Starwood 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 67

AUDIT COMMITTEE REPORT

The information contained in this Audit Committee Report shall not

be deemed to be “soliciting material” or “fi led” or “incorporated

by reference” in future fi lings with the SEC, or subject to the

liabilities of Section18 of the Exchange Act, except to the extent

that the Company specifi cally incorporates it by reference into a

document fi led under the Securities Act of 1933, as amended,

or the Exchange Act.

The Audit Committee (the “Audit Committee”) of the Board of

Directors (the “Board”) of Starwood Hotels& Resorts Worldwide,

Inc. (the “Company”), which is comprised entirely of “independent”

directors, as determined by the Board in accordance with the

New York Stock Exchange (the “NYSE”) listing requirements

and applicable federal securities laws, serves as an independent

and objective party to assist the Board in fulfi lling its oversight

responsibilities including, but not limited to, (i)monitoring the quality

and integrity of the Company’s fi nancial statements, (ii)monitoring

compliance with legal and regulatory requirements, (iii)assessing the

qualifi cations and independence of the independent registered public

accounting fi rm and (iv)establishing and monitoring the Company’s

systems of internal controls regarding fi nance, accounting and legal

compliance. The Audit Committee operates under a written charter

which meets the requirements of applicable federal securities laws

and the NYSE requirements.

In the fi rst quarter of 2013, the Audit Committee reviewed and

discussed the audited fi nancial statements for the year ended

December31, 2012 with management, the Company’s internal

auditors and the independent registered public accounting fi rm,

Ernst& Young LLP, including the matters required to be discussed

with the independent accountant by Statement of Auditing Standards

No.61, as amended. The Audit Committee also discussed with

the independent registered public accounting fi rm matters relating

to its independence, including a review of audit and non-audit

fees and the written disclosures and letter from Ernst& Young

LLP to the Audit Committee required pursuant to Rule3526

of the Public Company Accounting Oversight Board regarding

the independent accountants’ communications with the Audit

Committee concerning independence.

Based on the reviews and discussions referred to above, the

Audit Committee recommended to the Board that the fi nancial

statements referred to above be included in the Company’s Annual

Report on Form10-K for the year ended December31, 2012.

Audit Committee of the Board of Directors

Clayton C. Daley, Jr., Chairman

Adam M. Aron

Charlene Barshefsky

Thomas E. Clarke

Aylwin B. Lewis

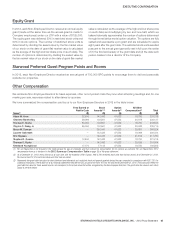

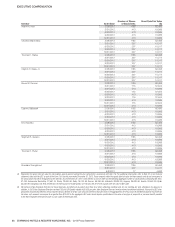

Audit Fees

The aggregate amounts paid by the Company for the fi scal years ended December31, 2012 and 2011 to the Company’s principal accounting

fi rm, Ernst&Young LLP, are as follows (in millions):

2012 2011

Audit Fees(1) $ 6.3 $ 6.6

Audit-Related Fees(2) $ 0.8 $ 0.8

Tax Fees(3) $ 0.9 $ 1.5

TOTAL $ 8.0 $ 8.9

(1) Audit fees include the fees paid for the annual audit, the review of quarterly financial statements and assistance with financial reports required as part of regulatory and statutory

filings and the audit of the Company’s internal controls over financial reporting with the objective of obtaining reasonable assurance about whether effective internal controls

over financial reporting were maintained in all material respects.

(2) Audit-related fees include fees for audits of employee benefit plans, audit and accounting consultation and other attest services.

(3) Tax fees include domestic and foreign tax compliance and consultations regarding tax matters.

The Company has adopted a policy which requires the Audit

Committee of the Board of Directors to approve the hiring of

any current or former employee (within the last fi veyears) of the

Company’s independent registered public accounting fi rm into

any position (i)as a manager or higher, (ii)in its accounting or tax

departments, (iii)where the hire would have direct involvement

in providing information for use in its fi nancial reporting systems,

or (iv)where the hire would be in a policy setting position. When

undertaking its review, the Audit Committee considers applicable

laws, regulations and related commentary regarding the defi nition of

“independence” for independent registered public accounting fi rms.