Starwood 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 59

EXECUTIVE COMPENSATION

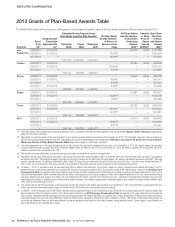

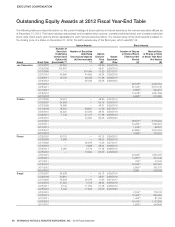

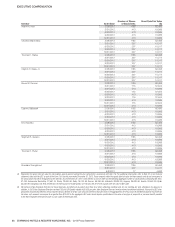

Name Grant Date

Option Awards Stock Awards

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable(1)(2)

Number of Securities

Underlying

Unexercised Options

(#) Unexercisable

(1)(2)

Option

Exercise

Price

($)(1)

Option

Expiration

Date

Number of Shares

or Units of Stock

That Have Not

Vested

(#)

Market Value

ofShares or Units

of Stock That Have

Not Vested

($)

Turner 5/07/2008 67,612 — 53.25 5/07/2016

2/27/2009 256,099 137,242 11.39 2/27/2017

2/26/2010 63,751 63,750 38.24 2/26/2018

2/28/2011 12,749 38,246 61.28 2/28/2019

2/28/2012 — 56,756 55.06 2/28/2020

2/26/2010 17,000(3) 975,120

2/28/2011 20,398(3) 1,170,029

3/01/2011 1,449(4) 83,115

2/28/2012 22,703(3) 1,302,244

3/01/2012 3,000(4) 172,080

Avril 2/28/2007 20,723 — 65.15 2/28/2015

2/28/2008 5,555 — 48.61 2/28/2016

2/27/2009 — 82,345 11.39 2/27/2017

2/26/2010 — 16,346 38.24 2/26/2018

2/28/2011 5,100 15,298 61.28 2/28/2019

2/28/2012 — 24,973 55.06 2/28/2020

2/26/2010 39,231(3) 2,250,290

2/28/2011 24,478(3) 1,404,058

3/01/2011 1,679(4) 96,307

2/28/2012 29,967(3) 1,718,907

3/01/2012 3,006(4) 172,424

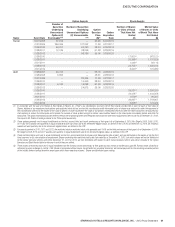

(1) In connection with the sale of 33 hotels to Host Hotels& Resorts, Inc. (“Host”), our stockholders received 0.6122 Host shares and $0.503 in cash for each of their ClassB

Shares. Holders of our employee stock options and restricted stock did not receive this consideration while the market price of shares was reduced to reflect the payment of

this consideration directly to the holders of the Class B Shares. In order to preserve the value of our options immediately before and after the Host transaction, we adjusted our

stock options to reduce the strike price and increase the number of stock options using the intrinsic value method based on the share price immediately before and after the

transaction. The option information provided reflects the number of options granted and the option exercise prices after these adjustments were made. As of December31, 2012,

this impacts Mr.Prabhu’s holdings related to his 2006 option award only.

(2) These options generally vest in equal installments on the first, second, third and fourth anniversary of their grant. As of September4, 2010, Mr.Siegel’s 2008, 2009, 2010,

2011 and 2012 awards vest quarterly in equal installments over four years due to his retirement-eligible status, as defined in the LTIP. As of December15, 2014, Mr.Prabhu’s

awards will vest quarterly due to his retirement-eligible status, as defined in the LTIP.

(3) For awards granted in 2010, 2011 and 2012, the restricted stock or restricted stock units generally vest 100% on the third anniversary of their grant. As of September4, 2010,

Mr.Siegel’s 2008, 2010 and 2011 awards vest quarterly in equal installments due to his retirement eligible status, as defined in the LTIP.

(4) These restricted stock units vest in equal installments on the first, second and third fiscal year-ends following the date of grant, and are distributed on the earlier of: (a)the third

fiscal year-end or (b)a termination of employment. Shares underlying the restricted stock units that vested as of December31, 2012, but which shares will not be distributed

to the named executive officers until either December31, 2013 or 2014, are non-forfeitable with respect to each named executive officer and will be included in the Option

Exercises and Stock Vested table for the year in which they are settled.

(5) These shares of restricted stock vest in equal installments on the first and second anniversary of their grant but may vest on an earlier basis upon Mr. Rivera’s death, disability or

retirement or upon a change in control. If Mr. Rivera is terminated without cause, he will forfeit any unvested shares but will receive payment for the remaining unvested portion

of the initially deferred annual incentive award upon which these awards are based. Shares are distributed upon vesting.