Time Magazine 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

equity as a component of Accumulated other comprehensive income, net, until the hedged item is recognized in

earnings, depending on whether the derivative is being used to hedge changes in fair value or cash flows. The

ineffective portion of a derivative’s change in fair value is immediately recognized in earnings. For those derivative

instruments that do not qualify for hedge accounting, changes in the fair value are recognized immediately in

earnings. The Company uses derivative instruments principally to manage the risk associated with movements in

foreign currency exchange rates and the risk that changes in interest rates will affect the fair value or cash flows of

its debt obligations. At December 31, 2009, there were no interest rate swaps or other similar derivative financial

instruments outstanding. See Note 13 for additional information regarding derivative instruments held by the

Company and risk management strategies.

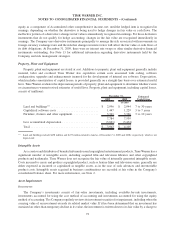

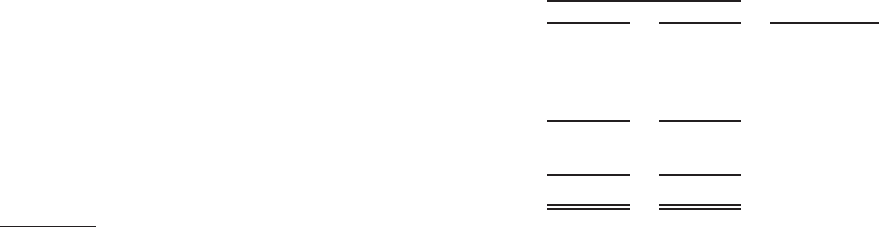

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions to property, plant and equipment generally include

material, labor and overhead. Time Warner also capitalizes certain costs associated with coding, software

configuration, upgrades and enhancements incurred for the development of internal use software. Depreciation,

which includes amortization of capital leases, is provided generally on a straight-line basis over estimated useful

lives. Time Warner evaluates the depreciation periods of property, plant and equipment to determine whether events

or circumstances warrant revised estimates of useful lives. Property, plant and equipment, including capital leases,

consist of (millions):

2009 2008

Estimated

Useful Lives

December 31,

(recast)

Land and buildings

(a)

............................. $ 2,996 $ 2,944 7 to 30 years

Capitalized software costs . ........................ 1,447 1,229 3 to 7 years

Furniture, fixtures and other equipment ................ 3,341 3,366 3 to 10 years

7,784 7,539

Less accumulated depreciation ...................... (3,821) (3,434)

Total ......................................... $ 3,963 $ 4,105

(a)

Land and buildings include $478 million and $477 million related to land as of December 31, 2009 and 2008, respectively, which is not

depreciated.

Intangible Assets

As a creator and distributor of branded information and copyrighted entertainment products, Time Warner has a

significant number of intangible assets, including acquired film and television libraries and other copyrighted

products and trademarks. Time Warner does not recognize the fair value of internally generated intangible assets.

Costs incurred to create and produce copyrighted product, such as feature films and television series, generally are

either expensed as incurred or capitalized as tangible assets, as in the case of cash advances and inventoriable

product costs. Intangible assets acquired in business combinations are recorded at fair value in the Company’s

consolidated balance sheet. For more information, see Note 2.

Asset Impairments

Investments

The Company’s investments consist of fair-value investments, including available-for-sale investments,

investments accounted for using the cost method of accounting and investments accounted for using the equity

method of accounting. The Company regularly reviews its investment securities for impairment, including when the

carrying value of an investment exceeds its related market value. If it has been determined that an investment has

sustained an other-than-temporary decline in its value, the investment is written down to its fair value by a charge to

72

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)