The Hartford 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

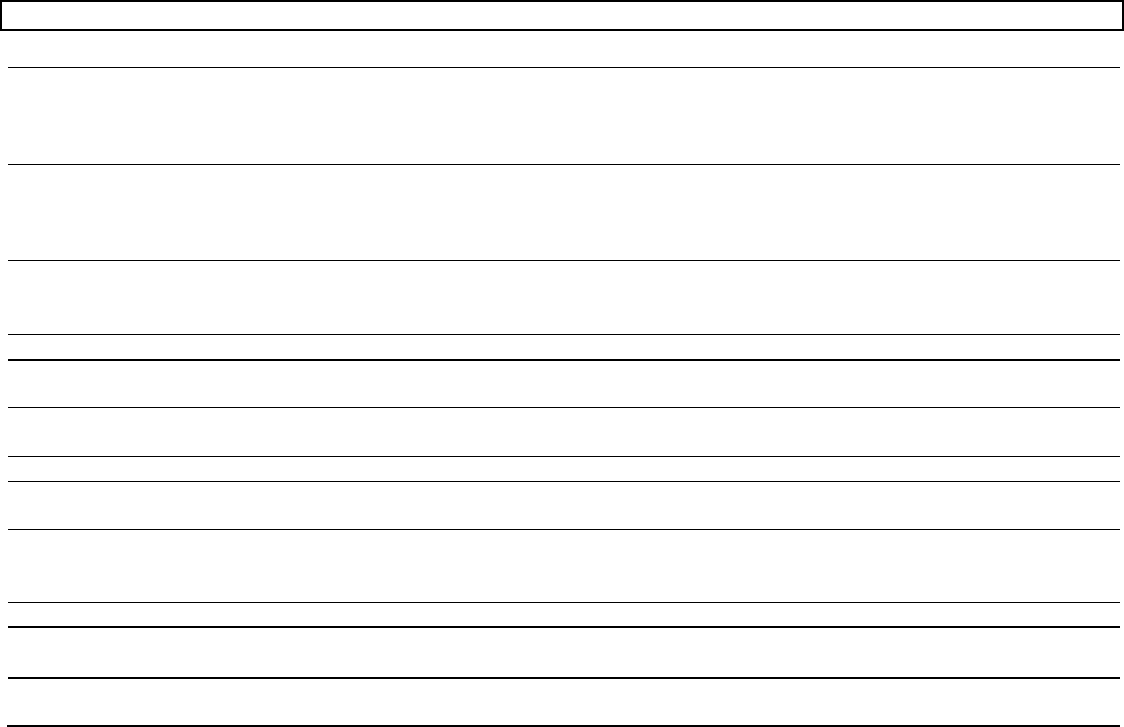

85

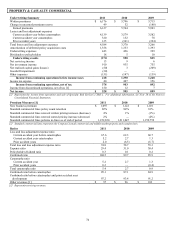

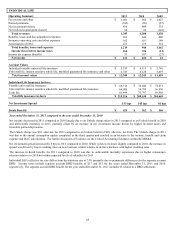

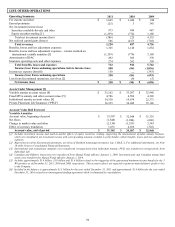

INDIVIDUAL LIFE

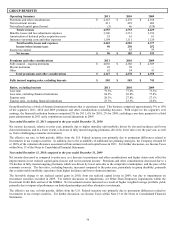

Operating Summary

2011

2010

2009

Fee income and other

$

1,001

$

952

$

1,027

Earned premiums

(102)

(96)

(87)

Net investment income

456

400

335

Net realized capital gains (losses)

30

24

(145)

Total revenues

1,385

1,280

1,130

Benefits, losses and loss adjustment expenses

816

644

640

Insurance operating costs and other expenses

182

181

188

Amortization of DAC

221

119

314

Total benefits, losses and expenses

1,219

944

1,142

Income (loss) before income taxes

166

336

(12)

Income tax expense (benefit)

33

107

(27)

Net income

$

133

$

229

$

15

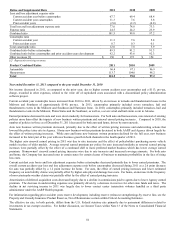

Account Values

Individual variable universal life insurance

$

5,535

$

6,115

$

5,766

Universal life, interest sensitive whole life, modified guaranteed life insurance and other

6,765

6,128

5,693

Total account values

$

12,300

$

12,243

$

11,459

Individual Life Insurance In-force

Variable universal life insurance

$

69,716

$

74,044

$

78,671

Universal life, interest sensitive whole life, modified guaranteed life insurance

64,006

58,789

56,030

Term life

81,494

75,797

69,968

Total life insurance in-force

$

215,216

$

208,630

$

204,669

Net Investment Spread

153 bps

145 bps

81 bps

Death Benefits

$

423

$

362

$

346

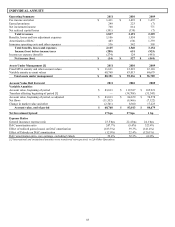

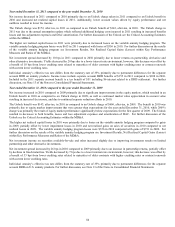

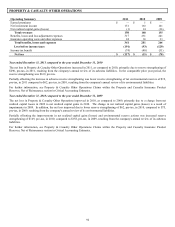

Year ended December 31, 2011 compared to the year ended December 31, 2010

Net income decreased in 2011 compared to 2010 largely due to an Unlock charge taken in 2011 compared to an Unlock benefit in 2010

and unfavorable mortality in 2011, partially offset by an increase in net investment income driven by higher invested assets and

favorable partnership income.

The Unlock charge was $69, after-tax, for 2011 compared to an Unlock benefit of $28, after-tax, for 2010. The Unlock charge in 2011

was due to the annual assumption update completed in the third quarter and resulted in an increase in fee income, benefit and claim

expense and DAC amortization. For further discussion of Unlocks see the Critical Accounting Estimates within the MD&A.

Net investment spread increased by 8 bps in 2011 compared to 2010. While yields were down slightly compared to 2010, the increase in

spread was driven by lower crediting rates on new business written relative to in-force business with higher crediting rates.

The increase in death benefits for 2011 compared to 2010 was due to unfavorable mortality experience due to higher reinsurance

retention relative to 2010 but within expected levels of volatility for 2011.

Individual Life’ s effective tax rate differs from the statutory rate of 35% primarily due to permanent differences for the separate account

DRD. Income taxes include separate account DRD benefits of $17 and $13 for the years ended December 31, 2011 and 2010,

respectively. The separate account DRD benefit for the year ended December 31, 2011 includes $5 related to a DRD settlement.