Time Magazine 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Networks segment reflected decreases at Turner’s news networks, mainly due to audience declines, in part tied to

the impact of the 2008 election coverage, and weakened demand, as well as at Turner’s international entertainment

networks, reflecting the negative impact of foreign exchange rates.

The decrease in Content revenues for the year ended December 31, 2009 was due primarily to declines at the

Filmed Entertainment and Networks segments. The decline at the Filmed Entertainment segment was mainly due to

a decrease in theatrical product revenues, partially offset by an increase in television product revenues. The negative

impact of foreign exchange rates also contributed to the decline in Content revenues at the Filmed Entertainment

segment. The decline at the Networks segment was due primarily to lower ancillary sales of HBO’s original

programming.

Each of the revenue categories is discussed in greater detail by segment in “Business Segment Results.”

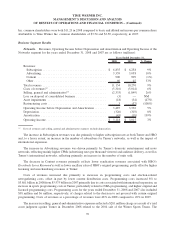

Costs of Revenues. For the year ended December 31, 2009 and 2008, costs of revenues totaled $14.438 billion

and $14.953 billion, respectively, and, as a percentage of revenues, were both 56%. The segment variations are

discussed in detail in “Business Segment Results.”

Selling, General and Administrative Expenses. For the year ended December 31, 2009 and 2008, selling,

general and administrative expenses decreased 8% to $6.153 billion in 2009 from $6.692 billion in 2008, due to

decreases across each of the segments. The segment variations are discussed in detail in “Business Segment

Results.”

Included in selling, general and administrative expenses are amounts related to securities litigation. The

Company recognized legal and other professional fees related to the defense of various securities lawsuits totaling

$30 million and $21 million in 2009 and 2008, respectively.

Included in costs of revenues and selling, general and administrative expenses is depreciation expense, which

increased to $679 million in 2009 from $670 million in 2008.

Amortization Expense. Amortization expense decreased to $319 million in 2009 from $356 million in 2008.

The decrease in amortization expense primarily related to declines at the Filmed Entertainment and Publishing

segments, partially offset by an increase at the Networks segment. The segment variations are discussed in detail in

“Business Segment Results.”

Restructuring Costs. During the year ended December 31, 2009, the Company incurred restructuring costs of

$212 million primarily related to various employee terminations and other exit activities, including $8 million at the

Networks segment, $105 million at the Filmed Entertainment segment and $99 million at the Publishing segment.

The total number of employees terminated across the segments in 2009 was approximately 1,500.

During the year ended December 31, 2008, the Company incurred restructuring costs of $327 million, primarily

related to various employee terminations and other exit activities, including $142 million at the Filmed

Entertainment segment, $176 million at the Publishing segment and $12 million at the Corporate segment,

partially offset by a reversal of $3 million at the Networks segment. The total number of employees terminated

across the segments in 2008 was approximately 1,700.

Operating Income (Loss). Operating Income was $4.545 billion in 2009 compared to Operating Loss of

$3.028 billion in 2008. Excluding the items previously noted under “Significant Transactions and Other

Items Affecting Comparability” totaling $148 million and $7.237 billion of expense for the year ended

December 31, 2009 and 2008, respectively, Operating Income increased $484 million, primarily reflecting

increases at the Networks and Filmed Entertainment segments, partially offset by a decline at the Publishing

segment. The segment variations are discussed under “Business Segment Results.”

29

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)