Time Magazine 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

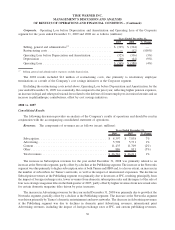

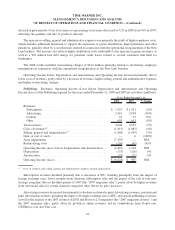

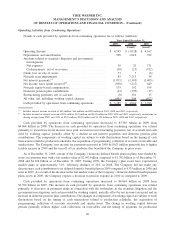

released in prior periods. Costs of revenues as a percentage of revenues decreased to 72% in 2008 from 76% in 2007,

reflecting the quantity and mix of products released.

The increase in selling, general and administrative expenses was primarily the result of higher employee costs,

which includes additional headcount to support the expansion of games distribution, digital platforms and other

initiatives, partially offset by cost reductions realized in connection with the operational reorganization of the New

Line business. The increase also reflects higher distribution costs attributable to the increase in games revenues, as

well as a $30 million bad debt charge for potential credit losses related to several customers that filed for

bankruptcy.

The 2008 results included restructuring charges of $142 million primarily related to involuntary employee

terminations in connection with the operational reorganization of the New Line business.

Operating Income before Depreciation and Amortization and Operating Income increased primarily due to

lower costs of revenues, partly offset by a decrease in revenues, higher selling, general and administrative expenses

and higher restructuring charges.

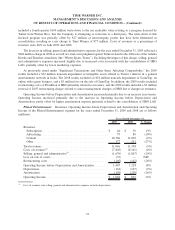

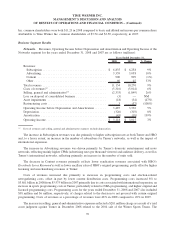

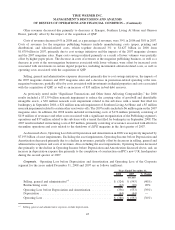

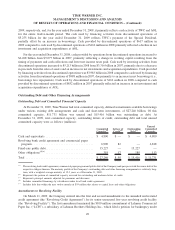

Publishing. Revenues, Operating Income (Loss) before Depreciation and Amortization and Operating

Income (Loss) of the Publishing segment for the years ended December 31, 2008 and 2007 are as follows (millions):

2008 2007 % Change

Years Ended December 31,

Revenues:

Subscription........................................ $ 1,523 $ 1,551 (2%)

Advertising ........................................ 2,419 2,698 (10%)

Content ........................................... 63 53 19%

Other ............................................. 603 653 (8%)

Total revenues ........................................ 4,608 4,955 (7%)

Costs of revenues

(a)

.................................... (1,813) (1,885) (4%)

Selling, general and administrative

(a)

....................... (1,840) (1,905) (3%)

Gain on sale of assets .................................. — 6 (100%)

Asset impairments ..................................... (7,195) — NM

Restructuring costs .................................... (176) (67) 163%

Operating Income (Loss) before Depreciation and Amortization . . . (6,416) 1,104 NM

Depreciation ......................................... (133) (126) 6%

Amortization ......................................... (75) (71) 6%

Operating Income (Loss) ................................ $ (6,624) $ 907 NM

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

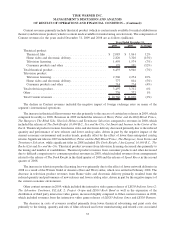

Subscription revenues declined primarily due to decreases at IPC, resulting principally from the impact of

foreign exchange rates, lower revenues from domestic subscription sales and the impact of the sale of four non-

strategic magazine titles in the third quarter of 2007 (the “2007 magazine sales”), partly offset by higher revenues

from newsstand sales for certain domestic magazine titles driven by price increases.

Advertising revenues decreased due primarily to declines in domestic print Advertising revenues, international

print Advertising revenues, including the impact of foreign exchange rates at IPC, and custom publishing revenues,

as well as the impacts of the 2007 closures of LIFE and Business 2.0 magazines (the “2007 magazine closures”) and

the 2007 magazine sales, partly offset by growth in online revenues, led by contributions from People.com,

CNNMoney.com and Time.com.

42

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)