The Hartford 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

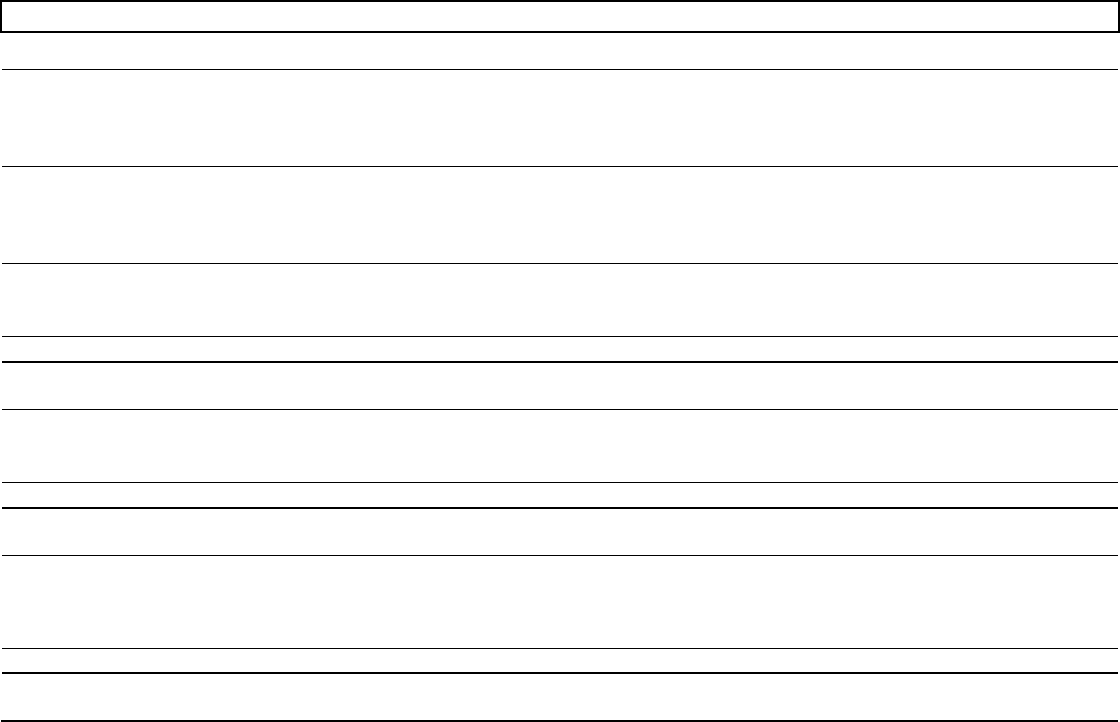

87

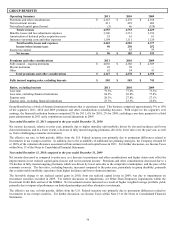

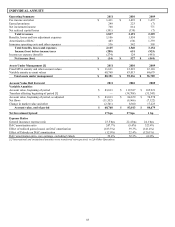

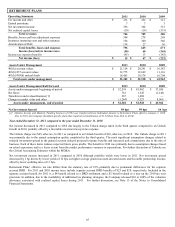

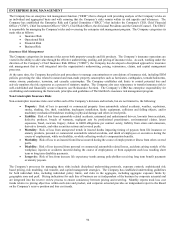

RETIREMENT PLANS

Operating Summary

2011

2010

2009

Fee income and other

$

373

$

352

$

321

Earned premiums

7

7

3

Net investment income

396

364

315

Net realized capital losses

(10)

(18)

(333)

Total revenues

766

705

306

Benefits, losses and loss adjustment expenses

308

278

269

Insurance operating costs and other expenses

354

340

346

Amortization of DAC

134

27

56

Total benefits, losses and expenses

796

645

671

Income (loss) before income taxes

(30)

60

(365)

Income tax expense (benefit)

(45)

13

(143)

Net income (loss)

$

15

$

47

$

(222)

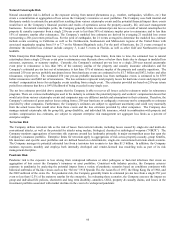

Assets Under Management

2011

2010

2009

401(k) account values

$

21,124

$

20,291

$

16,142

403(b)/457 account values

12,775

12,649

11,116

401(k)/403(b) mutual funds

18,403

19,578

16,704

Total assets under management

$

52,302

$

52,518

$

43,962

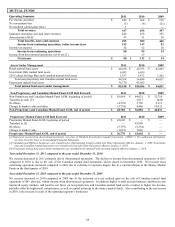

Assets Under Management Roll Forward

2011

2010

2009

Assets under management, beginning of period

$

52,518

$

43,962

$

37,036

Net flows

761

1,545

(1,142)

Transfers in and reclassifications [1]

267

1,488

—

Change in market value and other

(1,244)

5,523

8,068

Assets under management, end of period

$

52,302

$

52,518

$

43,962

Net Investment Spread

98 bps

99 bps

66 bps

[1] Lifetime Income and Maturity Funding business of $194 was transferred from Individual Annuity to Retirement Plans effective January 1, 2010.

Also in 2010, the Company identified specific plans that required reclassification of $1.3 billion from AUA to AUM.

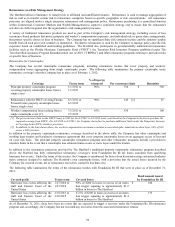

Year ended December 31, 2011 compared to the year ended December 31, 2010

Net income decreased in 2011 compared to 2010 due largely to the Unlock charge taken in the third quarter compared to an Unlock

benefit in 2010, partially offset by a favorable one-time true up in tax expense.

The Unlock charge was $45, after-tax, in 2011 as compared to an Unlock benefit of $18, after-tax, in 2010. The Unlock charge in 2011

was primarily due to the annual assumption update completed in the third quarter. The most significant assumption changes related to

reduced investment spread in the general account delayed projected expense benefits and increased trail commissions due to the mix of

business. Each of these items reduces expected future gross profits. The benefit in 2010 was primarily due to assumption changes based

on actual experience and to a lesser extent from the market performance variance to expectations. For further discussion of Unlocks see

the Critical Accounting Estimates within the MD&A.

Net investment income increased in 2011 compared to 2010 although portfolio yields were lower in 2011. Net investment spread

decreased by 1 bp driven by lower yields of 12 bps on higher average general account invested assets and favorable partnership income,

offset by lower crediting rates of 11 bps.

Retirement Plans’ effective tax rate differs from the statutory rate of 35% primarily due to permanent differences for the separate

account DRD. For 2011 and 2010 income taxes include separate account DRD benefits of $25 and $18, respectively. Included in the

separate account benefit for 2011 is a $4 benefit related to a DRD settlement and a $2 benefit related to a true up the 2010 tax year

provision. In addition, due to the availability of additional tax planning strategies, the Company released $10 or 100% of the valuation

allowance associated with realized capital losses during 2011. For further discussion, see Note 13 of the Notes to Consolidated

Financial Statements.