The Hartford 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-23

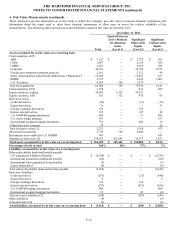

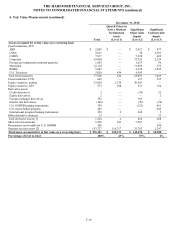

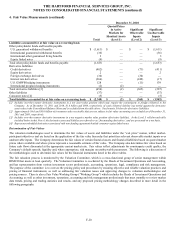

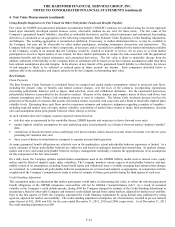

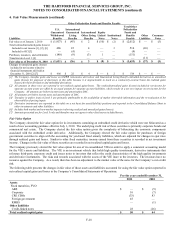

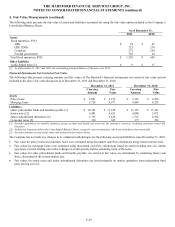

4. Fair Value Measurements (continued)

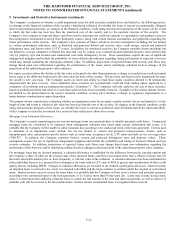

Level 3 Most of the Company’ s securities classified as Level 3 are valued based on brokers’ prices. This includes less liquid

securities such as lower quality asset-backed securities (“ABS”), commercial mortgage-backed securities (“CMBS”),

commercial real estate (“CRE”) CDOs and residential mortgage-backed securities (“RMBS”) primarily backed by below-

prime loans. Primary inputs for these structured securities are consistent with the typical inputs used in Level 2

measurements noted above, but are Level 3 due to their illiquid markets. Additionally, certain long-dated securities are

priced based on third party pricing services, including municipal securities, foreign government/government agencies, bank

loans and below investment grade private placement securities. Primary inputs for these long-dated securities are consistent

with the typical inputs used in Level 1 and Level 2 measurements noted above, but include benchmark interest rate or credit

spread assumptions that are not observable in the marketplace. Also included in Level 3 are certain derivative instruments

that either have significant unobservable inputs or are valued based on broker quotations. Significant inputs for these

derivative contracts primarily include the typical inputs used in the Level 1 and Level 2 measurements noted above, but also

may include the following:

• Credit derivatives – Significant unobservable inputs may include credit correlation and swap yield curve and credit

curve extrapolation beyond observable limits.

• Equity derivatives – Significant unobservable inputs may include equity volatility.

• Interest rate contracts – Significant unobservable inputs may include swap yield curve extrapolation beyond

observable limits and interest rate volatility.

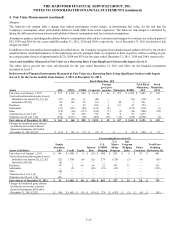

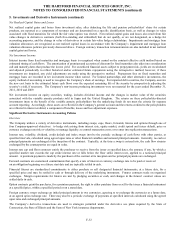

Product Derivatives

The Company currently offers certain variable annuity products with GMWB riders in the U.S., and formerly offered such products in

the U.K. and Japan. The GMWB represents an embedded derivative in the variable annuity contract. When it is determined that (1) the

embedded derivative possesses economic characteristics that are not clearly and closely related to the economic characteristics of the

host contract, and (2) a separate instrument with the same terms would qualify as a derivative instrument, the embedded derivative is

bifurcated from the host for measurement purposes. The embedded derivative is carried at fair value, with changes in fair value reported

in net realized capital gains and losses. The Company's GMWB liability is reported in other policyholder funds and benefits payable in

the Consolidated Balance Sheets.

In valuing the embedded derivative, the Company attributes to the derivative a portion of the expected fees to be collected over the

expected life of the contract from the contract holder equal to the present value of future GMWB claims (the “Attributed Fees”). The

excess of fees collected from the contract holder in the current period over the current period’ s Attributed Fees are associated with the

host variable annuity contract and reported in fee income.

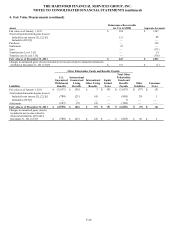

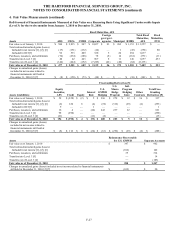

U.S. GMWB Reinsurance Derivative

The Company has reinsurance arrangements in place to transfer a portion of its risk of loss due to GMWB. These arrangements are

recognized as derivatives and carried at fair value in reinsurance recoverables. Changes in the fair value of the reinsurance agreements

are reported in net realized capital gains and losses.

The fair value of the U.S. GMWB reinsurance derivative is calculated as an aggregation of the components described in the Living

Benefits Required to be Fair Valued discussion below and is modeled using significant unobservable policyholder behavior inputs,

identical to those used in calculating the underlying liability, such as lapses, fund selection, resets and withdrawal utilization and risk

margins.

Separate Account Assets

Separate account assets are primarily invested in mutual funds but also have investments in fixed maturity and equity securities. The

separate account investments are valued in the same manner, and using the same pricing sources and inputs, as the fixed maturity, equity

security, and short-term investments of the Company.