Starwood 2012 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

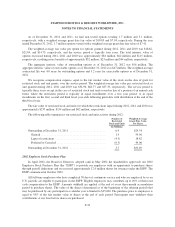

two interest rate swaps related to the 7.875% Senior Notes, which had notional amounts totaling $200 million (see

Note 23). As a result of the early redemption of the 7.875% Senior Notes, we recorded a net charge of

approximately $16 million in in the loss on early extinguishment of debt, net, line item in our statements of income,

representing the redemption premiums, swap settlements and other related redemption costs.

During the year ended December 31, 2011, we sold our interest in a consolidated joint venture which

resulted in the buyer assuming approximately $57 million of our mortgage debt.

During the year ended December 31, 2011, we entered into two interest rate swaps with a total notional

amount of $100 million, where we pay floating and receive fixed interest rates. These two interest rates swaps

were terminated in 2012 (see Note 23).

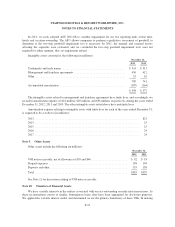

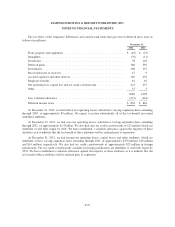

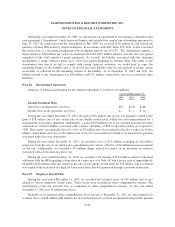

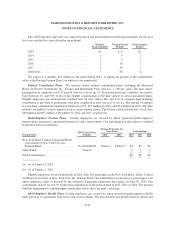

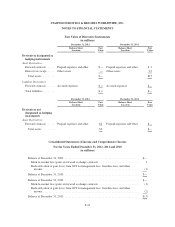

Note 16. Securitized Vacation Ownership Debt

Long-term and short-term securitized vacation ownership debt consisted of the following (in millions):

December 31,

2012 2011

2005 securitization, interest rates ranging from 5.25% to 6.29%, maturing 2013 .... $ 22 $ 37

2006 securitization, interest rates ranging from 5.28% to 5.85%, maturing 2018 .... 18 27

2009 securitization, interest rate at 5.81%, maturing 2015 ..................... 63 92

2010 securitization, interest rates ranging from 3.65% to 4.75%, maturing 2021 .... 138 190

2011 securitization, interest rates ranging from 3.67% to 4.82%, maturing 2026 .... 137 186

2012 securitization, interest rates ranging from 2.00% to 2.76%, maturing 2024 .... 155 —

533 532

Less current maturities ................................................. (150) (130)

Long-term debt ....................................................... $383 $402

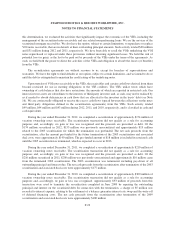

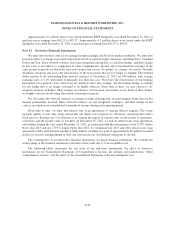

During the year ended December 31, 2012, we completed a securitization of approximately $174 million of

vacation ownership notes receivable (see Note 10).

During the years ended December 31, 2012 and 2011, interest expense associated with securitized vacation

ownership debt was $22 million.

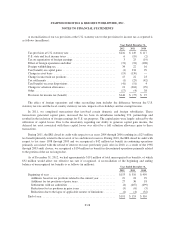

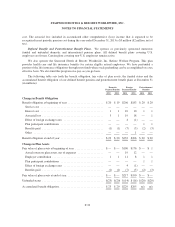

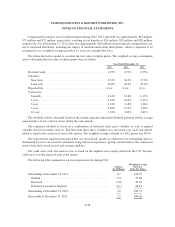

Note 17. Other Liabilities

Other liabilities consisted of the following (in millions):

December 31,

2012 2011

Deferred gains on asset sales ........................................... $ 944 $ 933

SPG point liability (a) ................................................. 733 724

Deferred revenue including VOI and residential sales ....................... 33 17

Benefit plan liabilities ................................................ 78 74

Insurance reserves ................................................... 45 47

Other ............................................................. 123 176

$1,956 $1,971

(a) Includes the actuarially determined liability related to the SPG program and the liability associated with the

American Express transaction discussed below.

F-31