Starwood 2012 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

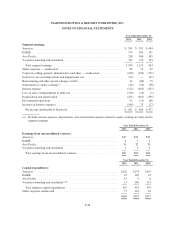

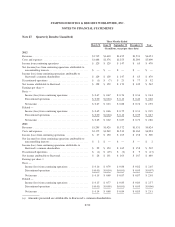

NOTES TO FINANCIAL STATEMENTS

Additionally, in connection with this settlement, the term of the management contract was extended by five

years. As a result of this settlement, we recorded a credit to selling, general, administrative and other expenses of

approximately $8 million for the difference between the carrying amount of the guarantee liability and the cash

payment of $1 million.

In connection with the purchase of the Le Méridien brand in November 2005, we were indemnified for

certain of Le Méridien’s historical liabilities by the entity that bought Le Méridien’s owned and leased hotel

portfolio. The indemnity is limited to the financial resources of that entity. However, at this time, we believe that

it is unlikely that we will have to fund any of these liabilities.

In connection with the sale of 33 hotels in 2006, we agreed to indemnify the buyer for certain liabilities,

including operations and tax liabilities. At this time, we believe that we will not have to make any material

payments under such indemnities.

Litigation. We are involved in various legal matters that have arisen in the normal course of business,

some of which include claims for substantial sums. We review these matters and loss contingencies each

reporting period to evaluate the degree of probability of an unfavorable outcome and our ability to make a

reasonable estimate of any associated loss. Accruals have been recorded when the outcome is probable and can

be reasonably estimated. As of December 31, 2012, certain contingencies have been evaluated as reasonably

possible, but not probable, with a range of exposure of $0 to $27 million. While the ultimate results of claims and

litigation cannot be determined, we do not expect that the resolution of all legal matters will have a material

adverse effect on our consolidated results of operations, financial position or cash flow. However, depending on

the amount and the timing, an unfavorable resolution of some or all of these matters could materially affect our

future results of operations or cash flows in a particular period.

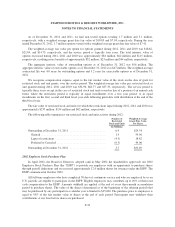

In August 2009, Sheraton Operating Corporation (“Sheraton”) filed a lawsuit as plaintiff in the Supreme

Court of the State of New York (the “Court”) against Castillo Grand LLC (“Castillo”) asserting claims arising

out of a dispute over a hotel development contract. Two earlier lawsuits arising out of the same hotel

development contract filed by Castillo against Sheraton in federal court had been dismissed for lack of subject

matter jurisdiction. Castillo filed counterclaims in the state court action alleging, among other things, that

Sheraton’s breach of contract resulted in design changes and construction delays. The matter was tried before the

Court and, on November 18, 2011, the Court issued its Post Trial Decision ruling in favor of Castillo on some

claims and counterclaims and in favor of Sheraton on others. Overall, the Court’s decision is unfavorable to

Sheraton. During the year ended December 31, 2011, as a result of this decision, we recorded a reserve for this

matter resulting in a pretax charge of $70 million.

During the year ended December 31, 2012, the Court issued its decision on Castillo’s claim for attorney’s

fees and expenses. Based on the Court’s favorable decision, we recorded an adjustment of $11 million to reverse

a portion of our litigation reserve related to this matter. As of December 31, 2012, Sheraton and Castillo had filed

appeals to the Appellate Division of the Supreme Court of the State of New York.

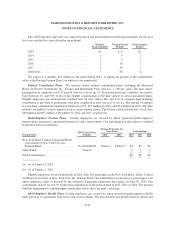

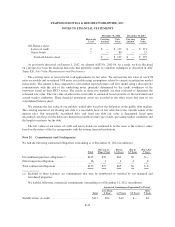

Collective Bargaining Agreements. At December 31, 2012, approximately 27% of our U.S.-based

employees were covered by various collective bargaining agreements, generally providing for basic pay rates,

working hours, other conditions of employment and orderly settlement of labor disputes. Generally, labor

relations have been maintained in a normal and satisfactory manner, and we believe that our employee relations

are satisfactory.

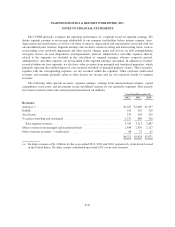

Environmental Matters. We are subject to certain requirements and potential liabilities under various

federal, state and local environmental laws, ordinances and regulations. Such laws often impose liability without

regard to whether the current or previous owner or operator knew of, or was responsible for, the presence of such

hazardous or toxic substances. Although we have incurred and expect to incur remediation and other

F-45