Starwood 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

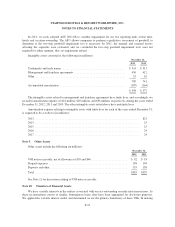

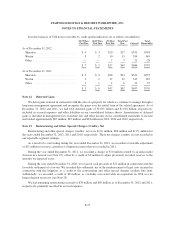

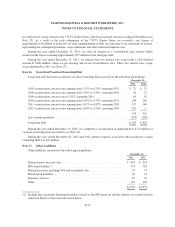

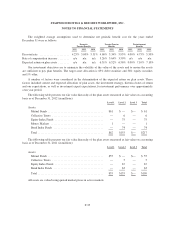

Past due balances of VOI notes receivable by credit quality indicators are as follows (in millions):

30-59 Days 60-89 Days >90 Days Total Past Total

Past Due Past Due Past Due Due Current Receivables

As of December 31, 2012

Sheraton ............................ $ 4 $ 3 $20 $27 $331 $358

Westin ............................. 3 2 10 15 334 349

Other .............................. — — 7 7 21 28

$ 7 $ 5 $37 $49 $686 $735

As of December 31, 2011

Sheraton ............................ $ 5 $ 3 $26 $34 $321 $355

Westin ............................. 3 2 17 22 345 367

Other .............................. 1 1 4 6 31 37

$ 9 $ 6 $47 $62 $697 $759

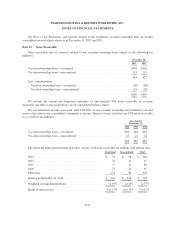

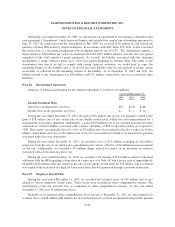

Note 12. Deferred Gains

We defer gains realized in connection with the sale of a property for which we continue to manage through a

long-term management agreement and recognize the gains over the initial term of the related agreement. As of

December 31, 2012 and 2011, we had total deferred gains of $1.035 billion and $1.018 billion, respectively,

included in accrued expenses and other liabilities in our consolidated balance sheets. Amortization of deferred

gains is included in management fees, franchise fees and other income in our consolidated statements of income

and totaled approximately $87 million, $87 million and $81 million in 2012, 2011 and 2010, respectively.

Note 13. Restructuring and Other Special Charges (Credits), Net

Restructuring and other special charges (credits), net were $(12) million, $68 million and $(75) million for

the years ended December 31, 2012, 2011 and 2010, respectively. These net charges (credits) are not recorded in

our reportable segment earnings.

As a result of a court ruling during the year ended December 31, 2012, we recorded a favorable adjustment

of $11 million to reverse a portion of a litigation reserve that we recorded in 2011.

During the year ended December 31, 2011, we recorded a charge of $70 million related to an unfavorable

decision in a lawsuit (see Note 25), offset by a credit of $2 million to adjust previously recorded reserves to the

amounts we expected to pay.

During the year ended December 31, 2010, we received cash proceeds of $75 million in connection with the

favorable settlement of a lawsuit. We recorded this settlement, net of the reimbursement of legal costs incurred in

connection with the litigation, as a credit to the restructuring and other special charges (credits) line item.

Additionally, we recorded a credit of $8 million, as a liability associated with an acquisition in 1998 was no

longer deemed necessary (see Note 25).

We had remaining restructuring accruals of $78 million and $89 million as of December 31, 2012 and 2011,

respectively, primarily recorded in accrued expenses.

F-25