The Hartford 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-57

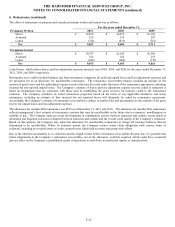

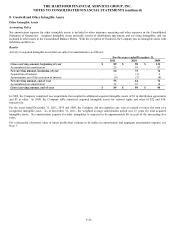

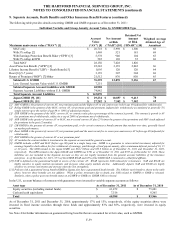

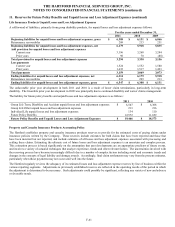

9. Separate Accounts, Death Benefits and Other Insurance Benefit Features

Accounting Policy

The Company records the variable portion of individual variable annuities, 401(k), institutional, 403(b)/457, private placement life and

variable life insurance products within separate accounts. Separate account assets are reported at fair value and separate account

liabilities are reported at amounts consistent with separate account assets. Investment income and gains and losses from those separate

account assets accrue directly to the policyholder, who assumes the related investment risk, and are offset by the related liability changes

reported in the same line item in the Consolidated Statements of Operations. The Company earns fees for investment management,

certain administrative expenses, and mortality and expense risks assumed which are reported in fee income.

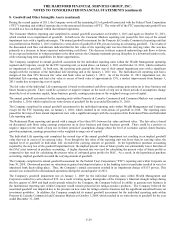

Certain contracts classified as universal life-type include death and other insurance benefit features including GMDB and GMIB,

offered with variable annuity contracts, or secondary guarantee benefits offered with universal life (“UL”) insurance contracts. GMDBs

and GMIBs have been written in various forms as described in this note. UL secondary guarantee benefits ensure that the universal life

policy will not terminate, and will continue to provide a death benefit, even if there is insufficient policy value to cover the monthly

deductions and charges. These death and other insurance benefit features require an additional liability be held above the account value

liability representing the policyholders’ funds. This liability is reported in reserve for future policy benefits in the Company’ s

Consolidated Balance Sheets. Changes in the death and other insurance benefit reserves are recorded in benefits, losses and loss

adjustment expenses in the Company’ s Consolidated Statements of Operations.

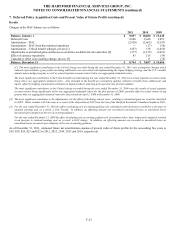

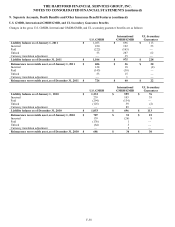

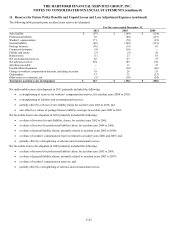

The death and other insurance benefit liability is determined by estimating the expected present value of the benefits in excess of the

policyholder’ s expected account value in proportion to the present value of total expected assessments. The liability is accrued as actual

assessments are recorded. The expected present value of benefits and assessments are generally derived from a set of stochastic

scenarios, that have been calibrated to our RTM separate account returns, and assumptions including market rates of return, volatility,

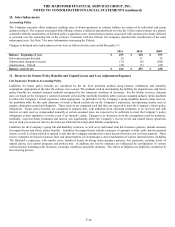

discount rates, lapse rates and mortality experience. Consistent with the Company’ s policy on the Unlock, the Company regularly

evaluates estimates used and adjusts the additional liability balance, with a related charge or credit to benefits, losses and loss

adjustment expense. For further information on the Unlock, see Note 7 Deferred Policy Acquisition Costs and Present Value of Future

Benefits.

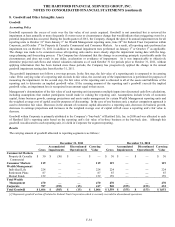

The Company reinsures a portion of its in-force GMDB and UL secondary guarantees. The death and other insurance benefit reserves,

net of reinsurance, are established by estimating the expected value of net reinsurance costs and death and other insurance benefits in

excess of the projected account balance. The additional death and other insurance benefits and net reinsurance costs are recognized

ratably over the accumulation period based on total expected assessments.