The Hartford 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-37

5. Investments and Derivative Instruments (continued)

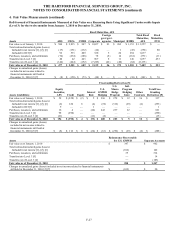

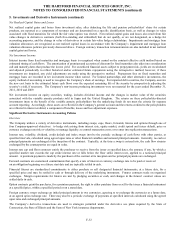

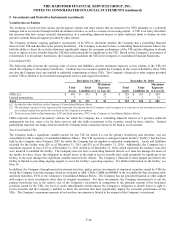

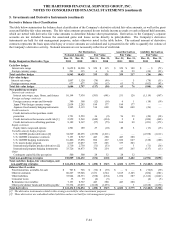

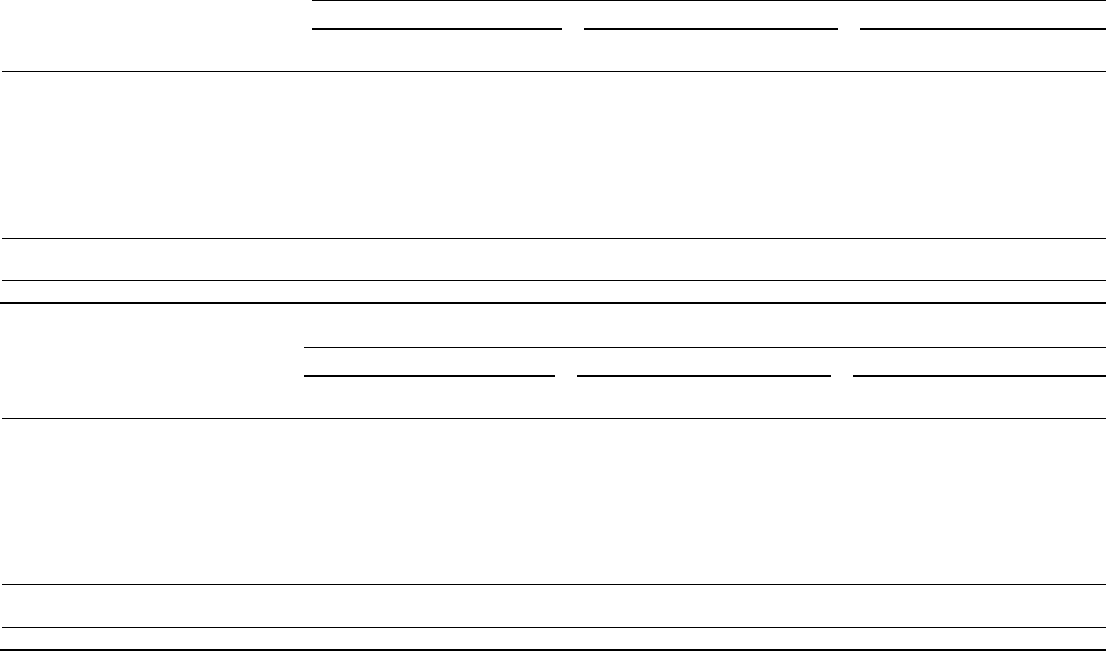

Security Unrealized Loss Aging

The following tables present the Company’ s unrealized loss aging for AFS securities by type and length of time the security was in a

continuous unrealized loss position.

December 31, 2011

Less Than 12 Months

12 Months or More

Total

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

ABS

$

629

$

594

$

(35)

$

1,169

$

872

$

(297)

$

1,798

$

1,466

$

(332)

CDOs 81 59 (22) 2,709 2,383 (326) 2,790 2,442

(348)

CMBS

1,297

1,194

(103)

2,144

1,735

(409)

3,441

2,929

(512)

Corporate [1]

4,388

4,219

(169)

3,268

2,627

(570)

7,656

6,846

(739)

Foreign govt./govt. agencies

218

212

(6)

51

47

(4)

269

259

(10)

Municipal

299

294

(5)

627

560

(67)

926

854

(72)

RMBS

415

330

(85)

1,206

835

(371)

1,621

1,165

(456)

U.S. Treasuries 343 341 (2) — — — 343 341

(2)

Total fixed maturities

7,670

7,243

(427)

11,174

9,059

(2,044)

18,844

16,302

(2,471)

Equity securities

167

138

(29)

439

265

(174)

606

403

(203)

Total securities in an unrealized loss

$

7,837

$

7,381

$

(456)

$

11,613

$

9,324

$

(2,218)

$

19,450

$

16,705

$

(2,674)

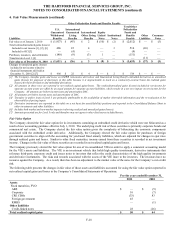

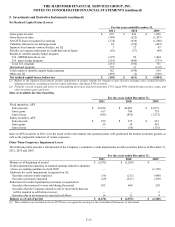

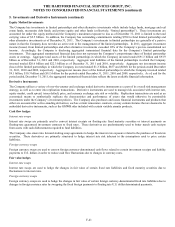

December 31, 2010

Less Than 12 Months 12 Months or More Total

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

Amortized

Cost

Fair

Value

Unrealized

Losses

ABS $

302 $ 290 $ (12) $ 1,410 $ 1,026 $ (384) $ 1,712 $ 1,316 $

(396)

CDOs

321

293

(28)

2,724

2,274

(450)

3,045

2,567

(478)

CMBS

556

530

(26)

3,962

3,373

(589)

4,518

3,903

(615)

Corporate

5,533

5,329

(199)

4,017

3,435

(548)

9,550

8,764

(747)

Foreign govt./govt. agencies

356

349

(7)

78

68

(10)

434

417

(17)

Municipal

7,485

7,173

(312)

1,046

863

(183)

8,531

8,036

(495)

RMBS

1,744

1,702

(42)

1,567

1,147

(420)

3,311

2,849

(462)

U.S. Treasuries

2,436

2,321

(115)

158

119

(39)

2,594

2,440

(154)

Total fixed maturities

18,733

17,987

(741)

14,962

12,305

(2,623)

33,695

30,292

(3,364)

Equity securities

53

52

(1)

637

506

(131)

690

558

(132)

Total securities in an unrealized loss

$

18,786

$

18,039

$

(742)

$

15,599

$

12,811

$

(2,754)

$

34,385

$

30,850

$

(3,496)

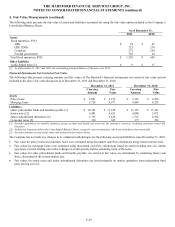

[1] Unrealized losses exclude the change in fair value of bifurcated embedded derivative features of certain securities. Subsequent changes in fair

value are recorded in net realized capital gains (losses).

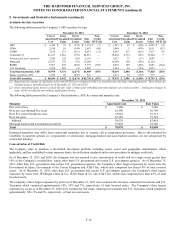

As of December 31, 2011, AFS securities in an unrealized loss position, comprised of 2,549 securities, primarily related to corporate

securities within the financial services sector, CMBS, and RMBS which have experienced significant price deterioration. As of

December 31, 2011, 75% of these securities were depressed less than 20% of cost or amortized cost. The decline in unrealized losses

during 2011 was primarily attributable to a decline in interest rates, partially offset by credit spread widening.

Most of the securities depressed for twelve months or more relate to structured securities with exposure to commercial and residential

real estate, as well as certain floating rate corporate securities or those securities with greater than 10 years to maturity, concentrated in

the financial services sector. Current market spreads continue to be significantly wider for structured securities with exposure to

commercial and residential real estate, as compared to spreads at the security’ s respective purchase date, largely due to the economic

and market uncertainties regarding future performance of commercial and residential real estate. In addition, the majority of securities

have a floating-rate coupon referenced to a market index where rates have declined substantially. The Company neither has an intention

to sell nor does it expect to be required to sell the securities outlined above.