Time Magazine 2009 Annual Report Download - page 133

Download and view the complete annual report

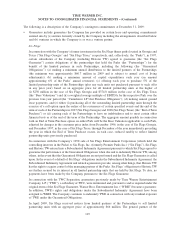

Please find page 133 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.commitments and the principal amount of AOL’s obligations outstanding under the facility and changes in

Time Warner’s senior unsecured long-term debt credit ratings. Also in connection with the AOL

Separation, Time Warner agreed to continue to provide credit support for certain AOL lease and trade

obligations of approximately $108 million ending on the earlier of December 9, 2011 and 30 days after

AOL obtains the right to borrow funds under a permanent credit facility, in exchange for a fee equal to a

rate per annum of 4.375% of the outstanding principal amount of such obligations, subject to periodic

increases. Since the AOL Separation, AOL has replaced or released Time Warner as the source of the credit

support for certain AOL lease and trade obligations or otherwise reduced Time Warner’s credit support

obligations. As of February 17, 2010, the amount of credit support provided by Time Warner for AOL lease

and trade obligations was $28 million.

• Generally, letters of credit and surety bonds support performance and payments for a wide range of global

contingent and firm obligations including insurance, litigation appeals, import of finished goods, real

estate leases and other operational needs. Other contingent commitments primarily include amounts

payable representing contingent consideration on certain acquisitions, which if earned would require the

Company to pay a portion or all of the contingent amount, and contingent payments for certain put/call

arrangements, whereby payments could be made by the Company to acquire assets, such as a venture

partner’s interest or a co-financing partner’s interest in one of the Company’s films.

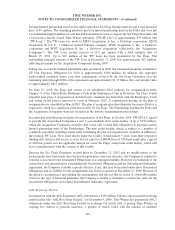

• On March 12, 2009, TWC borrowed the full committed amount of $1.932 billion under its unsecured term

loan credit facility entered into on June 30, 2008 (the “TWC Bridge Facility”), all of which was used by

TWC to pay a portion of the Special Dividend. On March 26, 2009, TWC completed an offering of

$3.0 billion in aggregate principal amount of debt securities and used a portion of the net proceeds from the

offering to prepay in full the outstanding loans and all other amounts due under the TWC Bridge Facility,

and the TWC Bridge Facility was terminated in accordance with its terms. Concurrently with the

termination of the TWC Bridge Facility and pursuant to the terms of the $1.535 billion credit

agreement (the “Supplemental Credit Agreement”) between the Company (as lender) and TWC (as

borrower) for a two-year senior unsecured supplemental term loan facility (the “Supplemental Credit

Facility”), on March 26, 2009, TWC terminated the commitments of Time Warner under the Supplemental

Credit Facility, and the Supplemental Credit Agreement was terminated in accordance with its terms.

Except as otherwise discussed above or below, Time Warner does not guarantee the debt of any of its

investments accounted for using the equity method of accounting.

Programming Licensing Backlog

Programming licensing backlog represents the amount of future revenues not yet recorded from cash contracts

for the licensing of theatrical and television product for pay cable, basic cable, network and syndicated television

exhibition. Because backlog generally relates to contracts for the licensing of theatrical and television product that

have already been produced, the recognition of revenue for such completed product is principally dependent on the

commencement of the availability period for telecast under the terms of the related licensing agreement. Cash

licensing fees are collected periodically over the term of the related licensing agreements. Backlog was

approximately $4.5 billion and $4.1 billion at December 31, 2009 and December 31, 2008, respectively.

Included in these amounts is licensing of film product from the Filmed Entertainment segment to the

Networks segment in the amount of $1.1 billion and $967 million at December 31, 2009 and December 31,

2008, respectively. Backlog excludes filmed entertainment advertising barter contracts, which are also expected to

result in the future realization of revenues and cash through the sale of the advertising spots received under such

contracts to third parties.

121

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)