The Hartford 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-46

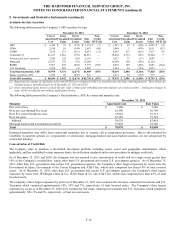

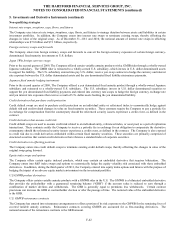

5. Investments and Derivative Instruments (continued)

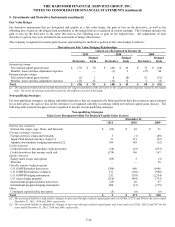

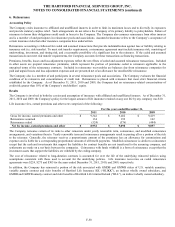

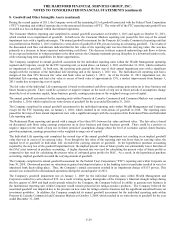

Fair Value Hedges

For derivative instruments that are designated and qualify as a fair value hedge, the gain or loss on the derivative, as well as the

offsetting loss or gain on the hedged item attributable to the hedged risk are recognized in current earnings. The Company includes the

gain or loss on the derivative in the same line item as the offsetting loss or gain on the hedged item. All components of each

derivative’ s gain or loss were included in the assessment of hedge effectiveness.

The Company recognized in income gains (losses) representing the ineffective portion of fair value hedges as follows:

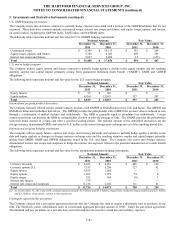

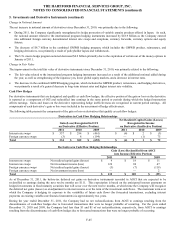

Derivatives in Fair Value Hedging Relationships

Gain (Loss) Recognized in Income [1]

2011

2010

2009

Derivative

Hedged

Item

Derivative

Hedged

Item

Derivative

Hedged

Item

Interest rate swaps

Net realized capital gains (losses)

$

(73)

$

70

$

(43)

$

36

$

72

$

(68)

Benefits, losses and loss adjustment expenses

—

—

(1)

3

(37)

40

Foreign currency swaps

Net realized capital gains (losses)

(1)

1

8

(8)

51

(51)

Benefits, losses and loss adjustment expenses

(22)

22

(12)

12

2

(2)

Total

$

(96)

$

93

$

(48)

$

43

$

88

$

(81)

[1] The amounts presented do not include the periodic net coupon settlements of the derivative or the coupon income (expense) related to the hedged

item. The net of the amounts presented represents the ineffective portion of the hedge.

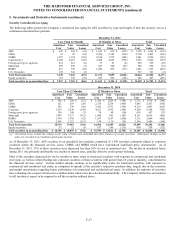

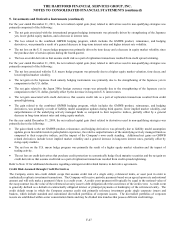

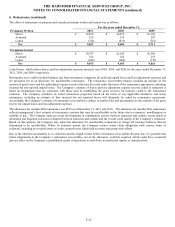

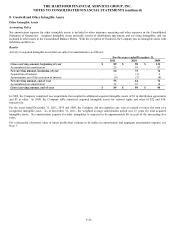

Non-qualifying Strategies

For non-qualifying strategies, including embedded derivatives that are required to be bifurcated from their host contracts and accounted

for as derivatives, the gain or loss on the derivative is recognized currently in earnings within net realized capital gains (losses). The

following table presents the gain or loss recognized in income on non-qualifying strategies:

Non-qualifying Strategies

Gain (Loss) Recognized within Net Realized Capital Gains (Losses)

December 31,

2011

2010

2009

Interest rate contracts

Interest rate swaps, caps, floors, and forwards

$

(22)

$

45

$

31

Foreign exchange contracts

Foreign currency swaps and forwards

3

(1)

(49)

Japan 3Win foreign currency swaps [1]

31

215

(22)

Japanese fixed annuity hedging instruments [2]

109

385

(12)

Credit contracts

Credit derivatives that purchase credit protection

(10)

(23)

(533)

Credit derivatives that assume credit risk

(174)

196

167

Equity contracts

Equity index swaps and options

(89)

5

(3)

Warrants

—

—

70

Variable annuity hedge program

U.S. GMWB product derivatives

(780)

486

4,686

U.S. GMWB reinsurance contracts

131

(102)

(988)

U.S. GMWB hedging instruments

252

(295)

(2,234)

U.S. macro hedge program

(216)

(445)

(733)

International program product derivatives

(25)

26

67

International program hedging instruments

800

(15)

(179)

Other

Contingent capital facility put option

(5)

(6)

(8)

Total

$

5

$

471

$

260

[1] The associated liability is adjusted for changes in spot rates through realized capital gains and was ($100), ($273) and $64 for the years ended

December 31, 2011, 2010 and 2009, respectively.

[2] The associated liability is adjusted for changes in spot rates through realized capital gains and losses and was ($129), ($332) and $67 for the

years ended December 31, 2011, 2010 and 2009, respectively.