The Hartford 2011 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-70

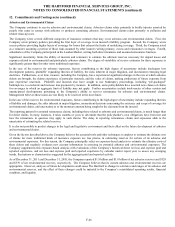

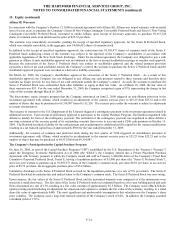

14. Debt

The Hartford’ s long-term debt securities are issued by either The Hartford Financial Services Group, Inc. (“HFSG Holding Company”)

or Hartford Life, Inc. (“HLI”), an indirect wholly owned subsidiary, and are unsecured obligations of HFSG Holding Company or HLI

and rank on a parity with all other unsecured and unsubordinated indebtedness of HFSG Holding Company or HLI.

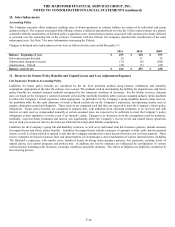

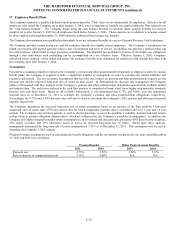

Debt is carried net of discount. The following table presents short-term and long-term debt by issuance as of December 31, 2011 and

2010.

Short-Term Debt

2011

2010

Current maturities of long-term debt and capital lease obligations

$

—

$

400

Total Short-Term Debt

$

—

$

400

Long-Term Debt

Senior Notes and Debentures

4.625% Notes, due 2013

320

320

4.75% Notes, due 2014

200

200

4.0% Notes, due 2015

300

300

7.3% Notes, due 2015

200

200

5.5% Notes, due 2016

300

300

5.375% Notes, due 2017

499

499

6.3% Notes, due 2018

500

500

6.0% Notes, due 2019

500

500

5.5% Notes, due 2020

499

499

7.65% Notes, due 2027

149

149

7.375% Notes, due 2031

92

92

5.95% Notes, due 2036

298

298

6.625% Notes, due 2040

299

299

6.1% Notes, due 2041

325

324

Total Senior Notes and Debentures

4,481

4,480

Junior Subordinated Debentures

3 month LIBOR plus 295 basis points, Notes due 2033

—

5

8.125% Notes, due 2068

500

500

10.0% Notes, due 2068

1,235

1,222

Total Junior Subordinated Debentures

1,735

1,727

Total Long-Term Debt

$

6,216

$

6,207

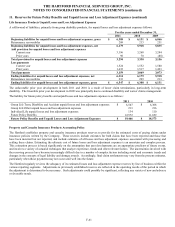

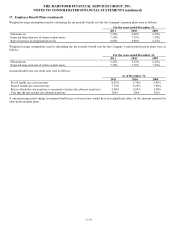

The effective interest rates on the 6.1% senior notes due 2041 and the 10.0% junior subordinated debentures due 2068 are 7.9% and

15.3%, respectively. The effective interest rate on the remaining notes does not differ materially from the stated rate.

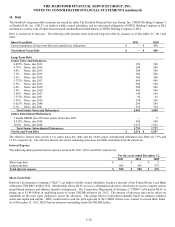

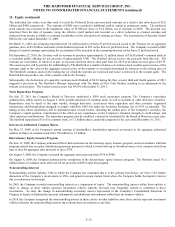

Interest Expense

The following table presents interest expense incurred for 2011, 2010, and 2009, respectively.

For the years ended December 31,

2011

2010

2009

Short-term debt

$

–

$

—

$

3

Long-term debt

508

508

473

Total interest expense

$

508

$

508

$

476

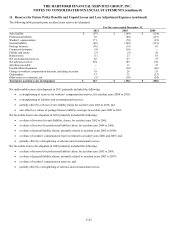

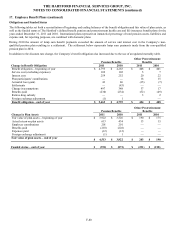

Short-Term Debt

Hartford Life Insurance Company (“HLIC”), an indirect wholly owned subsidiary, became a member of the Federal Home Loan Bank

of Boston (“FHLBB”) in May 2011. Membership allows HLIC access to collateralized advances, which may be used to support various

spread-based business and enhance liquidity management. The Connecticut Department of Insurance (“CTDOI”) will permit HLIC to

pledge up to $1.48 billion in qualifying assets to secure FHLBB advances for 2012. The amount of advances that can be taken are

dependent on the asset types pledged to secure the advances. The pledge limit is recalculated annually based on statutory admitted

assets and capital and surplus. HLIC would need to seek the prior approval of the CTDOI if there were a desire to exceed these limits.

As of December 31, 2011, HLIC had no advances outstanding under the FHLBB facility.