The Hartford 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

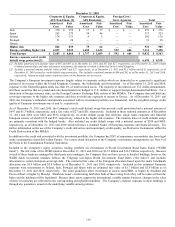

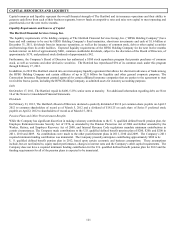

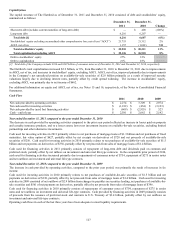

Contractholder Obligations

As of

December 31,

2011

Total Life contractholder obligations

$

239,723

Less: Separate account assets [1]

(143,870)

International statutory separate accounts [1]

(30,461)

General account contractholder obligations

$

65,392

Composition of General Account Contractholder Obligations

Contracts without a surrender provision and/or fixed payout dates [2]

$

30,339

Fixed MVA annuities [3]

9,727

International fixed MVA annuities

2,642

Guaranteed investment contracts (“GIC”) [4]

567

Other [5]

22,117

General account contractholder obligations

$

65,392

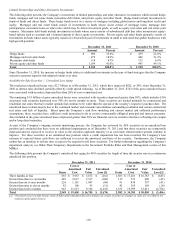

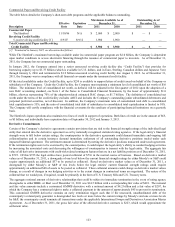

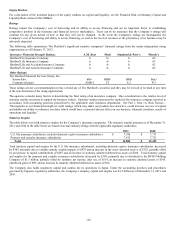

[1] In the event customers elect to surrender separate account assets or international statutory separate accounts, Life Operations will use the

proceeds from the sale of the assets to fund the surrender, and Life Operations’ liquidity position will not be impacted. In many instances Life

Operations will receive a percentage of the surrender amount as compensation for early surrender (surrender charge), increasing Life

Operations’ liquidity position. In addition, a surrender of variable annuity separate account or general account assets (see below) will decrease

Life Operations’ obligation for payments on guaranteed living and death benefits.

[2] Relates to contracts such as payout annuities or institutional notes, other than guaranteed investment products with an MVA feature (discussed

below) or surrenders of term life, group benefit contracts or death and living benefit reserves for which surrenders will have no current effect on

Life Operations’ liquidity requirements.

[3] Relates to annuities that are held in a statutory separate account, but under U.S. GAAP are recorded in the general account as Fixed MVA

annuity contract holders are subject to the Company’s credit risk. In the statutory separate account, Life Operations is required to maintain

invested assets with a fair value equal to the MVA surrender value of the Fixed MVA contract. In the event assets decline in value at a greater

rate than the MVA surrender value of the Fixed MVA contract, Life Operations is required to contribute additional capital to the statutory

separate account. Life Operations will fund these required contributions with operating cash flows or short-term investments. In the event that

operating cash flows or short-term investments are not sufficient to fund required contributions, the Company may have to sell other invested

assets at a loss, potentially resulting in a decrease in statutory surplus. As the fair value of invested assets in the statutory separate account are

generally equal to the MVA surrender value of the Fixed MVA contract, surrender of Fixed MVA annuities will have an insignificant impact on the

liquidity requirements of Life Operations.

[4] GICs are subject to discontinuance provisions which allow the policyholders to terminate their contracts prior to scheduled maturity at the lesser

of the book value or market value. Generally, the market value adjustment reflects changes in interest rates and credit spreads. As a result, the

market value adjustment feature in the GIC serves to protect the Company from interest rate risks and limit Life Operations’ liquidity

requirements in the event of a surrender.

[5] Surrenders of, or policy loans taken from, as applicable, these general account liabilities, which include the general account option for Individual

Annuity’s individual variable annuities and Individual Life variable life contracts, the general account option for Retirement Plans’ annuities and

universal life contracts sold by Individual Life may be funded through operating cash flows of Life Operations, available short-term investments,

or Life Operations may be required to sell fixed maturity investments to fund the surrender payment. Sales of fixed maturity investments could

result in the recognition of significant realized losses and insufficient proceeds to fully fund the surrender amount. In this circumstance, Life

Operations may need to take other actions, including enforcing certain contract provisions which could restrict surrenders and/or slow or defer

payouts.

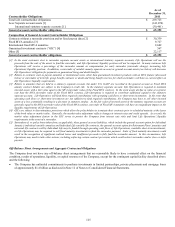

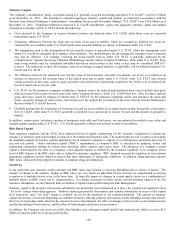

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

The Company does not have any off-balance sheet arrangements that are reasonably likely to have a material effect on the financial

condition, results of operations, liquidity, or capital resources of the Company, except for the contingent capital facility described above

and the following:

• The Company has unfunded commitments to purchase investments in limited partnerships, private placements and mortgage loans

of approximately $1.4 billion as disclosed in Note 12 of Notes to Consolidated Financial Statements.