The Hartford 2011 Annual Report Download - page 166

Download and view the complete annual report

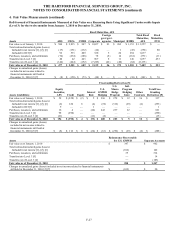

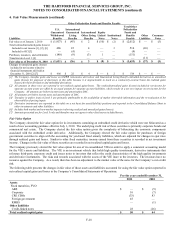

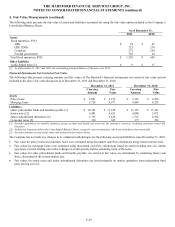

Please find page 166 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-31

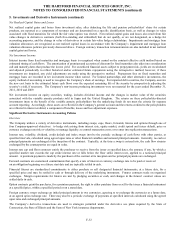

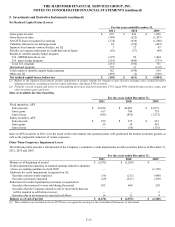

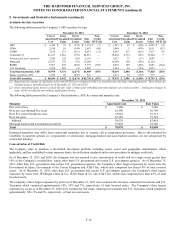

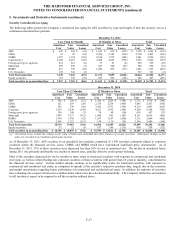

5. Investments and Derivative Instruments (continued)

The Company’ s evaluation of whether a credit impairment exists for debt securities includes but is not limited to, the following factors:

(a) changes in the financial condition of the security’ s underlying collateral, (b) whether the issuer is current on contractually obligated

interest and principal payments, (c) changes in the financial condition, credit rating and near-term prospects of the issuer, (d) the extent

to which the fair value has been less than the amortized cost of the security and (e) the payment structure of the security. The

Company’ s best estimate of expected future cash flows used to determine the credit loss amount is a quantitative and qualitative process

that incorporates information received from third-party sources along with certain internal assumptions and judgments regarding the

future performance of the security. The Company’ s best estimate of future cash flows involves assumptions including, but not limited

to, various performance indicators, such as historical and projected default and recovery rates, credit ratings, current and projected

delinquency rates, and loan-to-value (“LTV”) ratios. In addition, for structured securities, the Company considers factors including, but

not limited to, average cumulative collateral loss rates that vary by vintage year, commercial and residential property value declines that

vary by property type and location and commercial real estate delinquency levels. These assumptions require the use of significant

management judgment and include the probability of issuer default and estimates regarding timing and amount of expected recoveries

which may include estimating the underlying collateral value. In addition, projections of expected future debt security cash flows may

change based upon new information regarding the performance of the issuer and/or underlying collateral such as changes in the

projections of the underlying property value estimates.

For equity securities where the decline in the fair value is deemed to be other-than-temporary, a charge is recorded in net realized capital

losses equal to the difference between the fair value and cost basis of the security. The previous cost basis less the impairment becomes

the security’ s new cost basis. The Company asserts its intent and ability to retain those equity securities deemed to be temporarily

impaired until the price recovers. Once identified, these securities are systematically restricted from trading unless approved by a

committee of investment and accounting professionals (“Committee”). The Committee will only authorize the sale of these securities

based on predefined criteria that relate to events that could not have been reasonably foreseen. Examples of the criteria include, but are

not limited to, the deterioration in the issuer’ s financial condition, security price declines, a change in regulatory requirements or a

major business combination or major disposition.

The primary factors considered in evaluating whether an impairment exists for an equity security include, but are not limited to: (a) the

length of time and extent to which the fair value has been less than the cost of the security, (b) changes in the financial condition, credit

rating and near-term prospects of the issuer, (c) whether the issuer is current on preferred stock dividends and (d) the intent and ability

of the Company to retain the investment for a period of time sufficient to allow for recovery.

Mortgage Loan Valuation Allowances

The Company’ s security monitoring process reviews mortgage loans on a quarterly basis to identify potential credit losses. Commercial

mortgage loans are considered to be impaired when management estimates that, based upon current information and events, it is

probable that the Company will be unable to collect amounts due according to the contractual terms of the loan agreement. Criteria used

to determine if an impairment exists include, but are not limited to: current and projected macroeconomic factors, such as

unemployment rates, and property-specific factors such as rental rates, occupancy levels, LTV ratios and debt service coverage ratios

(“DSCR”). In addition, the Company considers historic, current and projected delinquency rates and property values. These

assumptions require the use of significant management judgment and include the probability and timing of borrower default and loss

severity estimates. In addition, projections of expected future cash flows may change based upon new information regarding the

performance of the borrower and/or underlying collateral such as changes in the projections of the underlying property value estimates.

For mortgage loans that are deemed impaired, a valuation allowance is established for the difference between the carrying amount and

the Company’ s share of either (a) the present value of the expected future cash flows discounted at the loan’ s effective interest rate, (b)

the loan's observable market price or, most frequently, (c) the fair value of the collateral. A valuation allowance has been established for

either individual loans or as a projected loss contingency for loans with an LTV ratio of 90% or greater and consideration of other credit

quality factors, including DSCR. Changes in valuation allowances are recorded in net realized capital gains and losses. Interest income

on impaired loans is accrued to the extent it is deemed collectible and the loans continue to perform under the original or restructured

terms. Interest income ceases to accrue for loans when it is probable that the Company will not receive interest and principal payments

according to the contractual terms of the loan agreement, or if a loan is more than 60 days past due. Loans may resume accrual status

when it is determined that sufficient collateral exists to satisfy the full amount of the loan and interest payments, as well as when it is

probable cash will be received in the foreseeable future. Interest income on defaulted loans is recognized when received.