The Hartford 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

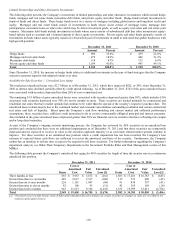

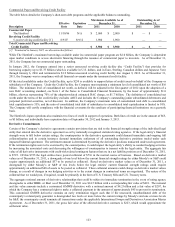

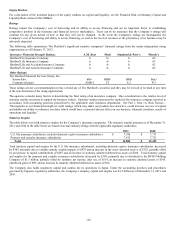

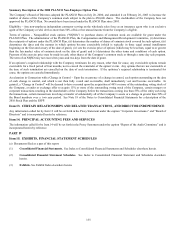

The following table identifies the Company’ s aggregate contractual obligations as of December 31, 2011:

Payments due by period

Total

Less than

1 year

1-3

years

3-5

years

More than

5 years

Property and casualty obligations [1]

$

22,093

$

5,721

$

4,384

$

2,818

$

9,170

Life, annuity and disability obligations [2]

341,984

22,894

34,895

30,701

253,494

Operating lease obligations [3]

242

58

81

47

56

Long-term debt obligations [4]

19,202

480

1,460

1,678

15,584

Consumer notes [5]

348

168

104

55

21

Purchase obligations [6]

3,484

2,693

544

214

33

Other long-term liabilities reflected on the balance sheet [7]

2,505

1,986

379

140

–

Total [8]

$

389,858

$

34,000

$

41,847

$

35,653

$

278,358

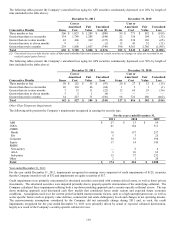

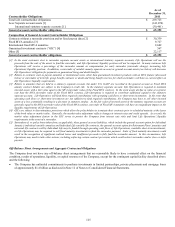

[1] The following points are significant to understanding the cash flows estimated for obligations under property and casualty contracts:

• Reserves for Property & Casualty unpaid losses and loss adjustment expenses include IBNR and case reserves. While payments due on claim

reserves are considered contractual obligations because they relate to insurance policies issued by the Company, the ultimate amount to be paid

to settle both case reserves and IBNR is an estimate, subject to significant uncertainty. The actual amount to be paid is not finally determined

until the Company reaches a settlement with the claimant. Final claim settlements may vary significantly from the present estimates,

particularly since many claims will not be settled until well into the future.

• In estimating the timing of future payments by year, the Company has assumed that its historical payment patterns will continue. However, the

actual timing of future payments could vary materially from these estimates due to, among other things, changes in claim reporting and payment

patterns and large unanticipated settlements. In particular, there is significant uncertainty over the claim payment patterns of asbestos and

environmental claims. In addition, the table does not include future cash flows related to the receipt of premiums that may be used, in part, to

fund loss payments.

• Under U.S. GAAP, the Company is only permitted to discount reserves for losses and loss adjustment expenses in cases where the payment

pattern and ultimate loss costs are fixed and determinable on an individual claim basis. For the Company, these include claim settlements with

permanently disabled claimants. As of December 31, 2011, the total property and casualty reserves in the above table are gross of a reserve

discount of $542.

[2] Estimated life, annuity and disability obligations include death and disability claims, policy surrenders, policyholder dividends and trail

commissions offset by expected future deposits and premiums on in-force contracts. Estimated life, annuity and disability obligations are based on

mortality, morbidity and lapse assumptions comparable with the Company’s historical experience, modified for recent observed trends. The

Company has also assumed market growth and interest crediting consistent with other assumptions. In contrast to this table, the majority of the

Company’s obligations are recorded on the balance sheet at the current account values and do not incorporate an expectation of future market

growth, interest crediting, or future deposits. Therefore, the estimated obligations presented in this table significantly exceed the liabilities

recorded in reserve for future policy benefits and unpaid losses and loss adjustment expenses, other policyholder funds and benefits payable and

separate account liabilities. Due to the significance of the assumptions used, the amounts presented could materially differ from actual results.

[3] Includes future minimum lease payments on operating lease agreements. See Note 12 of Notes to Consolidated Financial Statements for

additional discussion on lease commitments.

[4] Includes contractual principal and interest payments. See Note 14 of Notes to Consolidated Financial Statements for additional discussion of

long-term debt obligations.

[5] Consumer notes include principal payments and contractual interest for fixed rate notes and interest based on current rates for floating rate notes.

See Note 14 of Notes to Consolidated Financial Statements for additional discussion of consumer notes.

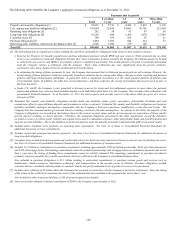

[6] Includes $1.4 billion in commitments to purchase investments including approximately $700 of limited partnership, $108 of private placements

and $553 of mortgage loans. Outstanding commitments under these limited partnerships and mortgage loans are included in payments due in less

than 1 year since the timing of funding these commitments cannot be reliably estimated. The remaining commitments to purchase investments

primarily represent payables for securities purchased which are reflected on the Company’s consolidated balance sheet.

Also included in purchase obligations is $1.1 billion relating to contractual commitments to purchase various goods and services such as

maintenance, human resources, information technology, and transportation in the normal course of business. Purchase obligations exclude

contracts that are cancelable without penalty or contracts that do not specify minimum levels of goods or services to be purchased.

[7] Includes cash collateral of $2 billion which the Company has accepted in connection with the Company’s derivative instruments. Since the timing

of the return of the collateral is uncertain, the return of the collateral has been included in the payments due in less than 1 year.

Also included in other long term liabilities is $48 of net unrecognized tax benefits.

[8] Does not include estimated voluntary contribution of $200 to the Company’s pension plan in 2012.