Time Magazine 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

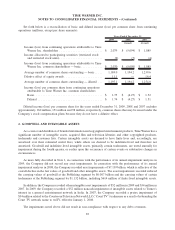

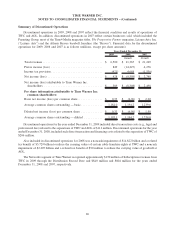

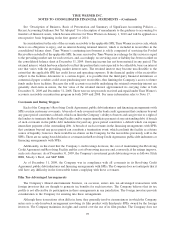

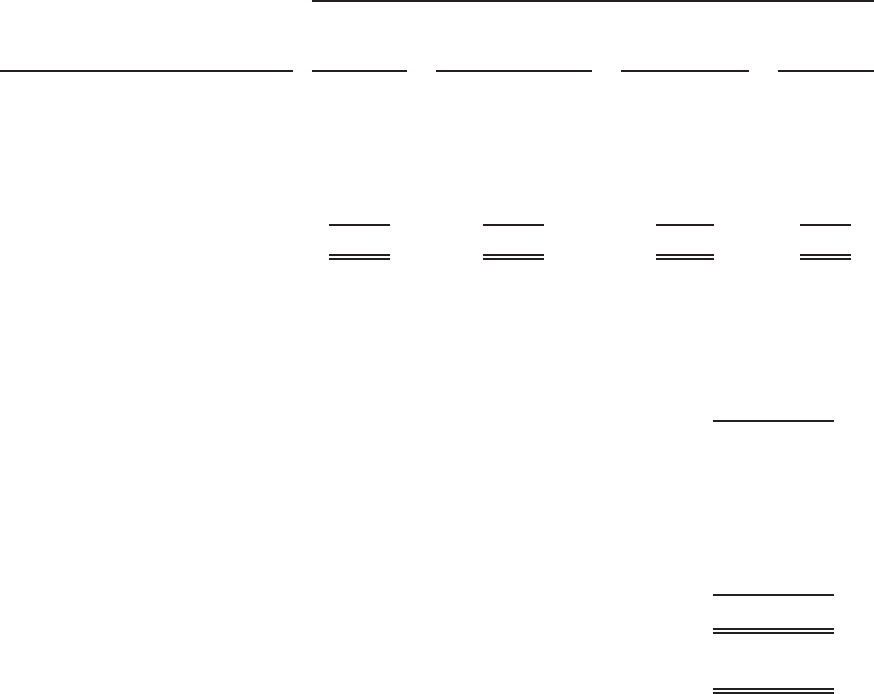

6. FAIR VALUE MEASUREMENTS

A fair value measurement is determined based on the assumptions that a market participant would use in pricing

an asset or liability. A three-tiered hierarchy draws distinctions between market participant assumptions based on

(i) observable inputs such as quoted prices in active markets (Level 1), (ii) inputs other than quoted prices in active

markets that are observable either directly or indirectly (Level 2) and (iii) unobservable inputs that require the

Company to use present value and other valuation techniques in the determination of fair value (Level 3). The

following table presents information about assets and liabilities required to be carried at fair value on a recurring

basis as of December 31, 2009 (millions):

Description

Fair Value

as of

December 31,

2009

Quoted Market Prices

in Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value Measurements as of December 31, 2009 Using

Assets:

Trading securities ........... $ 247 $ 243 $ 4 $ —

Available-for-sale securities .... 33 11 22 —

Derivatives ................ 45 5 8 32

Liabilities:

Derivatives ................ (91) — (91) —

Total ....................... $ 234 $ 259 $ (57) $ 32

The Company primarily applies the market approach for valuing recurring fair value measurements.

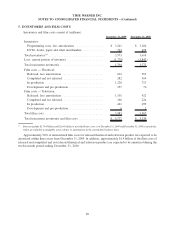

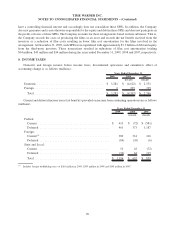

The following table reconciles the beginning and ending balances of assets classified as Level 3 and identifies

the net income (losses) the Company recognized during the year ended December 31, 2009 on such assets and

liabilities that were included in the balance as of December 31, 2009 (millions):

Derivatives

Balance as of January 1, 2009 . . . ..................................... $ 1

Total gains (losses):

Included in net income ............................................ 19

Included in other comprehensive income ............................... —

Purchases, issuances and settlements .................................... 12

Transfers in and/or out of Level 3. ..................................... —

Balance as of December 31, 2009 . ..................................... $ 32

Total net gain for the year ended December 31, 2009 included in net income related

to assets still held as of December 31, 2009 ............................ $ 19

Gains and losses recognized for assets and liabilities valued using significant unobservable inputs are reported

in investment gains (losses), net, in other loss, net (Note 17).

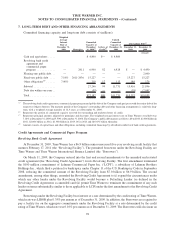

Other Financial Instruments

The Company’s other financial instruments including debt are not required to be carried at fair value. Based on

the interest rates prevailing at December 31, 2009, the fair value of Time Warner’s debt exceeds its carrying value by

approximately $1.749 billion and at December 31, 2008, the carrying value of Time Warner’s debt exceeded its fair

value by approximately $400 million. Unrealized gains or losses on debt do not result in the realization or

expenditure of cash and generally are not recognized for financial reporting purposes unless the debt is retired prior

to its maturity. The carrying value for the majority of the Company’s other financial instruments approximates fair

90

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)