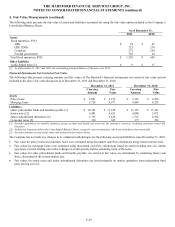

The Hartford 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-36

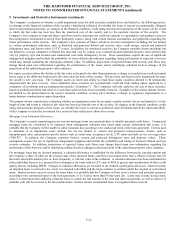

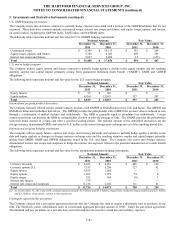

5. Investments and Derivative Instruments (continued)

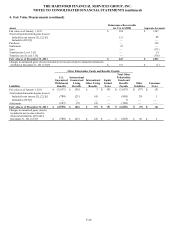

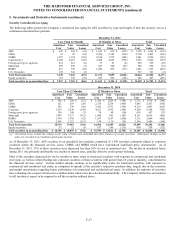

Available-for-Sale Securities

The following table presents the Company’ s AFS securities by type.

December 31, 2011

December 31, 2010

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Non-

Credit

OTTI [1]

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Non-

Credit

OTTI [1]

ABS $ 3,430

$

55

$

(332)

$

3,153 $ (7) $ 3,247 $ 38 $ (396) $ 2,889 $ (2)

CDOs

2,819

16

(348)

2,487

(44)

3,088

1

(478)

2,611

(82)

CMBS 7,192

271

(512)

6,951 (31) 8,297 235 (615) 7,917 (9)

Corporate [2]

41,161

3,661

(739)

44,011

—

38,496

2,174

(747)

39,884

7

Foreign govt./govt. agencies 2,030

141

(10)

2,161 — 1,627 73 (17) 1,683 —

Municipal

12,557

775

(72)

13,260

—

12,469

150

(495)

12,124

—

RMBS 5,961

252

(456)

5,757 (105) 6,036 109 (462) 5,683 (124)

U.S. Treasuries

3,828

203

(2)

4,029

—

5,159

24

(154)

5,029

—

Total fixed maturities, AFS

78,978

5,374

(2,471)

81,809

(187)

78,419

2,804

(3,364)

77,820

(210)

Equity securities, AFS 1,056

68

(203)

921 — 1,013 92 (132) 973 —

Total AFS securities

$

80,034

$

5,442

$

(2,674)

$

82,730

$

(187)

$

79,432

$

2,896

$

(3,496)

$

78,793

$

(210)

[1] Represents the amount of cumulative non-credit OTTI losses recognized in OCI on securities that also had credit impairments. These losses are

included in gross unrealized losses as of December 31, 2011 and 2010.

[2] Gross unrealized gains (losses) exclude the fair value of bifurcated embedded derivative features of certain securities. Subsequent changes in

value will be recorded in net realized capital gains (losses).

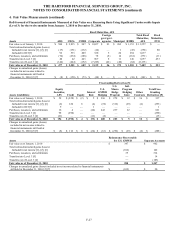

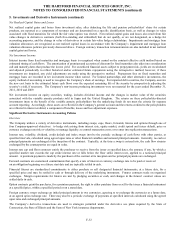

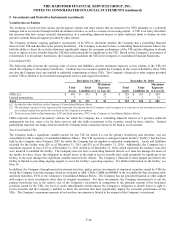

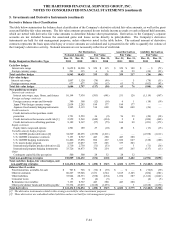

The following table presents the Company’ s fixed maturities, AFS, by contractual maturity year.

December 31, 2011

Maturity

Amortized Cost

Fair Value

One year or less

$

3,206

$

3,240

Over one year through five years

16,140

16,790

Over five years through ten years

15,041

16,111

Over ten years

25,189

27,320

Subtotal

59,576

63,461

Mortgage-backed and asset-backed securities

19,402

18,348

Total

$

78,978

$

81,809

Estimated maturities may differ from contractual maturities due to security call or prepayment provisions. Due to the potential for

variability in payment spreads (i.e. prepayments or extensions), mortgage-backed and asset-backed securities are not categorized by

contractual maturity.

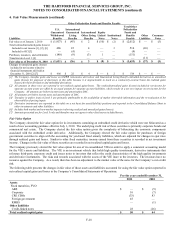

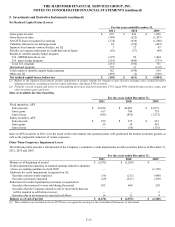

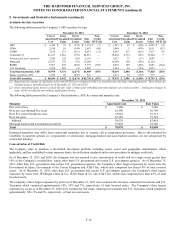

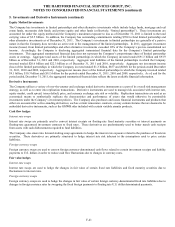

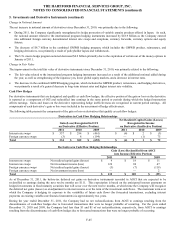

Concentration of Credit Risk

The Company aims to maintain a diversified investment portfolio including issuer, sector and geographic stratification, where

applicable, and has established certain exposure limits, diversification standards and review procedures to mitigate credit risk.

As of December 31, 2011 and 2010, the Company was not exposed to any concentration of credit risk of a single issuer greater than

10% of the Company’ s stockholders’ equity other than U.S. government and certain U.S. government agencies. As of December 31,

2011, other than U.S. government and certain U.S. government agencies, the Company’ s three largest exposures by issuer were the

Government of Japan, Government of the United Kingdom and AT&T Inc. which each comprised less than 0.8% of total invested

assets. As of December 31, 2010, other than U.S. government and certain U.S. government agencies, the Company’ s three largest

exposures by issuer were JP Morgan Chase & Co., Wells Fargo & Co. and AT&T Inc. which each comprised less than 0.5% of total

invested assets.

The Company’ s three largest exposures by sector as of December 31, 2011 were commercial real estate, municipal investments and U.S.

Treasuries which comprised approximately 10%, 10% and 7%, respectively, of total invested assets. The Company’ s three largest

exposures by sector as of December 31, 2010 were commercial real estate, municipal investments and U.S. Treasuries which comprised

approximately 10%, 9% and 9%, respectively, of total invested assets.