The Hartford 2011 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-55

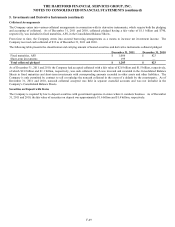

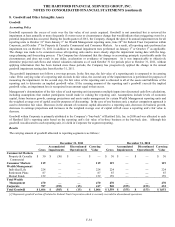

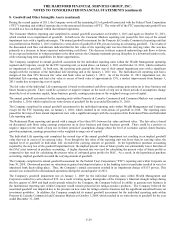

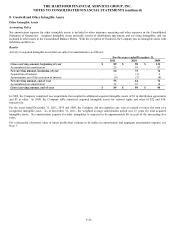

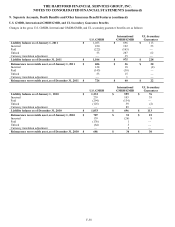

8. Goodwill and Other Intangible Assets (continued)

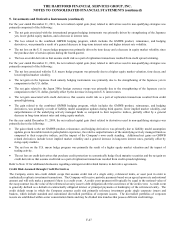

During the second quarter of 2011, the Company wrote off the remaining $15 of goodwill associated with the Federal Trust Corporation

(“FTC”) reporting unit within Corporate due to the announced divestiture of FTC. The write-off of the FTC reporting unit goodwill was

recorded as a loss on disposal within discontinued operations.

The Consumer Markets reporting unit completed its annual goodwill assessment on October 1, 2011 and again on October 31, 2011,

which resulted in no impairment of goodwill. In both tests, the Consumer Markets reporting unit passed the first step of the annual

impairment tests with a significant margin. The annual goodwill assessment for the Property & Casualty Commercial reporting unit that

was performed on October 1, 2011 resulted in a write-down of goodwill of $30, pre-tax leaving no remaining goodwill. The results of

the discounted cash flow calculations indicated that the fair value of the reporting unit was less than the carrying value; this was due

primarily to a decrease in future expected underwriting cash flows. The decrease in future expected underwriting cash flows is driven

by an expected reduction in written premium in the short term as the Company maintains pricing discipline in a downward market cycle,

while retaining long term capabilities for future opportunities.

The Company completed its annual goodwill assessment for the individual reporting units within the Wealth Management operating

segment and Corporate, except for the FTC reporting unit, as noted above, on January 1, 2011 and October 31, 2011, which resulted in

no impairment of goodwill. In both tests, the reporting units passed the first step of their annual impairment tests with a significant

margin with the exception of the Individual Life reporting unit at the January 1, 2011 test. The Individual Life reporting unit had a

margin of less than 10% between fair value and book value on January 1, 2011. As of the October 31, 2011 impairment test, the

Individual Life reporting unit had a fair value in excess of book value of approximately 15%, a modest improvement from January 1,

2011 results due to improving cost of capital.

The fair value of the Individual Life reporting unit is based on discounted cash flows using earnings projections on in force business and

future business growth. There could be a positive or negative impact on the result of step one in future periods if assumptions change

about the level of economic capital, future business growth, earnings projections or the weighted average cost of capital.

The annual goodwill assessment for the reporting units within Property & Casualty Commercial and Consumer Markets was completed

on October 1, 2010, which resulted in no write-downs of goodwill for the year ended December 31, 2010.

The Company completed its annual goodwill assessment for the individual reporting units within Wealth Management and Corporate,

except for the FTC reporting unit, on January 1, 2010, which resulted in no write-downs of goodwill in 2010. The reporting units

passed the first step of their annual impairment tests with a significant margin with the exception of the Retirement Plans and Individual

Life reporting units.

The Retirement Plans reporting unit passed with a margin of less than 10% between fair value and book value. The fair value is based

on discounted cash flows using earnings projections on in force business and future business growth. There could be a positive or

negative impact on the result of step one in future periods if assumptions change about the level of economic capital, future business

growth assumptions, earnings projections or the weighted average cost of capital.

The Individual Life reporting unit completed the second step of the annual goodwill impairment test resulting in an implied goodwill

value that was in excess of its carrying value. Even though the fair value of the reporting unit was lower than its carrying value, the

implied level of goodwill in Individual Life exceeded the carrying amount of goodwill. In the hypothetical purchase accounting

required by the step two of the goodwill impairment test, the implied present value of future profits was substantially lower than that of

the DAC asset removed in purchase accounting. A higher discount rate was used for calculating the present value of future profits as

compared to that used for calculating the present value of estimated gross profits for DAC. As a result, in the hypothetical purchase

accounting, implied goodwill exceeded the carrying amount of goodwill.

The Company completed its annual goodwill assessment for the Federal Trust Corporation (“FTC”) reporting unit within Corporate on

June 30, 2010. Downward pressure on valuations in general and depressed prices in the banking sector in particular resulted in very few

unassisted bank deals taking place. Thus, the Company’ s annual assessment resulted in an impairment charge of $153 pre-tax. This

amount was reclassified to discontinued operations during the second quarter of 2011.

The Company's goodwill impairment test on January 1, 2009 for the individual reporting units within Wealth Management and

Corporate resulted in a write-down of $32. As a result of rating agency downgrades of the Company’ s financial strength ratings during

the first quarter of 2009 and high credit spreads related to the Company, the Company believed its ability to generate new business in

the Institutional reporting unit within Corporate would remain pressured for ratings-sensitive products. The Company believed the

associated goodwill was impaired due to the pressure on new sales for ratings-sensitive business and the significant unrealized losses on

investment portfolios. In addition, the Company completed its annual goodwill assessment for the individual reporting units within

Property & Casualty Commercial and Consumer Markets on October 1, 2009, which resulted in no write-downs of goodwill for the year

ended December 31, 2009.