Starwood 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

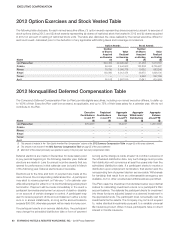

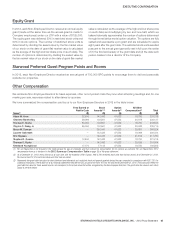

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 63

EXECUTIVE COMPENSATION

Mr.van Paasschen’s employment agreement provides that he

would be entitled to the following benefi ts if his employment were

terminated without cause or he resigned with good reason within

twelve months after a Change in Control or at any time prior to, but

in contemplation of, a Change in Control:

•

two times the sum of his base salary and target annual bonus;

•

a lump sum payment, in cash, equal to the unpaid incentive

compensation then subject to performance conditions, payable

at the maximum level of performance;

•

immediate vesting of stock options, restricted stock and

restricted stock units held under any stock option or long-term

incentive plan maintained by the Company;

•

a lump sum payment of his nonqualifi ed deferred compensation

paid in accordance with Section409A distribution rules;and

•

payment by us of an amount equal to any unvested amounts

in the executive’s 401(k) account that are forfeited by reason

of the executive’s termination of employment.

In addition, to the extent that Mr.van Paasschen becomes subject

to the “golden parachute” excise tax imposed under Section4999

of the Code, he would receive a gross-up payment in an amount

suffi cient to offset the effects of such excise tax.

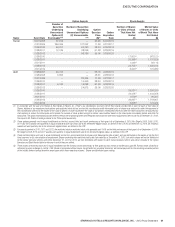

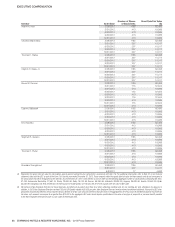

Estimated Payments Upon Termination

The tables below refl ect the estimated amounts payable to the named executive offi cers in the event their employment with us had

terminated as of December31, 2012 under various circumstances, and includes amounts earned through that date. The actual amounts

that would become payable in the event of an actual employment termination can only be determined at the time of such termination.

Involuntary Termination without Cause or Voluntary Termination for Good Reason

The following table discloses the amounts that would have become payable on account of an involuntary termination without cause or

a voluntary termination for good reason outside of the change in control context.

Name

Severance

Pay

($)

Medical

Benefi ts

($)

Vesting of

Restricted

Stock

($)(1)

Vesting of

Stock Options

($)(2)

Total

($)

van Paasschen 10,000,000 29,161 — — 10,029,161

Prabhu 766,785 10,721 4,256,055 1,851,083 6,884,644

Rivera 722,000 9,737 — — 731,737

Siegel 1,276,980 10,284 — — 1,287,264

Turner 766,785 10,284 — — 777,069

Avril(3) 222,111 16,082 3,654,3483 3,956,479 7,849,020

(1) Includes values for holdings of restricted stock and restricted stock units. With respect to Mr.Prabhu, includes vested but deferred restricted stock units in accordance with the

Executive Plan.

(2) Excludes vested stock options.

(3) Messrs.Siegel and Avril’s employment agreements provide for payments in the event of involuntary termination other than for cause but do not provide for payments in the event

of voluntary termination for good reason.

Termination on Account of Death or Disability

The following table discloses the amounts that would have become payable on account of a termination on account of death or disability.

Name

Severance

Pay

($)

Medical

Benefi ts

($)

Vesting of

Restricted

Stock

($)(1)

Vesting of

Stock Options

($)(2)

Total

($)

van Paasschen(3) 2,500,000 29,161 15,254,777 13,544,539 31,328,477

Prabhu 766,785 10,721 8,232,881 3,702,101 12,712,488

Rivera — — 3,827,002 3,247,558 7,074,560

Siegel 638,490 10,284 2,356,234 1,424,755 4,429,763

Turner 766,785 10,284 3,954,972 7,659,459 12,391,500

Avril 20,000 16,082 5,920,986 4,155,867 10,112,935

(1) Includes values for holdings of restricted stock and restricted stock units. Includes vested but deferred restricted stock units in accordance with the Executive Plan.

(2) Includes vested stock options. Vested stock options could be subject to loss by the named executive officers in the event of a termination for cause and certain other events but

could not in the event of termination on account of death or disability.

(3) Excludes $706,003 of Mr.van Paasschen’s nonqualified deferred compensation that is payable upon death, disability or certain changes in control as discussed in the section

entitled 2012 Nonqualified Deferred Compensation Table beginning on page60 of this proxy statement.