The Hartford 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-6

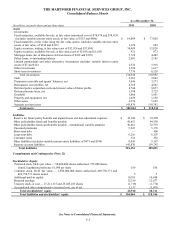

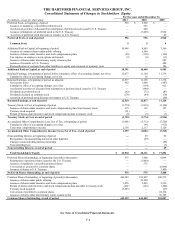

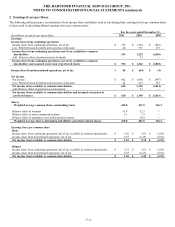

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

Consolidated Statements of Changes in Stockholders’ Equity

For the years ended December 31,

(In millions, except for share data)

2011

2010

2009

Preferred Stock, at beginning of period

556

$

2,960

$

—

Issuance of mandatory convertible preferred stock

—

556

—

Accelerated accretion of discount from redemption of preferred stock issued to U.S. Treasury

—

440

—

Issuance (redemption) of preferred stock to the U.S. Treasury

—

(3,400)

2,920

Accretion of preferred stock discount on issuance to U.S. Treasury

—

—

40

Preferred Stock, at end of period

556

556

2,960

Common Stock

5

5

4

Additional Paid-in Capital, at beginning of period 10,448

8,985

7,569

Issuance of common shares under public offering

—

1,599

—

Issuance of shares under incentive and stock compensation plans

(50)

(130)

(126)

Tax expense on employee stock options and awards (7)

(6)

(11)

Issuance of shares under discretionary equity issuance plan

—

—

887

Issuance of warrants to U.S. Treasury

—

—

480

Reclassification of warrants from other liabilities to equity and extension of warrants’ term —

—

186

Additional Paid-in Capital, at end of period

10,391

10,448

8,985

Retained Earnings, at beginning of period, before cumulative effect of accounting change, net of tax

12,077

11,164

11,336

Cumulative effect of accounting change, net of tax —

26

—

Retained Earnings, at beginning of period, as adjusted

12,077

11,190

11,336

Net income (loss)

662

1,680

(887)

Cumulative effect of accounting changes, net of tax

—

(194)

912

Accelerated accretion of discount from redemption of preferred stock issued to U.S. Treasury

—

(440)

—

Dividends on preferred stock

(42)

(75)

(87)

Dividends declared on common stock

(178)

(84)

(70)

Accretion of preferred stock discount on issuance to U.S. Treasury

—

—

(40)

Retained Earnings, at end of period

12,519

12,077

11,164

Treasury Stock, at Cost, at beginning of period

(1,774)

(1,936)

(2,120)

Issuance of shares under incentive and stock compensation plans from treasury stock

115

165

187

Treasury stock acquired

(51)

—

—

Return of shares under incentive and stock compensation plans to treasury stock

(8)

(3)

(3)

Treasury Stock, at Cost, at end of period

(1,718)

(1,774)

(1,936)

Accumulated Other Comprehensive Loss, Net of Tax, at beginning of period

(1,001)

(3,312)

(7,520)

Cumulative effect of accounting changes, net of tax —

194

(912)

Total other comprehensive income

2,158

2,117

5,120

Accumulated Other Comprehensive Income (Loss), Net of Tax, at end of period

1,157

(1,001)

(3,312)

Noncontrolling Interest, at beginning of period

—

29

92

Recognition of noncontrolling interest in other liabilities

—

(29)

—

Change in noncontrolling interest ownership

—

—

(56)

Noncontrolling loss

—

—

(7)

Noncontrolling Interest, at end of period

—

—

29

Total Stockholders’ Equity

$

22,910

$

20,311

$

17,894

Preferred Shares Outstanding, at beginning of period (in thousands)

575

3,400

6,048

Redemption of preferred shares issued to the U.S. Treasury

—

(3,400)

—

Issuance of mandatory convertible preferred shares

—

575

—

Conversion of preferred to common shares

—

—

(6,048)

Issuance of shares to U.S. Treasury

—

—

3,400

Preferred Shares Outstanding, at end of period

575

575

3,400

Common Shares Outstanding, at beginning of period (in thousands)

444,549

383,007

300,579

Issuance of shares under public offering

—

59,590

—

Issuance of shares under incentive and stock compensation plans 1,476

2,095

2,356

Return of shares under incentive and stock compensation plans and other to treasury stock

(261)

(143)

(204)

Treasury stock acquired

(3,225)

—

(27)

Conversion of preferred to common shares

—

—

24,194

Issuance of shares under discretionary equity issuance plan

—

—

56,109

Common Shares Outstanding, at end of period

442,539

444,549

383,007

See Notes to Consolidated Financial Statements.