The Hartford 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-73

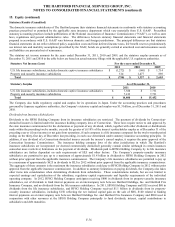

14. Debt (continued)

Consumer Notes

The Company issued consumer notes through its Retail Investor Notes Program prior to 2009. A consumer note is an investment

product distributed through broker-dealers directly to retail investors as medium-term, publicly traded fixed or floating rate, or a

combination of fixed and floating rate, notes. Consumer notes are part of the Company’ s spread-based business and proceeds are used to

purchase investment products, primarily fixed rate bonds. Proceeds are not used for general operating purposes. Consumer notes

maturities may extend up to 30 years and have contractual coupons based upon varying interest rates or indexes (e.g. consumer price

index) and may include a call provision that allows the Company to extinguish the notes prior to its scheduled maturity date. Certain

Consumer notes may be redeemed by the holder in the event of death. Redemptions are subject to certain limitations, including calendar

year aggregate and individual limits. The aggregate limit is equal to the greater of $1 or 1% of the aggregate principal amount of the

notes as of the end of the prior year. The individual limit is $250 thousand per individual. Derivative instruments are utilized to hedge

the Company’ s exposure to market risks in accordance with Company policy. As of December 31, 2011, these consumer notes have

interest rates ranging from 4% to 5% for fixed notes and, for variable notes, based on December 31, 2011 rates, either consumer price

index plus 100 to 260 basis points, or indexed to the S&P 500, Dow Jones Industrials, foreign currency, or the Nikkei 225. The

aggregate maturities of Consumer Notes are as follows: $155 in 2012, $78 in 2013, $13 in 2014, $30 in 2015, $18 in 2016, and $20

thereafter. For 2011, 2010 and 2009, interest credited to holders of consumer notes was $15, $25, and $51, respectively.

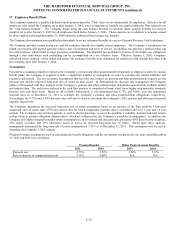

15. Equity

Issuance of Common Stock

On March 23, 2010, The Hartford issued approximately 59.6 million shares of common stock at a price to the public of $27.75 per share

and received net proceeds of $1.6 billion.

Issuance of Series F Preferred Stock

On March 23, 2010, The Hartford issued 23 million depositary shares, each representing a 1/40th interest in The Hartford’ s 7.25%

mandatory convertible preferred stock, Series F, at a price of $25 per depositary share and received net proceeds of approximately $556.

The Company will pay cumulative dividends on each share of the mandatory convertible preferred stock at a rate of 7.25% per annum

on the initial liquidation preference of $1,000 per share. Dividends will accrue and cumulate from the date of issuance and, to the extent

that the Company is legally permitted to pay dividends and its board of directors declares a dividend payable, the Company will, from

July 1, 2010 until and including January 1, 2013 pay dividends on each January 1, April 1, July 1 and October 1, in cash and (whether or

not declared prior to that date) on April 1, 2013 will pay or deliver, as the case may be, dividends in cash, shares of its common stock, or

a combination thereof, at its election. Dividends on and repurchases of the Company’ s common stock will be subject to restrictions in

the event that the Company fails to declare and pay, or set aside for payment, dividends on the Series F preferred stock.

The 575,000 shares of mandatory convertible preferred stock, Series F, will automatically convert into shares of common stock on April

1, 2013, if not earlier converted at the option of the holder, at any time, or upon the occurrence of a fundamental change. The number of

shares issuable upon mandatory conversion of each share of mandatory convertible preferred stock will be a variable amount based on

the average of the daily volume weighted average price per share of the Company’ s common stock during a specified period of 20

consecutive trading days with the number of shares of common stock ranging from 29.536 to 36.036 per share of mandatory convertible

preferred stock, subject to anti-dilution adjustments.

Preferred Stock

The Company has 50,000,000 shares of preferred stock authorized. See discussion below on the Company’ s participation in the Capital

Purchase Program.

In connection with the Company’ s investment agreement with Allianz SE, Allianz was issued 6,048,387 shares of the Company’ s Series

D Non-Voting Contingent Convertible Preferred Stock. Each share of preferred stock was initially convertible into four shares of

common stock. On January 9, 2009, Allianz converted its 6,048,387 shares of Series D Preferred Stock into 24,193,548 shares of

common stock.