Time Magazine 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

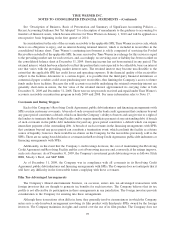

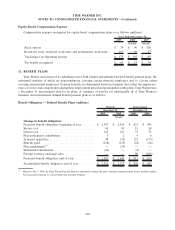

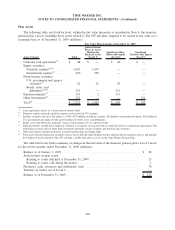

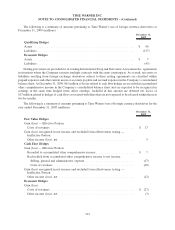

Equity-Based Compensation Expense

Compensation expense recognized for equity-based compensation plans is as follows (millions):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Stock options .......................................... $ 74 $ 96 $ 108

Restricted stock, restricted stock units and performance stock units . . 101 96 87

Total impact on Operating Income .......................... $ 175 $ 192 $ 195

Tax benefit recognized ................................... $ 67 $ 73 $ 74

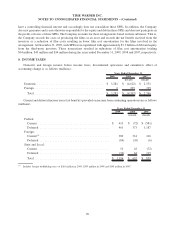

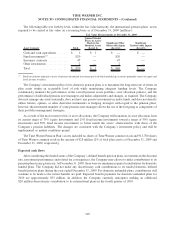

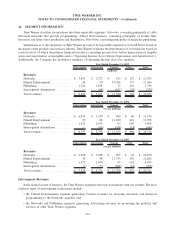

11. BENEFIT PLANS

Time Warner and certain of its subsidiaries have both funded and unfunded defined benefit pension plans, the

substantial majority of which are noncontributory, covering certain domestic employees and, to a lesser extent

covering international employees. Pension benefits are determined based on formulas that reflect the employees’

years of service and compensation during their employment period and participation in the plans. Time Warner uses

a December 31 measurement date for its plans. A summary of activity for substantially all of Time Warner’s

domestic and international defined benefit pension plans is as follows:

Benefit Obligation — Defined Benefit Plans (millions)

2009 2008 2009 2008

December 31,

Domestic

December 31,

International

(recast)

Change in benefit obligation:

Projected benefit obligation, beginning of year ....... $ 2,347 $ 2,324 $ 623 $ 945

Service cost ................................. 65 80 13 24

Interest cost ................................. 142 141 37 51

Plan participants contribution .................... 3 2 4 6

Actuarial (gain)/loss ........................... 98 (51) 172 (175)

Benefits paid ................................ (128) (115) (24) (24)

Plan amendments

(a)

............................ — (34) — —

Settlements/curtailments ........................ (26) — (4) —

Foreign currency exchange rates .................. — — 90 (204)

Projected benefit obligation, end of year ............ $ 2,501 $ 2,347 $ 911 $ 623

Accumulated benefit obligation, end of year ......... $ 2,316 $ 2,177 $ 826 $ 557

(a)

Effective July 1, 2008, the Time Warner Pension Plan was amended to change the plan’s benefit payment formula from a monthly annuity

based payment formula to a fixed lump-sum payment formula.

104

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)