Time Magazine 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

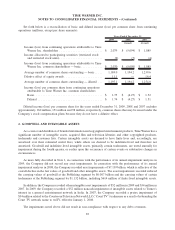

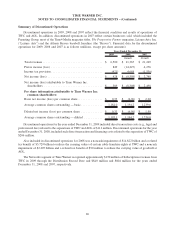

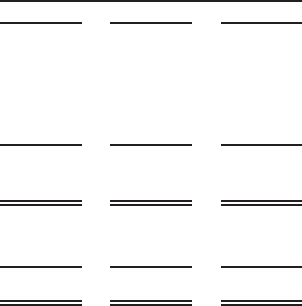

Set forth below is a reconciliation of basic and diluted income (loss) per common share from continuing

operations (millions, except per share amounts):

2009 2008 2007

Years Ended December 31,

(recast) (recast)

Income (loss) from continuing operations attributable to Time

Warner Inc. shareholders .......................... $ 2,079 $ (5,094) $ 1,889

Income allocated to participating securities (restricted stock

and restricted stock units).......................... (9) (5) (4)

Income (loss) from continuing operations attributable to Time

Warner Inc. common shareholders — basic ............. $ 2,070 $ (5,099) $ 1,885

Average number of common shares outstanding — basic..... 1,184.0 1,194.2 1,239.6

Dilutive effect of equity awards ....................... 11.1 — 14.4

Average number of common shares outstanding — diluted . . . 1,195.1 1,194.2 1,254.0

Income (loss) per common share from continuing operations

attributable to Time Warner Inc. common shareholders:

Basic ......................................... $ 1.75 $ (4.27) $ 1.52

Diluted ....................................... $ 1.74 $ (4.27) $ 1.51

Diluted income (loss) per common share for the years ended December 31, 2009, 2008 and 2007 excludes

approximately 160 million, 151 million and 98 million, respectively, common shares that may be issued under the

Company’s stock compensation plans because they do not have a dilutive effect.

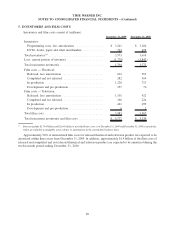

2. GOODWILL AND INTANGIBLE ASSETS

As a creator and distributor of branded information and copyrighted entertainment products, Time Warner has a

significant number of intangible assets, acquired film and television libraries and other copyrighted products,

trademarks and customer lists. Certain intangible assets are deemed to have finite lives and, accordingly, are

amortized over their estimated useful lives, while others are deemed to be indefinite-lived and therefore not

amortized. Goodwill and indefinite-lived intangible assets, primarily certain tradenames, are tested annually for

impairment during the fourth quarter, or earlier upon the occurrence of certain events or substantive changes in

circumstances.

As more fully described in Note 1, in connection with the performance of its annual impairment analyses in

2009, the Company did not record any asset impairments. In connection with the performance of its annual

impairment analyses in 2008, the Company recorded asset impairments of $7.139 billion, which is reflective of the

overall decline in the fair values of goodwill and other intangible assets. The asset impairments recorded reduced

the carrying values of goodwill at the Publishing segment by $6.007 billion and the carrying values of certain

tradenames at the Publishing segment by $1.132 billion, including $614 million of finite-lived intangible assets.

In addition, the Company recorded other intangible asset impairments of $52 million in 2009 and $34 million in

2007. In 2009, the Company recorded a $52 million noncash impairment of intangible assets related to Turner’s

interest in a general entertainment network in India. In 2007, the Company recorded a pretax impairment of

$34 million related to the Courtroom Television Network LLC (“Court TV”) tradename as a result of rebranding the

Court TV network name to truTV, effective January 1, 2008.

The impairments noted above did not result in non-compliance with respect to any debt covenants.

83

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)