Starwood 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 55

EXECUTIVE COMPENSATION

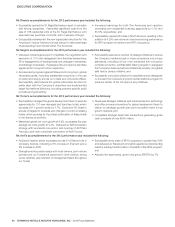

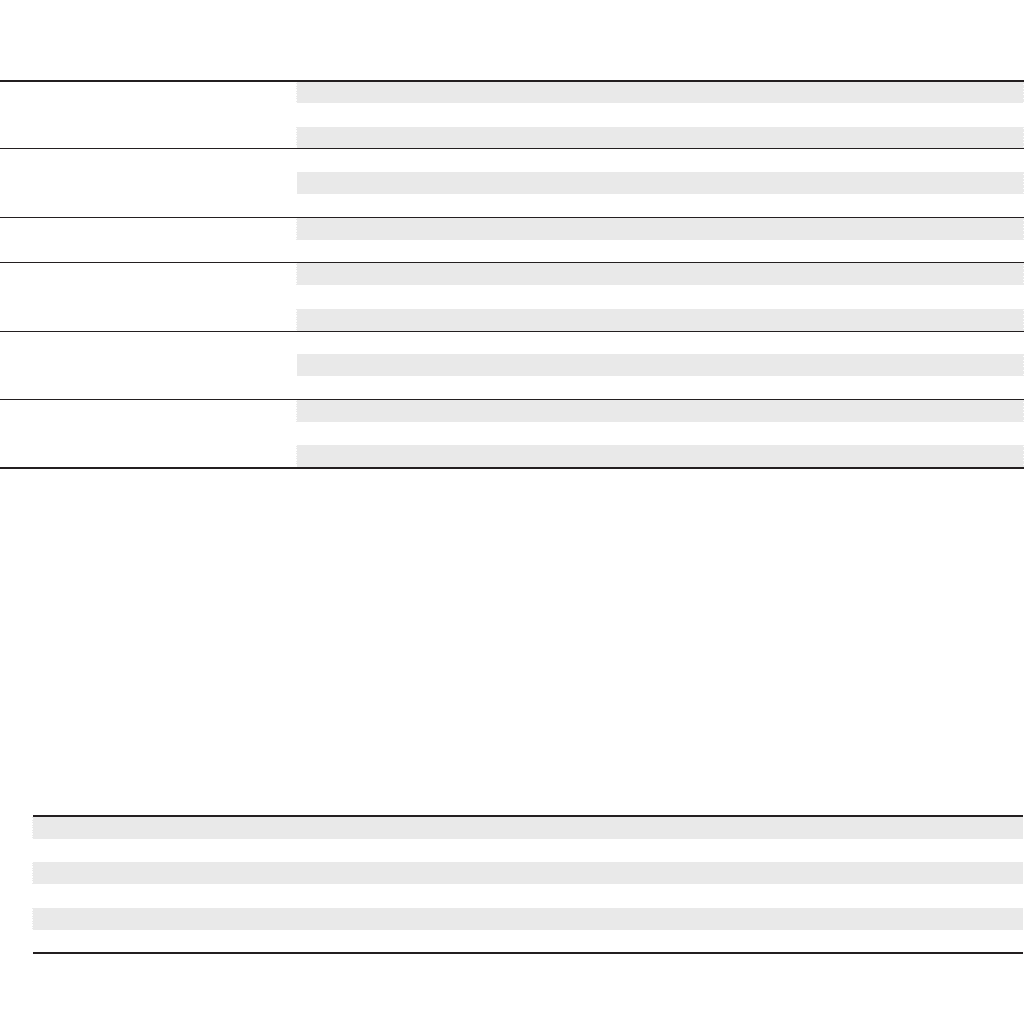

2012 Summary Compensation Table

The table below sets forth a summary of the compensation earned by the named executive offi cers for up to the past three years:

Name and Principal Position Year Salary

($)(1)

Bonus

($)(2)

Stock

Awards

($)(3)

Option

Awards

($)(4)

Non-Equity

Incentive Plan

Compensation

($)(5)

All Other

Compensation

($)(6)

Total

($)

Frits van Paasschen

Chief Executive Offi cer andPresident

2012 1,250,000 — 4,327,101 1,172,036 2,300,000 53,902 9,103,039

2011 1,250,000 — 3,997,530 1,125,465 2,450,000 32,863 8,855,858

2010 1,208,333 — 3,956,262 1,210,395 3,000,000 19,927 9,394,917

Vasant M. Prabhu

Vice Chairman

andChiefFinancial Offi cer

2012 764,279 — 2,310,809 639,296 705,443 10,000 4,429,827

2011 751,750 — 2,174,427 630,256 736,715 11,198 4,304,346

2010 733,235 — 2,312,035 726,243 902,100 9,800 4,683,413

Sergio D. Rivera

Co-President, The Americas

2012 669,912 — 1,258,469 255,726 1,764,240 26,894 4,005,241

Kenneth S. Siegel

Chief Administrative Offi cer,

General Counsel and Secretary

2012 638,490 12,770 1,476,605 404,877 587,411 10,000 3,130,153

2011 638,490 — 1,600,725 461,442 625,720 11,981 3,338,358

2010 634,582 — 1,468,148 459,953 766,188 9,800 3,338,671

Simon M. Turner

President, Global Development

2012 763,991 — 1,310,690 1,065,480 705,443 10,000 3,855,604

2011 733,142 — 1,314,216 1,125,465 735,020 9,800 3,917,643

2010 644,792 — 693,824 1,888,226 778,500 9,800 4,015,142

Matthew E. Avril

Former President, Hotel Group

2012 764,279 — 1,710,765 468,818 352,722 26,891 3,323,475

2011 751,750 — 1,574,435 450,186 736,715 10,557 3,523,643

2010 747,292 — 1,550,838 484,167 902,100 9,901 3,694,298

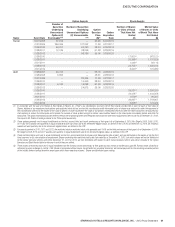

(1) Represents salary actually earned during the fiscal year listed.

(2) Represents a lump sum cash payment equal to 2% of Mr. Siegel’s 2012 base salary, which lump sum payment was provided instead of a salary increase for 2012. For more

information about this payment, see the section entitled 2012 Base Salary and Discretionary Payment beginning on page 42 of this proxy statement.

(3) Represents the grant date fair value for restricted stock and restricted stock unit awards granted during the year computed in accordance with Financial Accounting Standards

Board Accounting Standards Codification Topic 718, or ASC718. For additional information, refer to Note22 of our financial statements filed with the SEC as part of the

Form10-K for the year ended December31, 2012. These amounts reflect the grant date fair value for these awards and do not correspond to the actual value that will be

recognized by the named executive officers. See the 2012 Grants of Plan-Based Awards Table on page56 of this proxy statement for information on awards granted

in 2012.

(4) Represents the grant date fair value for stock option awards granted during the year computed in accordance with ASC718. For additional information, refer to Note22 of our

financial statements filed with the SEC as part of the Form10-K for the year ended December31, 2012. These amounts reflect the grant date fair value for these awards and

do not correspond to the actual value that will be recognized by the named executive officers. See the 2012 Grants of Plan-Based Awards Table on page56 of this

proxy statement for information on awards granted in 2012.

(5) Represents cash awards paid in March2013 with respect to performance in 2012, as discussed under the section entitled 2012 Annual Incentive Compensation

beginning on page 43 of this proxy statement and the payout for a special long-term cash incentive award for Mr. Rivera, as discussed under the section entitled 2012 Long-

Term Incentive Compensation beginning on page47 of this proxy statement. Cash incentive awards disclosed for 2011 include the following 2011 amounts that were

converted into restricted stock units in 2012 and such number of restricted stock units was increased by 33% in accordance with the Executive Plan (no amounts earned for

2012 performance were so deferred, as that program was discontinued with respect to the 2012 annual incentive program):

Name 2011AmountDeferred

van Paasschen 612,500

Prabhu 184,179

Rivera 177,057

Siegel 156,430

Turner 183,755

Avril 184,179

(6) The amounts reported in “All Other Compensation” for 2012 include our contributions to the Savings Plan of $10,000 for each NEO, life insurance premiums for Mr.van

Paasschen, chauffeured car service for Mr. van Paasschen of $16,732, company reimbursement for Mr. Rivera’s relocation of $16,894, and tax gross-up payments (including a

payment to Mr.van Paasschen in the amount of $12,361). Each officer’s perquisites and personal benefits for 2012 are less than $10,000, and no other item reported in this

column for 2012 has a value that exceeds $10,000 with the exception of spousal travel expenses for Mr. Avril of $11,985.