Time Magazine 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

forfeitures, is $81 million and is expected to be recognized over a weighted-average period between one and two

years.

The weighted-average fair value of a Time Warner stock option granted during the years ended December 31,

2009, 2008 and 2007 was $5.07 ($3.14, net of tax), $12.30 ($7.63, net of tax) and $15.45 ($9.58, net of tax),

respectively. The total intrinsic value of Time Warner options exercised during the years ended December 31, 2009,

2008 and 2007 was $13 million, $53 million and $313 million, respectively. Cash received from the exercise of

Time Warner stock options was $56 million, $134 million and $521 million for the years ended December 31, 2009,

2008 and 2007, respectively. The tax benefits realized from Time Warner stock options exercised in the years ended

December 31, 2009, 2008 and 2007 were $5 million, $20 million and $119 million, respectively.

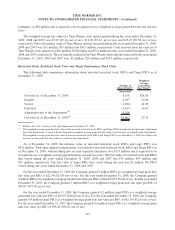

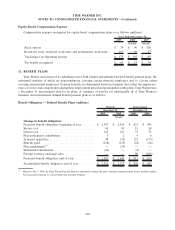

Restricted Stock, Restricted Stock Units and Target Performance Stock Units

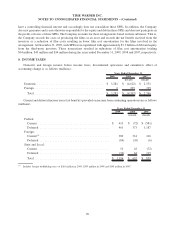

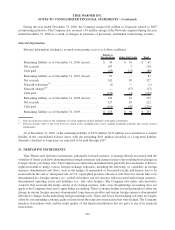

The following table summarizes information about unvested restricted stock, RSUs and Target PSUs as of

December 31, 2009:

Number of

Shares/Units

(a)

Weighted-

Average

Grant Date

Fair Value

(a)

(thousands)

Unvested as of December 31, 2008 ............................ 8,158 $51.81

Granted ................................................ 4,947 22.40

Vested ................................................. (1,850) 41.87

Forfeited ............................................... (1,817) 34.53

Adjustment due to the Separations

(b)

........................... 5,024

Unvested as of December 31, 2009

(b)

.......................... 14,462 27.15

(a)

Reflects the 1-for-3 reverse stock split implemented on March 27, 2009.

(b)

The weighted-average grant date fair value of the unvested restricted stock, RSUs and Target PSUs included in the line item “Adjustment

due to the Separations” is equal to the pre-Separation weighted-average grant date fair value of such awards, as reduced by the Adjustments.

The weighted-average grant date fair value of unvested restricted stock, RSUs and Target PSUs as of December 31, 2009 also reflects the

decrease in the grant-date fair value as a result of the Adjustments.

As of December 31, 2009, the intrinsic value of unvested restricted stock, RSUs and target PSUs was

$421 million. Total unrecognized compensation cost related to unvested restricted stock, RSUs and Target PSUs as

of December 31, 2009, without taking into account expected forfeitures, was $137 million and is expected to be

recognized over a weighted-average period between one and two years. The fair value of restricted stock and RSUs

that vested during the years ended December 31, 2009, 2008 and 2007 was $76 million, $59 million and

$53 million, respectively. The fair value of target PSUs that vested during the year was $2 million. No PSUs

vested during the years ended December 31, 2008 and 2007.

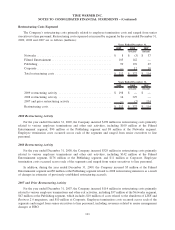

For the year ended December 31, 2009, the Company granted 5 million RSUs at a weighted-average grant date

fair value per RSU of $22.34 ($13.85 net of tax). For the year ended December 31, 2008, the Company granted

4 million RSUs at a weighted-average grant date fair value per RSU of $44.49 ($27.58 net of tax). For the year ended

December 31, 2007, the Company granted 3 million RSUs at a weighted-average grant date fair value per RSU of

$59.67 ($37.00 net of tax).

For the year ended December 31, 2009, the Company granted 0.2 million target PSUs at a weighted-average

grant date fair value per PSU of $23.67 ($14.68 net of tax). For the year ended December 31, 2008, the Company

granted 0.4 million target PSUs at a weighted-average grant date fair value per PSU of $52.59 ($32.61 net of tax).

For the year ended December 31, 2007, the Company granted 0.4 million target PSUs at a weighted-average grant

date fair value per PSU of $58.41 ($36.21 net of tax).

103

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)