The Hartford 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

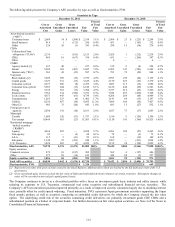

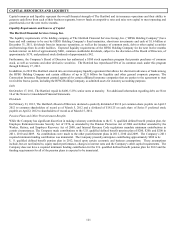

Financial Services

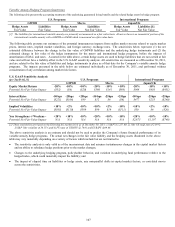

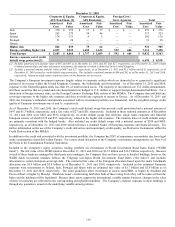

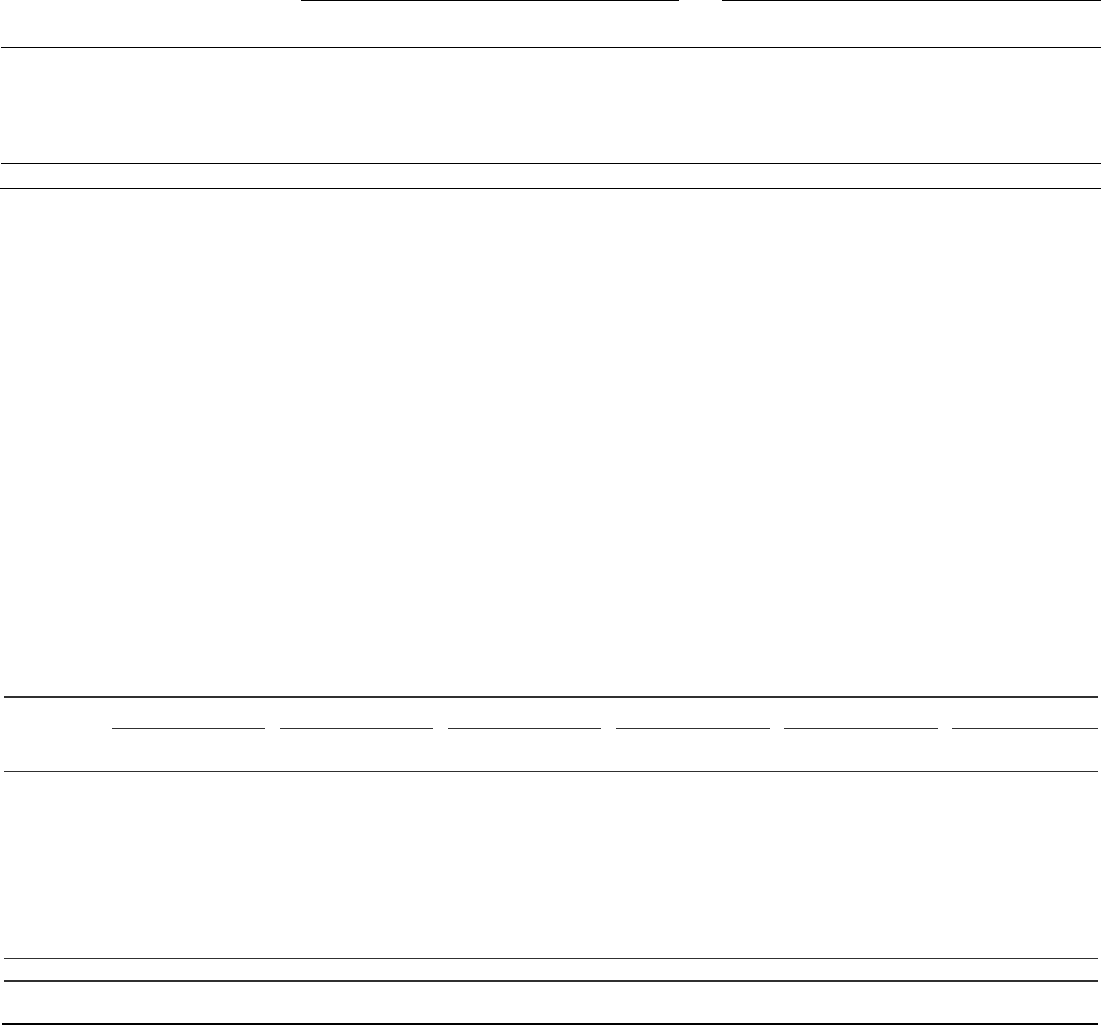

The Company’ s exposure to the financial services sector is predominantly through banking and insurance institutions. The following

table presents the Company’ s exposure to the financial services sector included in the Securities by Type table above.

December 31, 2011 December 31, 2010

Amortized

Cost

Fair Value

Net

Unrealized

Amortized

Cost

Fair Value

Net

Unrealized

AAA

$

240

$

245

$

5

$

302

$

309

$

7

AA

1,698

1,675

(23)

2,085

2,095

10

A

3,664

3,685

21

3,760

3,599

(161)

BBB

2,335

1,998

(337)

1,677

1,518

(159)

BB & below

305

270

(35)

290

253

(37)

Total

$

8,242

$

7,873

$

(369)

$

8,114

$

7,774

$

(340)

Domestic financial companies continued to stabilize throughout 2011 due to improved earnings performance, strengthening of asset

quality and capital retention. However, spread volatility remains high due to concerns around European sovereign risks and potential

contagion, regulatory pressures and a weaker U.S. macroeconomic environment. Financial institutions remain vulnerable to these

concerns, as well as ongoing stress in the real estate markets which could adversely impact the Company’ s net unrealized position.

Included in the table above as of December 31, 2011, is an amortized cost and fair value of $1.3 billion and $1.2 billion, respectively,

related to European investment exposure, of which only $20 and $19, respectively, relates to GIIPS. As of December 31, 2010,

amortized cost and fair value includes $1.8 billion and $1.7 billion, respectively, of European exposure, of which only $75 and $66,

respectively, relates to GIIPS.

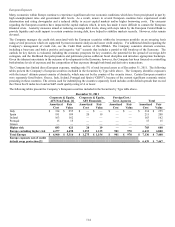

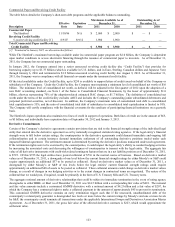

Commercial Real Estate

The commercial real estate market continued to show signs of improving fundamentals, such as increases in transaction activities, more

readily available financing and new issuances. While delinquencies still remain at historically high levels, they are expected to move

lower in 2012.

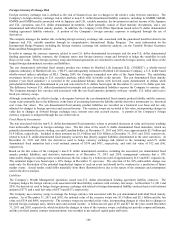

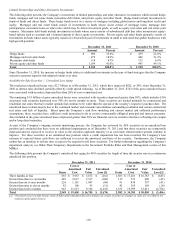

The following table presents the Company’ s exposure to commercial mortgage backed-securities (“CMBS”) bonds by current credit

quality and vintage year, included in the Securities by Type table above. Credit protection represents the current weighted average

percentage of the outstanding capital structure subordinated to the Company’ s investment holding that is available to absorb losses

before the security incurs the first dollar loss of principal and excludes any equity interest or property value in excess of outstanding

debt.

CMBS – Bonds [1]

December 31, 2011

AAA

AA

A

BBB

BB and Below

Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior

$

408

$

415

$

148

$

144

$

83

$

81

$

16

$

13

$

33

$

30

$

688

$

683

2004

333

349

68

75

45

41

30

28

26

21

502

514

2005

520

556

101

96

178

151

177

138

71

57

1,047

998

2006

713

762

516

493

180

159

362

298

430

302

2,201

2,014

2007

245

267

296

275

123

97

166

130

195

149

1,025

918

2008 55 60 — — — — — — — — 55 60

2009

28

29

—

—

—

—

—

—

—

—

28

29

2010

29

31

—

—

—

—

—

—

—

—

29

31

2011

417

440

—

—

—

—

—

—

—

—

417

440

Total

$

2,748

$

2,909

$

1,129

$

1,083

$

609

$

529

$

751

$

607

$

755

$

559

$

5,992

$

5,687

Credit

protection

27.3%

22.7%

19.7%

13.8%

8.2%

21.6%