The Hartford 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

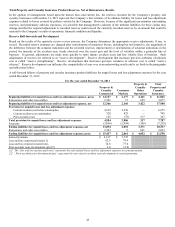

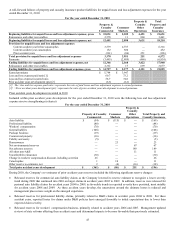

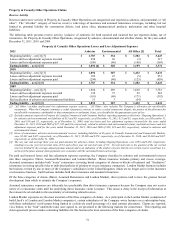

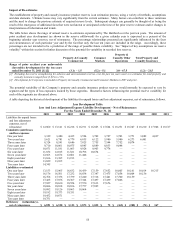

The following table sets forth, for the years ended December 31, 2011, 2010 and 2009, paid and incurred loss activity by the three

categories of claims for asbestos and environmental.

Paid and Incurred Losses and Loss Adjustment Expenses (“LAE”) Development – Asbestos and Environmental

Asbestos [1]

Environmental [1]

2011

Paid

Losses & LAE

Incurred

Losses & LAE

Paid

Losses & LAE

Incurred

Losses & LAE

Gross

Direct $

170 $ 350 $ 32 $ 25

Assumed Reinsurance

55

12

8

—

London Market

23

16

6

4

Total

248

378

46

29

Ceded

(59)

(84)

(6)

(3)

Net

$

189

$

294

$

40

$

26

2010

Gross

Direct

$

201

$

209

$

35

$

50

Assumed Reinsurance 128 — 12 5

London Market

42

(15)

7

10

Total

371

194

54

65

Ceded

(77)

(5)

(14)

2

Net

$

294

$

189

$

40

$

67

2009

Gross

Direct

$

160

$

117

$

29

$

92

Assumed – Domestic

56

52

7

—

London Market

18

—

10

12

Total

234

169

46

104

Ceded

(53)

(31)

(6)

(29)

Net prior to reclassification

$

181

$

138

$

40

$

75

Reclassification of asbestos and

environmental liabilities [2]

—

51

—

3

Net

$

181

$

189

$

40

$

78

[1] Excludes asbestos and environmental paid and incurred loss and LAE reported in Ongoing Operations. Total gross losses and LAE incurred in

Ongoing Operations for the years ended December 31, 2011, 2010 and 2009 includes $30, $15 and $17, respectively, related to asbestos and

environmental claims. Total gross losses and LAE paid in Ongoing Operations for the years ended December 31, 2011, 2010 and 2009 includes

$22, $14 and $20, respectively, related to asbestos and environmental claims.

[2] During the three months ended June 30, 2009, the Company reclassified liabilities of $54 that were previously classified as “All Other” to

“Asbestos” and “Environmental”.

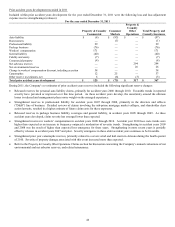

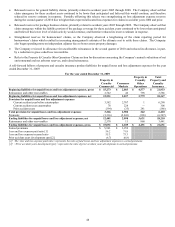

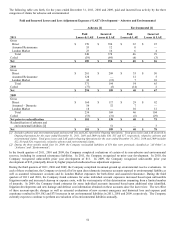

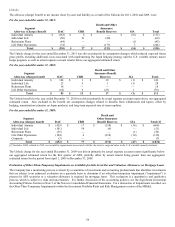

In the fourth quarters of 2011, 2010 and 2009, the Company completed evaluations of certain of its non-asbestos and environmental

reserves, including its assumed reinsurance liabilities. In 2011, the Company recognized no prior year development. In 2010, the

Company recognized unfavorable prior year development of $11. In 2009, the Company recognized unfavorable prior year

development of $35, principally driven by higher projected unallocated loss adjustment expenses.

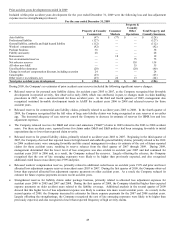

During the third quarters of 2011, 2010 and 2009, the Company completed its annual ground up environmental reserve evaluations. In

each of these evaluations, the Company reviewed all of its open direct domestic insurance accounts exposed to environmental liability as

well as assumed reinsurance accounts and its London Market exposures for both direct and assumed reinsurance. During the third

quarters of 2011 and 2010, the Company found estimates for some individual account exposures increased based upon unfavorable

litigation results and increased clean-up or expense costs, with the vast majority of this deterioration emanating from a limited number

of insureds. In 2009, the Company found estimates for some individual accounts increased based upon additional sites identified,

litigation developments and new damage and defense cost information obtained on these accounts since the last review. The net effect

of these account-specific changes as well as actuarial evaluations of new account emergence and historical loss and expense paid

experience resulted in $19, $62 and $75 increases in net environmental liabilities in 2011, 2010 and 2009, respectively. The Company

currently expects to continue to perform an evaluation of its environmental liabilities annually.