Starwood 2012 Annual Report Download - page 135

Download and view the complete annual report

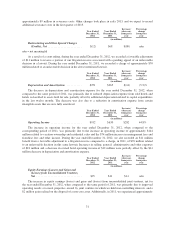

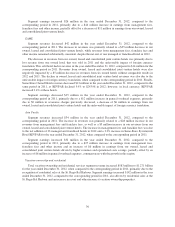

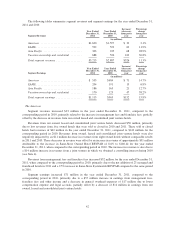

Please find page 135 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Segment earnings increased $26 million in the year ended December 31, 2012, compared to the

corresponding period in 2011, primarily due to a $44 million increase in earnings from management fees,

franchise fees and other income, partially offset by a decrease of $11 million in earnings from our owned, leased

and consolidated joint venture hotels.

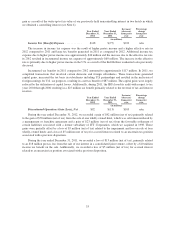

EAME

Segment revenues decreased $42 million in the year ended December 31, 2012, compared to the

corresponding period in 2011. The decrease in revenues was primarily related to a $35 million decrease in our

owned, leased and consolidated joint venture hotels, while revenues from management fees, franchise fees and

other income remained substantially consistent, despite the net exit of one managed or franchised hotel in 2012.

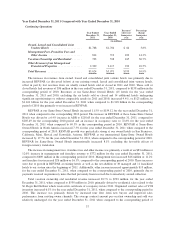

The decrease in revenues from our owned, leased and consolidated joint venture hotels was primarily due to

lost revenue from one owned hotel that was sold in 2011 and the unfavorable impact of foreign currency

translation. This sold hotel had no revenue in the year ended December 31, 2012, compared to $14 million for the

corresponding period in 2011. Revenues from owned, leased and consolidated joint venture hotels were also

negatively impacted by a $5 million decrease in revenues from six owned hotels without comparable results in

2012 and 2011. The decline in owned, leased and consolidated joint venture hotel revenues was also due to the

unfavorable impact of foreign currency translation, when compared to the corresponding period in 2011. Finally,

Same-Store Owned Hotel revenues decreased $12 million in the year ended December 31, 2012, compared to the

same period in 2011, as REVPAR declined 5.9% to $243.98 in 2012; however, in local currency, REVPAR

increased 2.4% at these hotels.

Segment earnings decreased $25 million in the year ended December 31, 2012, compared to the

corresponding period in 2011, primarily due to a $12 million increase in general overhead expenses, primarily

due to $9 million in severance charges previously discussed, a decrease of $6 million in earnings from our

owned, leased and consolidated joint venture hotels and the unfavorable impact of foreign currency translation.

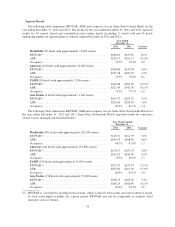

Asia Pacific

Segment revenues increased $34 million in the year ended December 31, 2012, compared to the

corresponding period in 2011. The increase in revenues was primarily related to a $28 million increase in our

revenues from management fees and franchise fees, as well as a $5 million increase in our revenues from our

owned, leased and consolidated joint venture hotels. The increase in management fees and franchise fees was due

to the net addition of 33 managed and franchised hotels in 2012 and a 3.3% increase in Same-Store Systemwide

Hotel REVPAR for the year ended December 31, 2012, when compared to the corresponding period in 2011.

Segment earnings increased $32 million in the year ended December 31, 2012, compared to the

corresponding period in 2011, primarily due to a $27 million increase in earnings from management fees,

franchise fees and other income and an increase of $6 million in earnings from our owned, leased and

consolidated joint venture hotels driven by higher revenues and operational costs savings, partially offset by an

increase of $6 million in general overhead expenses, commensurate with the growth in this region.

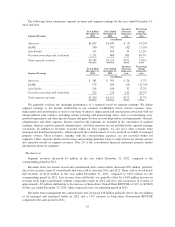

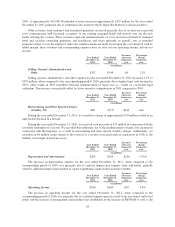

Vacation ownership and residential

Total vacation ownership and residential services segment revenue increased $583 million to $1.271 billion

for the year ended December 31, 2012, when compared to the corresponding period in 2011, primarily due to the

recognition of residential sales at the St. Regis Bal Harbour. Segment earnings increased $142 million in the year

ended December 31, 2012, compared to the corresponding period in 2011, also driven by residential sales at the

St. Regis Bal Harbour and an increase in resort and other income at vacation ownership properties.

36