The Hartford 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

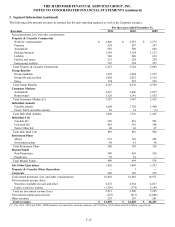

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-9

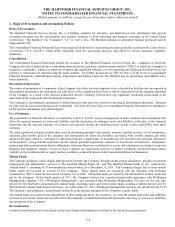

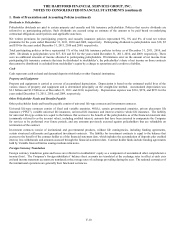

1. Basis of Presentation and Accounting Policies (continued)

Future Adoption of New Accounting Standards

Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts

In October 2010, the FASB issued a standard clarifying the definition of acquisition costs that are eligible for deferral. Acquisition

costs are to include only those costs that are directly related to the successful acquisition or renewal of insurance contracts; incremental

direct costs of contract acquisition that are incurred in transactions with either independent third parties or employees; and advertising

costs meeting the capitalization criteria for direct-response advertising.

This standard is effective for fiscal years beginning after December 15, 2011, and interim periods within those years. This standard may

be applied prospectively upon the date of adoption, with retrospective application permitted, but not required. Early adoption as of the

beginning of a fiscal year is permitted.

The Company elected to adopt this standard retrospectively on January 1, 2012, resulting in a write down of the Company’ s deferred

acquisition costs relating to those costs which no longer meet the revised standard as summarized above. The Company estimates the

cumulative effect of the retrospective adoption of this standard, when reflected in future financial statements, will reduce stockholders’

equity as of December 31, 2011 by approximately $1.5 billion, after-tax and increase 2011 net income by approximately $45.

Excluding the effects of the DAC Unlock and amortization related to realized gains and losses, the estimated effect would be a decrease

to 2011 net income of approximately $10. Future income statement impacts will reflect higher non-deferrable expenses and lower

amortization due to the lower DAC balance, before the effect of any DAC Unlock and amortization related to realized gains and losses.

Significant Accounting Policies

The Company’ s significant accounting policies are described below or are referenced below to the applicable Note where the

description is included.

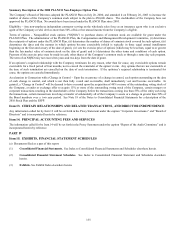

Accounting Policy

Note

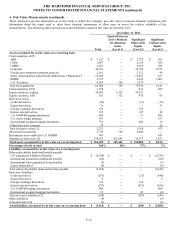

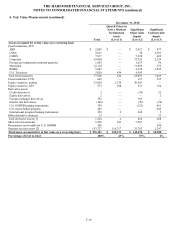

Fair Value Measurements

4

Investments and Derivative Instruments

5

Reinsurance

6

Deferred Policy Acquisition Costs and Present Value of Future Profits

7

Goodwill and Other Intangible Assets

8

Separate Accounts, Death Benefits and Other Insurance Benefit Features

9

Sales Inducements

10

Reserve for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses

11

Commitments and Contingencies

12

Income Taxes

13

Employee Benefit Plans

17

Revenue Recognition

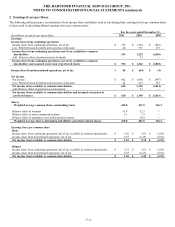

Property and casualty insurance premiums are earned on a pro rata basis over the lives of the policies and include accruals for ultimate

premium revenue anticipated under auditable and retrospectively rated policies. Unearned premiums represent the premiums applicable

to the unexpired terms of policies in force. An estimated allowance for doubtful accounts is recorded on the basis of periodic

evaluations of balances due from insureds, management’ s experience and current economic conditions. The Company charges off any

balances that are determined to be uncollectible. The allowance for doubtful accounts included in premiums receivable and agents’

balances in the Consolidated Balance Sheets was $119 as of December 31, 2011 and 2010.

Traditional life and group disability products premiums are generally recognized as revenue when due from policyholders.

Fee income for universal life-type contracts consists of policy charges for policy administration, cost of insurance charges and surrender

charges assessed against policyholders’ account balances and are recognized in the period in which services are provided. The amounts

collected from policyholders for investment and universal life-type contracts are considered deposits and are not included in revenue.

Unearned revenue reserves, representing amounts assessed as consideration for origination of a universal life-type contract, are deferred

and recognized in income over the period benefited, generally in proportion to estimated gross profits.

Other revenue consists primarily of revenues associated with the Company’ s servicing businesses.