The Hartford 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

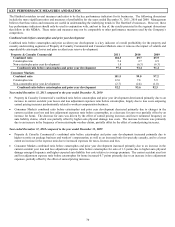

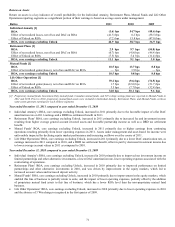

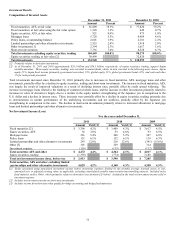

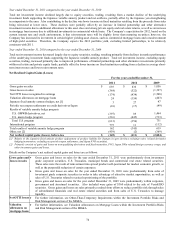

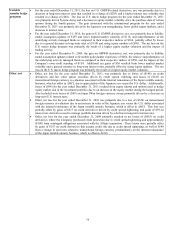

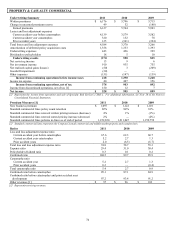

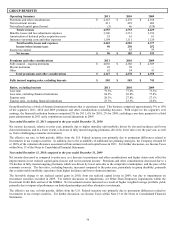

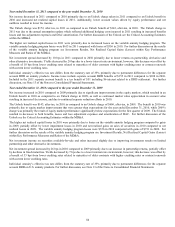

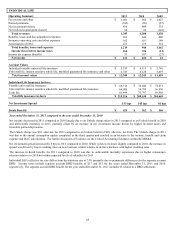

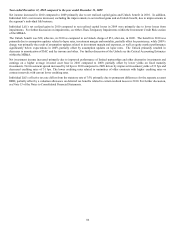

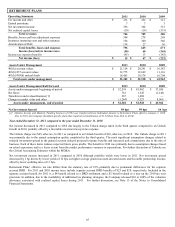

Year ended December 31, 2011 compared to the year ended December 31, 2010

Net income decreased in 2011, as compared to the prior year, primarily due to a decrease in underwriting results due to higher current

accident year losses, including catastrophes, and unfavorable prior accident years development in 2011 compared to favorable prior

accident years development in 2010. The decrease in underwriting results was partially offset by the net realized capital gain on the sale

of SRS. The annual goodwill assessment for the Property & Casualty Commercial reporting unit resulted in a write-down of goodwill

of $30, pre-tax for the year ended December 31, 2011. For further discussion, see Goodwill and Other Intangible Assets within Note 8

of the Notes to Consolidated Financial Statements.

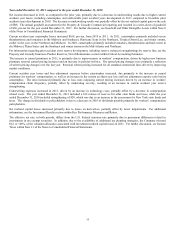

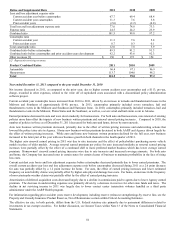

Current accident year catastrophe losses increased $168, pre-tax, from 2010 to 2011. In 2011, catastrophes primarily included severe

thunderstorms and tornadoes in the Midwest and Southeast, Hurricane Irene in the Northeast, Tropical Storm Lee, and winter storms,

earlier in the year, in the Northeast and Midwest. In 2010, catastrophes primarily included tornadoes, thunderstorms and hail events in

the Midwest, Plains States and the Southeast and winter storms in the Mid-Atlantic and Northeast.

For information regarding prior accident years reserve development, including reserve (releases) strengthenings by reserve line, see the

Property and Casualty Insurance Product Reserves, Net of Reinsurance section within Critical Accounting Estimates.

The increase in earned premiums in 2011, is primarily due to improvements in workers’ compensation, driven by higher new business

premium, renewal earned pricing increases and an increase in policies-in-force. The earned pricing changes were primarily a reflection

of written pricing changes over the last year. Renewal written pricing increased for all standard commercial lines driven by improving

market conditions.

Current accident year losses and loss adjustment expenses before catastrophes increased, due primarily to the increase in earned

premiums for workers’ compensation, as well as an increase in the current accident year loss and loss adjustment expense ratio before

catastrophes. The ratio increased primarily due to loss costs outpacing earned pricing increases driven by an increase in workers'

compensation claim frequency, partially offset by moderating severity, resulting in an increase in current accident year reserve

strengthening.

Underwriting expenses increased in 2011, driven by an increase in technology costs, partially offset by a decrease in compensation

related costs. The year ended December 31, 2011 included a $12 release of reserves for other state funds and taxes, while the year

ended December 31, 2010 included strengthening of $20, which was due to an increase in the assessment for New York state funds and

taxes. The change in dividends to policyholders is due to a decrease in 2010 of dividends payable primarily for workers’ compensation

policyholders.

Net realized capital losses increased primarily due to losses on derivatives, partially offset by lower impairments. For additional

information, see the Investment Results section within Key Performance Measures and Ratios.

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to

investments in tax exempt securities. In addition, due to the availability of additional tax planning strategies, the Company released

$22, or 100%, of the valuation allowance associated with investment realized capital losses in 2011. For further discussion, see Income

Taxes within Note 13 of the Notes to Consolidated Financial Statements.