The Hartford 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

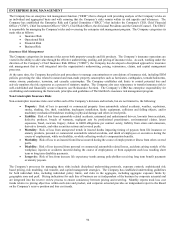

ENTERPRISE RISK MANAGEMENT

The Company has an enterprise risk management function (“ERM”) that is charged with providing analysis of the Company’ s risks on

an individual and aggregated basis and with ensuring that the Company’ s risks remain within its risk appetite and tolerances. The

Company has established the Enterprise Risk and Capital Committee (“ERCC”) that includes the Company's CEO, Chief Financial

Officer (“CFO”), Chief Investment Officer (“CIO”), Chief Risk Officer, the divisional Presidents and the General Counsel. The ERCC

is responsible for managing the Company's risks and overseeing the enterprise risk management program. The Company categorizes its

main risks as follows:

• Insurance Risk

• Operational Risk

• Financial Risk

• Business Risk

Insurance Risk Management

The Company categorizes its insurance risks across both property-casualty and life products. The Company’ s insurance operations are

vested in the ability to add value through the effective underwriting, pooling, and pricing of insurance risks. As such, working under the

direction of the Company’ s Chief Insurance Risk Officer (“CIRO”), the Company has developed a disciplined approach to insurance

risk management that is well integrated into the organization’ s underwriting, pricing, reinsurance, claims, and capital management

processes.

At the same time, the Company has policies and procedures to manage concentrations or correlations of insurance risk, including ERM

policies governing the risks related to natural and man-made property catastrophes such as hurricanes, earthquakes, tornado/hailstorms,

winter storms, pandemics, terrorism, and casualty catastrophes. The Company establishes risk limits to control potential loss and

actively monitors the risk exposures as a percent of statutory surplus. The Company also uses reinsurance to transfer insurance risk to

well-established and financially secure reinsurers (see Reinsurance Section). The Company’ s CIRO has enterprise responsibility for

establishing and maintaining the framework, principles and guidelines of The Hartford’ s insurance risk management program.

Non-Catastrophic Insurance Risks

Non-catastrophic insurance risks exist within each of the Company’ s divisions and include, but are not limited to, the following:

• Property: Risk of loss to personal or commercial property from automobile related accidents, weather, explosions,

smoke, shaking, fire, theft, vandalism, inadequate installation, faulty equipment, collisions and falling objects, and/or

machinery mechanical breakdown resulting in physical damage and other covered perils.

• Liability: Risk of loss from automobile related accidents, uninsured and underinsured drivers, lawsuits from accidents,

defective products, breach of warranty, negligent acts by professional practitioners, environmental claims, latent

exposures, fraud, coercion, forgery, failure to fulfill obligations per contract surety, liability from errors and omissions,

derivative lawsuits, and other securities actions and covered perils.

• Mortality: Risk of loss from unexpected trends in insured deaths impacting timing of payouts from life insurance or

annuity products, personal or commercial automobile related accidents, and death of employees or executives during the

course of employment, while on disability, or while collecting worker’ s compensation benefits.

• Morbidity: Risk of loss to an insured from illness incurred during the course of employment or illness from other covered

perils.

• Disability: Risk of loss incurred from personal or commercial automobile related losses, accidents arising outside of the

workplace, injuries or accidents incurred during the course of employment, or from equipment each loss resulting short

term or long term disability payments.

• Longevity: Risk of loss from increase life expectancy trends among policyholders receiving long term benefit payments

or annuity payouts.

The Company’ s processes for managing these risks include disciplined underwriting protocols, exposure controls, sophisticated risk

based pricing, risk modeling, risk transfer, and capital management strategies. The Company has established underwriting guidelines

for both individual risks, including individual policy limits, and risks in the aggregate, including aggregate exposure limits by

geographic zone and peril. Pricing indications for each line of business are set independent of the business by corporate actuarial and

are integrated into the reserve review process to ensure consistency between pricing and reserving. Monthly reports track loss cost

trends relative to pricing objectives within each state and product, and corporate actuarial provides an independent report to the Board

on the Company’ s reserve position and loss cost trends.