Starwood 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 39

EXECUTIVE COMPENSATION

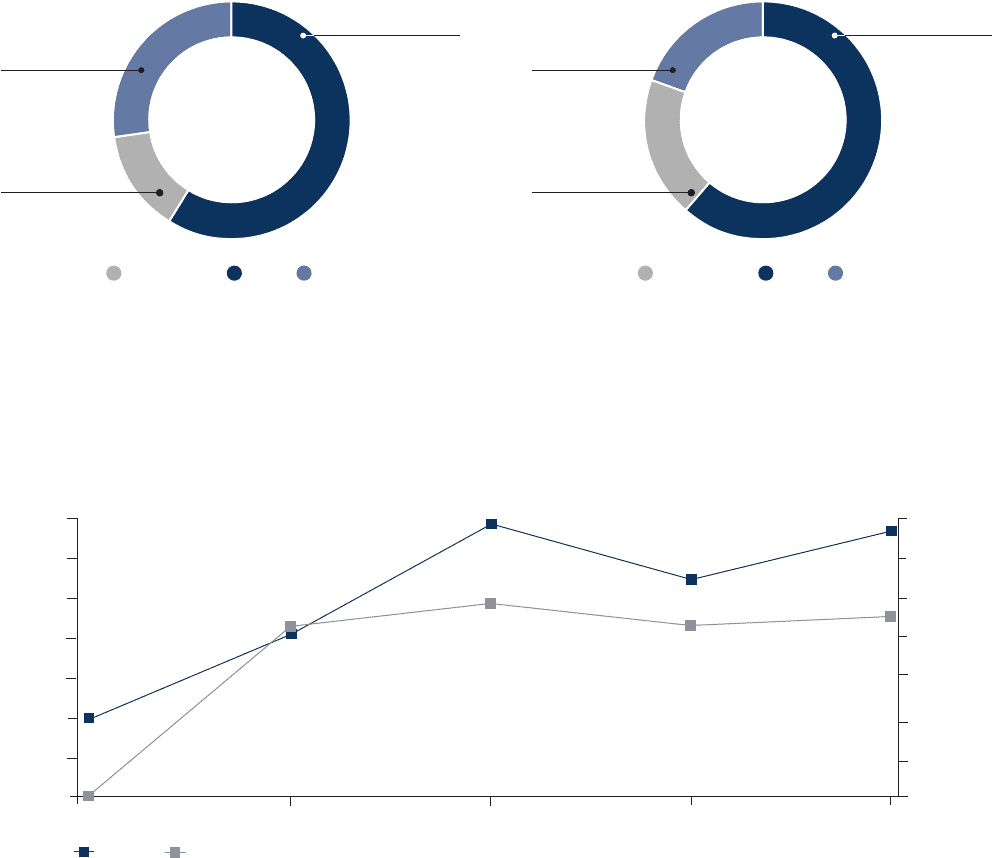

59%

14%

27%

CEO COMPENSATION MIX

LTIBase Salary Bonus

TARGET

61%

19%

19%

NEO COMPENSATION MIX

LTIBase Salary Bonus

TARGET

In addition, our 2012 pay decisions were in line with changes in our stock price, measured both on an annual and three-year basis.

Our one-year and three-year total stockholder return results, measured as of the end of 2012, were 22% and 63%, respectively. As

the chart below indicates, a comparison of the compensation that we have reported in the Summary Compensation Table since 2009

for Mr. van Paasschen has moved in tandem with our annual total stockholder return over the past four years:

TSR CEO Compensation

STOCK RETURN PERFORMANCE vs. CEO COMPENSATION

2008 2010

2009 2012

2011

0

50

100

150

200

250

300

350

TSR assuming investment of $100 on

December 31, 2008 ($) CEO Compensation ($ 000)

4,500

5,500

6,500

7,500

8,500

9,500

10,500

11,500

We believe that this chart demonstrates that we have effectively

operated an executive compensation program that has closely

linked CEO pay changes to the stock price results experienced

by our stockholders under Mr. van Paasschen’s leadership. For

purposes of this chart, total stockholder return includes the

reinvestment of dividends and is calculated on a compounded

annual growth rate basis.

Our analysis of our recent results, stock price performance and

trends in CEO pay demonstrate to us that our CEO pay decisions

in both 2012 and in recent years are closely aligned with Company

performance, and refl ect a balanced and responsible approach

to executive compensation.

Compensation Best Practices

For 2012, we engaged in the following pay practices, which we

believe align with market best practices, with respect to our named

executive offi cer compensation program:

•

All Incentive Awards Subject to Clawback—all incentive

awards received by any senior vice president or more senior

offi cer, including our named executive offi cers, remain subject to

a clawback policy that mandates repayment in certain instances

where there is a restatement of our fi nancial statements.

•

No Hedging Activities Linked to Company Stock — our offi cers

and directors, including our named executive offi cers, were

required to refrain from engaging in any hedging or monetization

transaction directly linked to company stock.