The Hartford 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

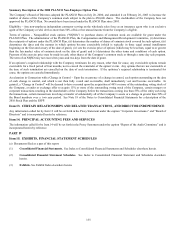

F-7

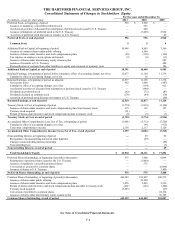

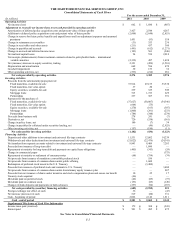

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Consolidated Statements of Cash Flows

For the years ended December 31,

(In millions)

2011

2010

2009

Operating Activities

Net income (loss)

$

662

$

1,680

$

(887)

Adjustments to reconcile net income (loss) to net cash provided by operating activities

Amortization of deferred policy acquisition costs and present value of future profits

3,427

2,544

4,267

Additions to deferred policy acquisition costs and present value of future profits (2,608) (2,648) (2,853)

Change in reserve for future policy benefits and unpaid losses and loss adjustment expenses and unearned

premiums 1,451 (93) 558

Change in reinsurance recoverables

(31)

353

236

Change in receivables and other assets

(211)

437

380

Change in payables and accruals

(491)

(612)

(1,271)

Change in accrued and deferred income taxes

(103)

561

(246)

Net realized capital losses

24

554

2,010

Net receipts (disbursements) from investment contracts related to policyholder funds – international

variable annuities

(2,332)

497

1,498

Net (increase) decrease in equity securities, trading

2,321

(499)

(1,501)

Depreciation and amortization

668

596

470

Goodwill impairment

30

153

32

Other operating activities, net

(533)

(214)

281

Net cash provided by operating activities

2,274

3,309

2,974

Investing Activities

Proceeds from the sale/maturity/prepayment of:

Fixed maturities, available-for-sale

37,914

49,155

53,538

Fixed maturities, fair value option

37

20

—

Equity securities, available-for-sale

239

325

949

Mortgage loans

515

1,723

629

Partnerships

237

367

391

Payments for the purchase of:

Fixed maturities, available-for-sale

(37,627)

(50,807)

(54,346)

Fixed maturities, fair value option

(664)

(75)

—

Equity securities, available-for-sale

(270)

(163)

(307)

Mortgage loans

(1,800)

(291)

(233)

Partnerships (784) (348) (274)

Proceeds from business sold

278

241

(7)

Derivatives, net

720

(338)

(561)

Change in policy loans, net

180

(7)

34

Change in payables for collateral under securities lending, net

—

(46)

(2,925)

Other investing activities, net

(157)

(190)

(11)

Net cash used for investing activities

(1,182)

(434)

(3,123)

Financing Activities

Deposits and other additions to investment and universal life-type contracts

11,531

12,602

14,239

Withdrawals and other deductions from investment and universal life-type contracts

(21,022)

(22,476)

(24,341)

Net transfers from separate accounts related to investment and universal life-type contracts 9,843 8,409 7,203

Proceeds from issuance of long-term debt — 1,090 —

Repayments at maturity for long-term debt and payments on capital lease obligations

(405)

(343)

(24)

Change in commercial paper

—

—

(375)

Repayments at maturity or settlement of consumer notes

(68)

(754)

(74)

Net proceeds from issuance of mandatory convertible preferred stock

—

556

—

Net proceeds from issuance of common shares under public offering

—

1,600

—

Redemption of preferred stock issued to the U.S. Treasury

—

(3,400)

—

Proceeds from issuance of preferred stock and warrants to U.S. Treasury

—

—

3,400

Net proceeds from issuance of common shares under discretionary equity issuance plan

—

—

887

Proceeds from net issuance of shares under incentive and stock compensation plans and excess tax benefit

10

25

17

Treasury stock acquired

(46)

—

—

Dividends paid on preferred stock

(42)

(85)

(73)

Dividends paid on common stock

(153)

(85)

(149)

Changes in bank deposits and payments on bank advances

(257)

(94)

(187)

Net cash provided by (used for) financing activities

(609)

(2,955)

523

Foreign exchange rate effect on cash

36

—

(43)

Net increase (decrease) in cash

519

(80)

331

Cash - beginning of period

2,062

2,142

1,811

Cash - end of period

$

2,581

$

2,062

$

2,142

Supplemental Disclosure of Cash Flow Information

Income taxes paid (received)

$

179

$

308

$

(243)

Interest paid

$

501

$

485

$

475

See Notes to Consolidated Financial Statements.