The Hartford 2011 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-81

17. Employee Benefit Plans (continued)

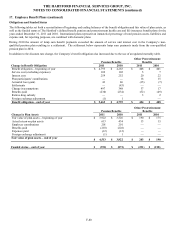

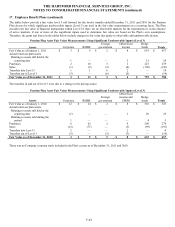

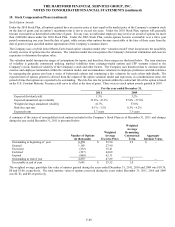

The fair value of assets for pension benefits, and hence the funded status, presented in the table above exclude assets of $109 and $107

held in rabbi trusts and designated for the non-qualified pension plans as of December 31, 2011 and 2010, respectively. The assets do

not qualify as plan assets; however, the assets are available to pay benefits for certain retired, terminated and active participants. Such

assets are available to the Company’ s general creditors in the event of insolvency. The assets consist of equity and fixed income

investments. To the extent the fair value of these rabbi trusts were included in the table above, pension plan assets would have been

$4,622 and $4,029 as of December 31, 2011 and 2010, respectively, and the funded status of pension benefits would have been $(843)

and $(766) as of December 31, 2011 and 2010, respectively.

The accumulated benefit obligation for all defined benefit pension plans was $5,413 and $4,753 as of December 31, 2011 and 2010,

respectively.

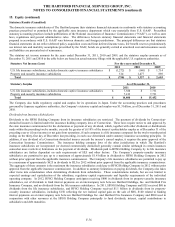

The following table provides information for The Hartford’ s defined benefit pension plans with an accumulated benefit obligation in

excess of plan assets as of December 31, 2011 and 2010.

December 31,

2011

2010

Projected benefit obligation

$

5,441

$

4,771

Accumulated benefit obligation

5,394

4,733

Fair value of plan assets

4,492

3,901

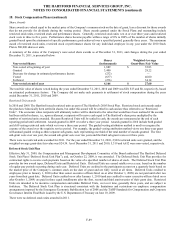

Amounts recognized in the Consolidated Balance Sheets consist of:

Pension Benefits

Other Postretirement Benefits

2011

2010

2011

2010

Other Assets

Noncurrent assets

$

—

$

—

$

—

$

—

Other Liabilities

Current liabilities

21

19

34

34

Noncurrent liabilities

931

854

187

184

Total

$

952

$

873

$

221

$

218

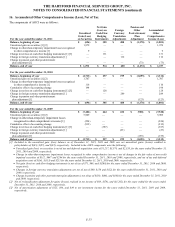

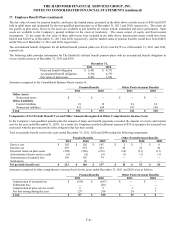

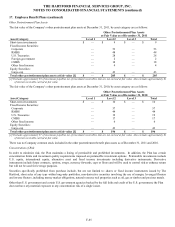

Components of Net Periodic Benefit Cost and Other Amounts Recognized in Other Comprehensive Income (Loss)

In the Company’ s non-qualified pension plan the amount of lump sum benefit payments exceeded the amount of service and interest

cost for the year ended December 31, 2010. As a result, the Company recorded settlement expense of $20 to recognize the actuarial loss

associated with the pro-rata portion of the obligation that has been settled.

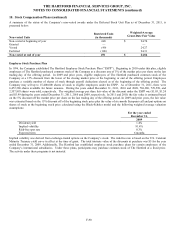

Total net periodic benefit cost for the years ended December 31, 2011, 2010 and 2009 include the following components:

Pension Benefits

Other Postretirement Benefits

2011

2010

2009

2011

2010

2009

Service cost

$

102

$

102

$

105

$

5

$

7

$

6

Interest cost

259

252

243

20

22

24

Expected return on plan assets

(298)

(286)

(276)

(14)

(13)

(11)

Amortization of prior service credit

(9)

(9)

(9)

(1)

(1)

(1)

Amortization of actuarial loss

159

107

74

—

—

—

Settlements

—

20

—

—

—

—

Net periodic benefit cost

$

213

$

186

$

137

$

10

$

15

$

18

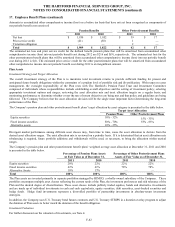

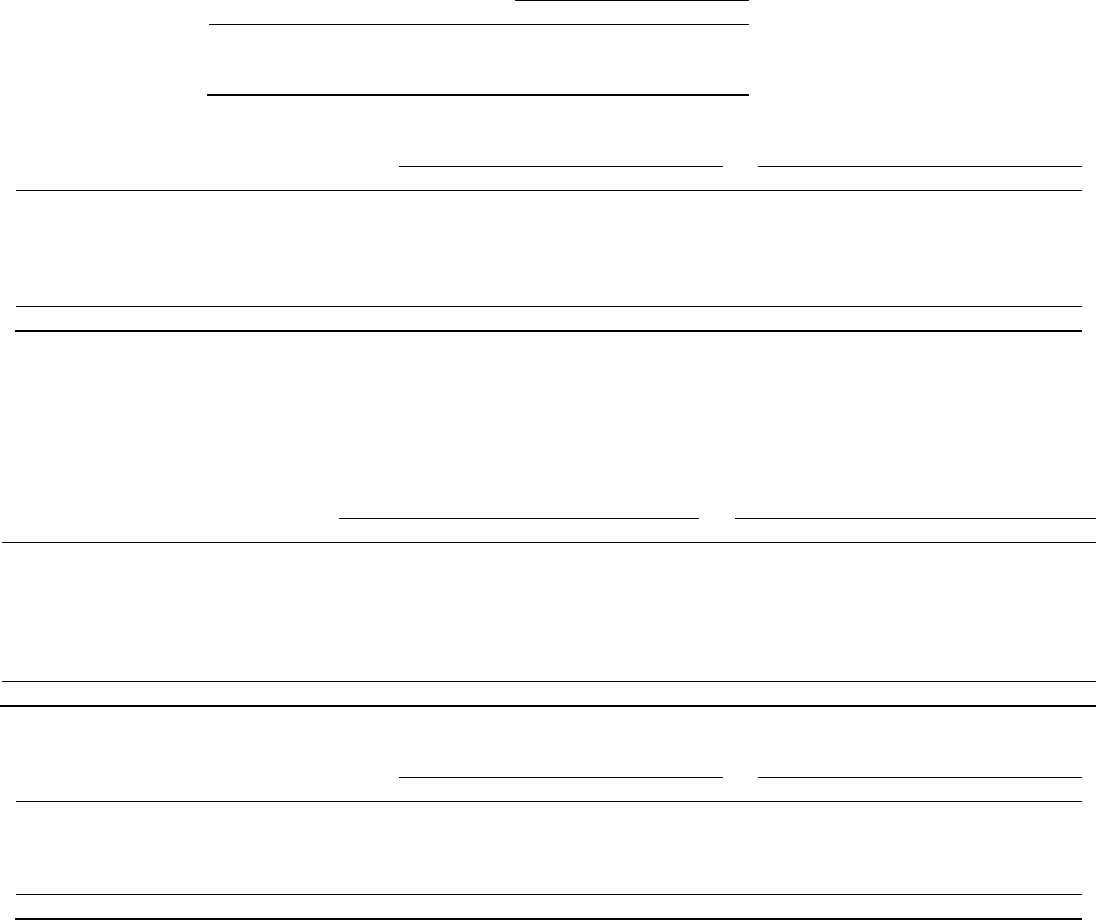

Amounts recognized in other comprehensive income (loss) for the years ended December 31, 2011 and 2010 were as follows:

Pension Benefits

Other Postretirement Benefits

2011

2010

2011

2010

Amortization of actuarial loss

$

(159)

$

(107)

$

—

$

—

Settlement loss

—

(20)

—

—

Amortization of prior service credit

9

9

1

1

Net loss arising during the year

237

298

24

7

Total

$

87

$

180

$

25

$

8