Time Magazine 2009 Annual Report Download - page 105

Download and view the complete annual report

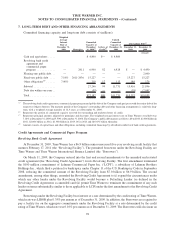

Please find page 105 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.additional usage fee of 0.10% per annum on the outstanding loans and other extensions of credit (including letters of

credit) under the Revolving Facility if and when such amounts exceed 50% of the aggregate commitments

thereunder.

The Revolving Facility provides same-day funding and multi-currency capability, and a portion of the

commitment, not to exceed $500 million at any time, may be used for the issuance of letters of credit. The

Revolving Facility contains a maximum leverage ratio covenant of 4.5 times the consolidated EBITDA of Time

Warner. The terms and related financial metrics associated with the leverage ratio are defined in the Revolving

Credit Agreement. At December 31, 2009, the Company was in compliance with the leverage covenant, with a

leverage ratio, calculated in accordance with the agreement, of approximately 1.90 times. The Revolving Facility

does not contain any credit ratings-based defaults or covenants or any ongoing covenant or representations

specifically relating to a material adverse change in Time Warner’s financial condition or results of operations.

Borrowings under the Revolving Facility may be used for general corporate purposes, and unused credit is available

to support borrowings by Time Warner under its commercial paper program. The Revolving Facility also contains

certain events of default customary for credit facilities of this type (with customary grace periods, as applicable).

At December 31, 2009, there were no borrowings outstanding under the Revolving Facility, $82 million in

outstanding face amount of letters of credit were issued under the Revolving Facility and no commercial paper was

outstanding under the CP Program (as defined below). The Company’s unused committed capacity as of

December 31, 2009 was $11.731 billion, including $4.800 billion of cash and equivalents.

The funding commitments under the Company’s Revolving Credit Agreement are provided by a geographically

diverse group of over 20 major financial institutions based in countries including the United States, Canada, France,

Germany, Japan and the United Kingdom. No institution accounts for more than 9% of the aggregate undrawn loan

commitments under this agreement as of December 31, 2009.

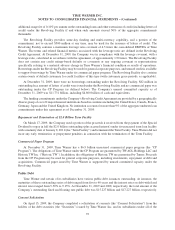

Repayment and Termination of $2.0 Billion Term Facility

On March 17, 2009, the Company used a portion of the proceeds it received from the payment of the Special

Dividend to repay in full the $2.0 billion outstanding (plus accrued interest) under its unsecured term loan facility

with a maturity date of January 8, 2011 (the “Term Facility”) and terminated the Term Facility. Time Warner did not

incur any early termination or prepayment penalties in connection with the termination of the Term Facility.

Commercial Paper Program

At December 31, 2009, Time Warner has a $6.9 billion unsecured commercial paper program (the “CP

Program”). The obligations of Time Warner under the CP Program are guaranteed by TW AOL Holdings LLC and

Historic TW Inc. (“Historic TW”). In addition, the obligations of Historic TW are guaranteed by Turner. Proceeds

from the CP Program may be used for general corporate purposes, including investments, repayment of debt and

acquisitions. Commercial paper issued by Time Warner is supported by unused committed capacity under the

Revolving Facility.

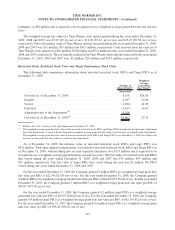

Public Debt

Time Warner and certain of its subsidiaries have various public debt issuances outstanding. At issuance, the

maturities of these outstanding series of debt ranged from five to 40 years and the interest rates on debt with fixed

interest rates ranged from 5.50% to 9.15%. At December 31, 2009 and 2008, respectively, the total amount of the

Company’s outstanding fixed and floating rate public debt was $15.227 billion and $17.227 billion, respectively.

Consent Solicitation

On April 15, 2009, the Company completed a solicitation of consents (the “Consent Solicitation”) from the

holders of the debt securities (the “Securities”) issued by Time Warner Inc. and its subsidiaries under all of the

93

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)