Starwood 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement6

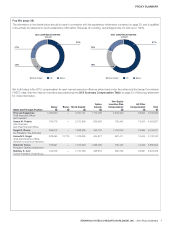

PROXY SUMMARY

Named Executive Offi cer Compensation (page37 )

Philosophy and Objectives (page 40 )

As a consumer lifestyle company with a branded hotel portfolio

at its core, we operate in a competitive, dynamic and challenging

business environment. In step with this mission and environment,

the key objectives for our compensation program for our named

executive offi cers for 2012 were to (1) attract and retain talented

executives from within and outside the hospitality industry who

understand the importance of innovation, brand enhancement and

consumer experience, (2) motivate our executives to sustain high

performance and achieve our fi nancial and strategic/operational/

leadership goals (without encouraging excessive risk taking), and (3)

align the investment interests of stockholders and the compensation

interests of our executives by linking executive compensation

to our annual business results and stock performance. More

specifi cally, our compensation program for our named executive

offi cers was designed to achieve:

•

Alignment with Stockholders – Signifi cant equity incentives with

stock ownership guidelines help ensure long-term compensation

is strongly linked to stockholder returns.

•Achievement of Company Financial Objectives – A portion

of named executive offi cer compensation is tied directly to our

fi nancial performance.

•

Achievement of Strategic/Operational/Leadership Objectives

– A portion of our named executive offi cer compensation depends

on the achievement of specifi c individual objectives that align with

the execution of our business strategy, as well as demonstrated

performance tied to our core leadership competencies that

include team building and the development of future talent.

2012 Compensation Highlights (page 37 )

Key highlights of our named executive offi cer compensation

program for fi scal 2012 included:

•

Base Salaries – Mr. van Paasschen did not receive an increase in

base salary in fi scal 2012. The base salaries of most other named

executive offi cers increased to more closely align these offi cers’

salaries with the median base salary of executives at peer companies.

•

Incentive Pay Largely Contingent Upon Our Performance

– Seventy-fi vepercent of our named executive offi cers’ total

target annual cash incentive opportunity was tied to our 2012

fi nancial results, representing no change in philosophy compared

to fi scal 2011.

•

Special Long-Term Cash Incentive Award – Mr. Rivera

received a payout of $1.1 million in settlement of a special

long-term cash incentive award originally granted to him in

2009 regarding our St. Regis Bal Harbour property. Although

the target payout for this award was $1.0 million, the Board paid

Mr. Rivera at 110% of target due to exceptional fi nancial results

that beat expectations, signifi cant outperformance against all

payment terms and overwhelming external positive reviews of

the property since it opened.

•

Modest Increase in Equity Grants – The total equity grants

made to our named executive offi cers increased by less than

5% when compared to fi scal 2011.

•

Pay Mix Geared Towards Variable Compensation – The

proportion of the CEO’s total compensation that was variable

was 86% in fi scal 2012, unchanged from fi scal 2011.

Elimination of Future Tax Gross-Ups—In line with market best

practice, the Compensation Committee agreed in 2012 that we

will no longer provide tax gross-ups other than those required to

be paid under existing employment agreements. In addition, Mr.

van Paasschen’s employment agreement renewal, discussed in

the section entitled New 2013 Employment Agreement with Mr.

van Paasschen beginning on page 50 of this proxy statement,

will not provide for any excise tax gross-up.

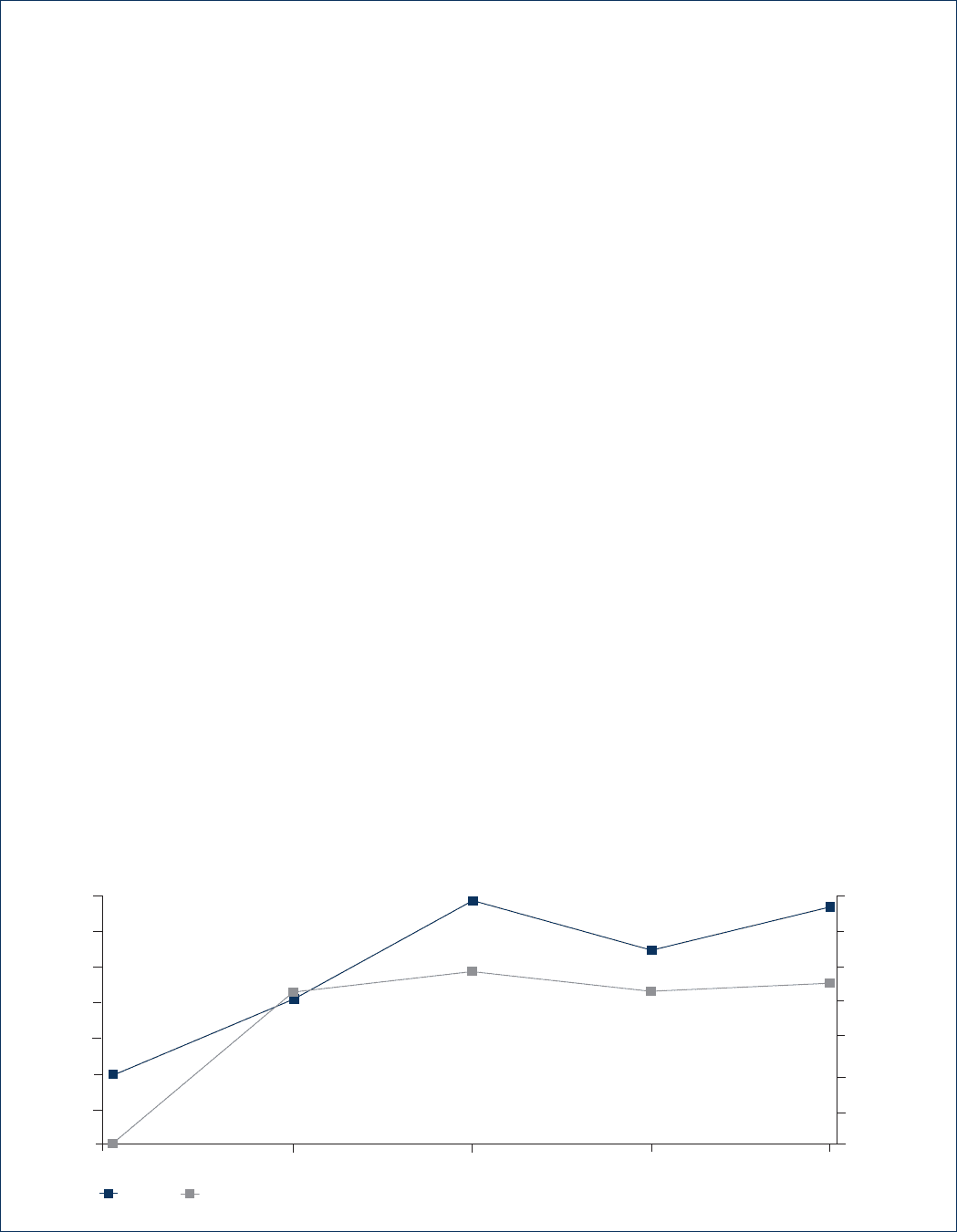

As the chart below indicates, a comparison of the compensation

that we have reported in the Summary Compensation Table since

2009 for Mr. van Paasschen has moved in tandem with our annual

total stockholder return over the past four years:

TSR CEO Compensation

STOCK RETURN PERFORMANCE vs. CEO COMPENSATION

2008 2010

2009 2012

2011

0

50

100

150

200

250

300

350

TSR assuming investment of $100 on

December 31, 2008 ($) CEO Compensation ($ 000)

4,500

5,500

6,500

7,500

8,500

9,500

10,500

11,500