Starwood 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

During the year ended December 31, 2010, we recorded a net loss on dispositions of approximately $39

million, primarily related to a $53 million loss on the sale of one wholly-owned hotel subject to a long-term

management contract and a $4 million impairment of fixed assets that are being retired in connection with a

significant renovation of a wholly-owned hotel. These charges were partially offset by a gain of $14 million from

insurance proceeds received for a claim at a wholly-owned hotel that suffered damage from a storm, a $5 million

gain as a result of an acquisition of a controlling interest in a joint venture in which we previously held a non-

controlling interest (see Note 4) and a $4 million gain from the sale of non-hotel assets.

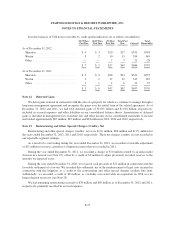

During the years ended December 31, 2012, 2011 and 2010, we reviewed the recoverability of the carrying

values of our owned hotels and determined that certain hotels or hotel assets were impaired. The fair values of

the hotels were estimated primarily from discounted cash flows models. Impairment charges totaling $2 million,

$7 million and $2 million, relating to two, six and one hotels, were recorded in the years ended December 31,

2012, 2011 and 2010, respectively, and to the following segment asset groups (in millions):

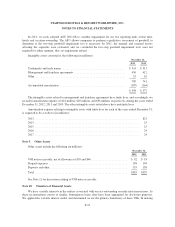

Year Ended December 31,

2012 2011 2010

Americas ...................................................... $— $5 $ 2

EAME ........................................................ 2 2 —

Total ........................................................ $ 2 $7 $ 2

Note 6. Assets Held for Sale

During the year ended December 31, 2012, we entered into a purchase and sale agreement for the sale of

certain wholly-owned hotels. We received a non-refundable deposit during the fourth quarter of 2012, and the

hotels and estimated goodwill of $4 million expected to be allocated to these assets have been reclassified as

assets held for sale as of December 31, 2012 and 2011. In connection with the anticipated sales, we recognized

an impairment charge of $4 million recorded to the gain (loss) on asset dispositions and impairments, net, line

item to reflect the fair market value of the properties based on the current market price less costs to sell. The sales

of these hotels, which are encumbered by franchise agreements, closed in January 2013, and we received gross

cash proceeds of approximately $36 million.

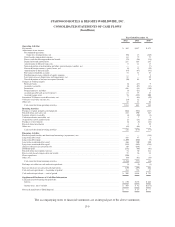

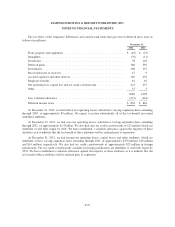

Note 7. Plant, Property and Equipment

Plant, property and equipment consisted of the following (in millions):

December 31,

2012 2011

Land and improvements ............................................. $ 554 $ 612

Buildings and improvements ......................................... 2,985 3,031

Furniture, fixtures and equipment ..................................... 1,876 1,852

Construction work in process ......................................... 169 244

5,584 5,739

Less accumulated depreciation and amortization .......................... (2,422) (2,507)

$ 3,162 $ 3,232

F-19