The Hartford 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

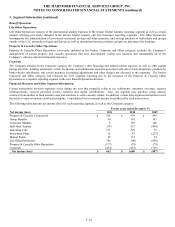

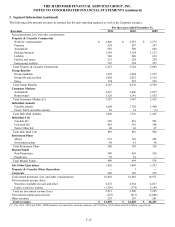

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-18

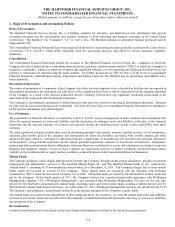

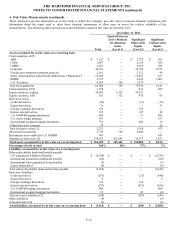

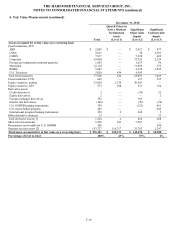

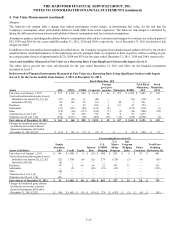

4. Fair Value Measurements (continued)

These disclosures provide information as to the extent to which the Company uses fair value to measure financial instruments and

information about the inputs used to value those financial instruments to allow users to assess the relative reliability of the

measurements. The following tables present assets and (liabilities) carried at fair value by hierarchy level.

December 31, 2011

Total

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets accounted for at fair value on a recurring basis

Fixed maturities, AFS

ABS

$

3,153

$

—

$

2,792

$

361

CDOs

2,487

—

2,119

368

CMBS

6,951

—

6,363

588

Corporate

44,011

—

41,756

2,255

Foreign government/government agencies

2,161

—

2,112

49

States, municipalities and political subdivisions (“Municipal”)

13,260

—

12,823

437

RMBS

5,757

—

4,694

1,063

U.S. Treasuries

4,029

750

3,279

—

Total fixed maturities

81,809

750

75,938

5,121

Fixed maturities, FVO

1,328

—

833

495

Equity securities, trading

30,499

1,967

28,532

—

Equity securities, AFS

921

352

476

93

Derivative assets

Credit derivatives

(24)

—

(11)

(13)

Equity derivatives

31

—

—

31

Foreign exchange derivatives

519

—

519

—

Interest rate derivatives

195

—

147

48

U.S. GMWB hedging instruments

494

—

11

483

U.S. macro hedge program

357

—

—

357

International program hedging instruments

731

—

692

39

Other derivative contracts

28

—

—

28

Total derivative assets [1]

2,331

—

1,358

973

Short-term investments

7,736

750

6,986

—

Reinsurance recoverable for U.S. GMWB

443

—

—

443

Separate account assets [2]

139,432

101,644

36,757

1,031

Total assets accounted for at fair value on a recurring basis

$

264,499

$

105,463

$

150,880

$

8,156

Percentage of level to total

100%

40%

57%

3%

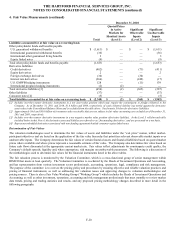

Liabilities accounted for at fair value on a recurring basis

Other policyholder funds and benefits payable

U.S. guaranteed withdrawal benefits

$

(2,538)

$

—

$

—

$

(2,538)

International guaranteed withdrawal benefits

(66)

—

—

(66)

International other guaranteed living benefits

(5)

—

—

(5)

Equity linked notes

(9)

—

—

(9)

Total other policyholder funds and benefits payable

(2,618)

—

—

(2,618)

Derivative liabilities

Credit derivatives

(573)

—

(25)

(548)

Equity derivatives

9

—

—

9

Foreign exchange derivatives

134

—

134

—

Interest rate derivatives

(527)

—

(421)

(106)

U.S. GMWB hedging instruments

400

—

—

400

International program hedging instruments

19

—

23

(4)

Total derivative liabilities [3]

(538)

—

(289)

(249)

Other Liabilities

(9)

—

—

(9)

Consumer notes [4]

(4)

—

—

(4)

Total liabilities accounted for at fair value on a recurring basis

$

(3,169)

$

—

$

(289)

$

(2,880)