The Hartford 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

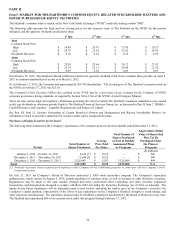

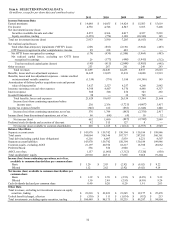

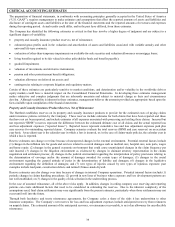

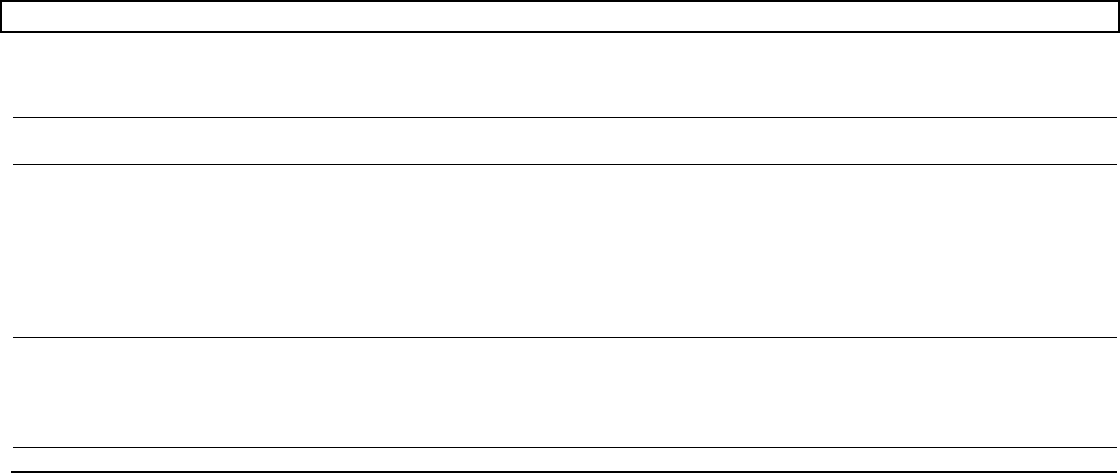

CONSOLIDATED RESULTS OF OPERATIONS

Net income (loss) by segment

2011

2010

2009

Increase

(Decrease) From

2010 to 2011

Increase

(Decrease) From

2009 to 2010

Property & Casualty Commercial

$

528

$

995

$

899

$

(467)

$

96

Group Benefits

90

185

193

(95)

(8)

Commercial Markets

618

1,180

1,092

(562)

88

Consumer Markets

5

143

140

(138)

3

Individual Annuity

(14)

527 (444)

(541)

971

Individual Life

133

229

15

(96)

214

Retirement Plans

15

47

(222)

(32)

269

Mutual Funds

98

132

34

(34)

98

Wealth Management

232

935

(617)

(703)

1,552

Life Other Operations

358

(90)

(698)

448

608

Property & Casualty Other Operations

(117)

(53)

(78)

(64)

25

Corporate

(434)

(435)

(726)

1

291

Total net income (loss)

$

662

$

1,680

$

(887)

$

(1,018)

$

2,567

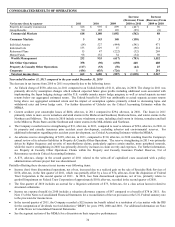

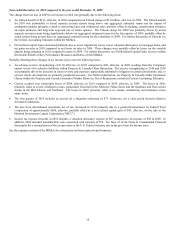

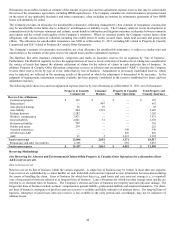

Year ended December 31, 2011 compared to the year ended December 31, 2010

The decrease in net income from 2010 to 2011 was primarily due to the following items:

• An Unlock charge of $530, after-tax, in 2011 compared to an Unlock benefit of $111, after-tax, in 2010. The charge in 2011 was

primarily driven by assumption changes which reduced expected future gross profits including additional costs associated with

implementing the Japan hedging strategy and the U.S. variable annuity macro hedge program, as well as actual separate account

returns below our aggregated estimated return. The Unlock benefit for 2010 was attributable to actual separate account returns

being above our aggregated estimated return and the impact of assumption updates primarily related to decreasing lapse and

withdrawal rates and lower hedge costs. For further discussion of Unlocks see the Critical Accounting Estimates within the

MD&A.

• Current accident year catastrophe losses of $484, after-tax, in 2011 compared to $294, after-tax, in 2010. The losses in 2011

primarily relate to more severe tornadoes and wind storms in the Midwest and Southeast, Hurricane Irene, and winter storms in the

Northeast and Midwest. The losses in 2010 include severe windstorm events, including a hail storm in Arizona, tornadoes and hail

in the Midwest, Plains States and the Southeast and winter storms in the Mid-Atlantic and Northeast.

• The Company recorded reserve strengthening of $31, after-tax, in 2011, compared to reserve releases of $294, after-tax, in 2010, in

its property and casualty insurance prior accident years development, excluding asbestos and environmental reserves. For

additional information regarding prior accident years development, see Critical Accounting Estimates within the MD&A.

• An asbestos reserve strengthening of $189, after-tax, in 2011, compared to $110, after-tax, in 2010 resulting from the Company's

annual review of its asbestos liabilities in Property & Casualty Other Operations. The reserve strengthening in 2011 was primarily

driven by higher frequency and severity of mesothelioma claims, particularly against certain smaller, more peripheral insureds,

while the reserve strengthening in 2010 was primarily driven by increases in claim severity and expenses. For further information,

see Property & Casualty Other Operations Claims within the Property and Casualty Insurance Product Reserves, Net of

Reinsurance section in Critical Accounting Estimates.

• A $73, after-tax, charge in the second quarter of 2011 related to the write-off of capitalized costs associated with a policy

administration software project that was discontinued.

Partially offsetting these decreases in net income were following items:

• Income (loss) from discontinued operations, net of tax, increased due to a realized gain on the sale of Specialty Risk Services of

$150, after-tax, in the first quarter of 2011, which was partially offset by a loss of $74, after-tax, from the disposition of Federal

Trust Corporation in the second quarter of 2011. In 2010, loss from discontinued operations, net of tax, primarily relates to

goodwill impairment on Federal Trust Corporation of approximately $100, after-tax, recorded in the second quarter of 2010.

• The first quarter of 2010 includes an accrual for a litigation settlement of $73, before-tax, for a class action lawsuit related to

structured settlements.

• Income tax expense (benefit) in 2010 includes a valuation allowance expense of $87 compared to a benefit of $78 in 2011. See

Note 13 of the Notes to Consolidated Financial Statements for a reconciliation of the tax provision at the U.S. Federal statutory rate

to the provision for income taxes.

• In the second quarter of 2011, the Company recorded a $52 income tax benefit related to a resolution of a tax matter with the IRS

for the computation of dividends received deduction (“DRD”) for years 1998, 2000 and 2001. For additional information see Note

13 of the Notes to Consolidated Financial Statements.

• See the segment sections of the MD&A for a discussion on their respective performances.