from January 1 through December 31 are set forth below (millions):

2009 2008

(recast)

Beginning balance ......................................... $ 1,954 $ 1,656

Additions for prior year tax positions ........................... 130 194

Additions for current year tax positions ......................... 227 193

Reductions for prior year tax positions .......................... (273) (65)

Settlements .............................................. (66) (13)

Lapses in statute of limitations ................................ (19) (11)

Ending balance ........................................... $ 1,953 $ 1,954

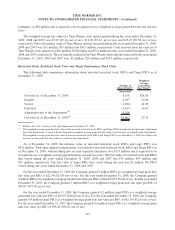

During the twelve months ended December 31, 2009, the Company recorded interest reserves through the

statement of operations of approximately $88 million and made interest payments in connection with settlements

reached during 2009 of approximately $11 million. During the year ended December 31, 2008, the Company

recorded interest reserves through the statement of operations of approximately $54 million and made interest

payments in connection with settlements reached during 2008 of approximately $14 million.

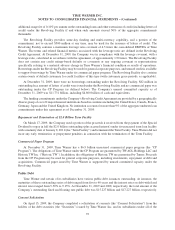

During 2009, the Internal Revenue Service (“IRS”) substantially concluded its examination of the Company’s

federal income tax returns for the 2002 — 2004 tax years, which did not result in the Company being required to

make any material payments. One matter relating to the character of certain warrants received from a third party has

been referred to the IRS Appeals Division. The Company believes its position with regard to this matter is more

likely than not to be sustained. However, should the IRS prevail, the additional tax payable by the Company would

be approximately $70 million.

The Company and its subsidiaries file income tax returns in the U.S. and various state and local and foreign

jurisdictions. The IRS is currently conducting an examination of the Company’s U.S. income tax returns for the

2005 through 2007 period. The tax years that remain subject to examination by significant jurisdiction are as

follows:

U.S. federal ......................................... 2002 through the current period

California ........................................... 2005 through the current period

New York State ...................................... 2000 through the current period

New York City ....................................... 1997 through the current period

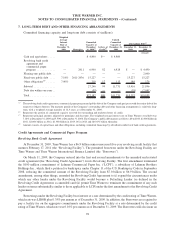

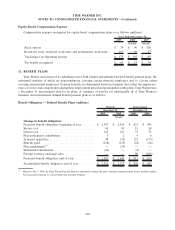

9. SHAREHOLDERS’ EQUITY

Spin-Offs of TWC and AOL

In connection with the TWC Separation, the Company recognized a reduction of $7.989 billion to shareholders’

equity, including $1.167 billion attributable to noncontrolling interests. In connection with the AOL Separation, the

Company recognized a reduction of $3.202 billion to shareholders’ equity.

Common Stock Repurchase Program

On July 26, 2007, Time Warner’s Board of Directors authorized a common stock repurchase program that

allows the Company to purchase up to an aggregate of $5 billion of common stock. Purchases under this stock

repurchase program may be made from time to time on the open market and in privately negotiated transactions.

The size and timing of these purchases are based on a number of factors, including price and business and market

conditions. From the program’s inception through December 31, 2009, the Company repurchased approximately

93 million shares of common stock for approximately $4.0 billion pursuant to trading programs under Rule 10b5-1

99

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)