Starwood 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

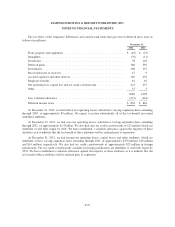

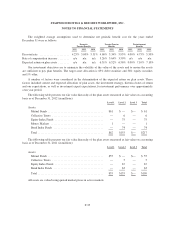

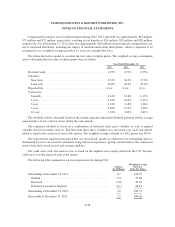

During the year ended December 31, 2009, we entered into an amendment to our existing co-branded credit

card agreement (“Amendment”) with American Express and extended the term of our co-branding agreement to

June 15, 2015. In connection with the Amendment in July 2009, we received $250 million in cash toward the

purchase of future SPG points by American Express. In accordance with ASC Topic 470, Debt, we have recorded

this transaction as a financing arrangement with an implicit interest rate of 4.5%. The Amendment requires a

fixed amount of $50 million per year to be deducted from the $250 million advance over the five-year period

regardless of the total amount of points purchased. As a result, the liability associated with this financing

arrangement is being reduced ratably over a five-year period beginning in October 2009. The terms of the

Amendment state that if we fail to comply with certain financial covenants, we would have to repay the

remaining balance of the liability, and, if we do not pay such liability, then we are required to pledge certain

receivables as collateral for the remaining balance of the liability. As of December 31, 2012 and 2011, the

liability related to the Amendment was $28 million and $72 million, respectively, and was recorded in other

liabilities.

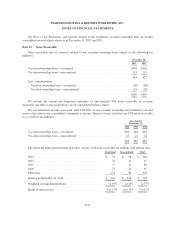

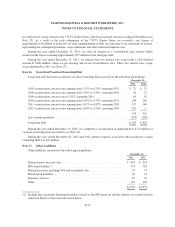

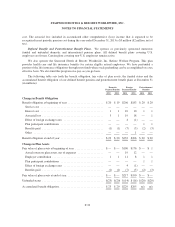

Note 18. Discontinued Operations

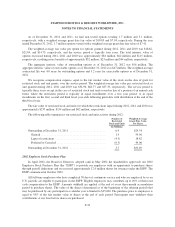

Summary of financial information for discontinued operations is as follows (in millions):

Year Ended December 31,

2012 2011 2010

Income Statement Data

Gain (loss) on disposition, net of tax ............................... $92 $(13) $168

Income (loss) from operations, net of tax ........................... $— $— $ (1)

During the year ended December 31, 2012, the gain of $92 million (net of tax) was primarily related to the

gain of $78 million (net of tax) on the sale of one wholly owned hotel, which was sold unencumbered by a

management or franchise agreement. Additionally, a gain of $23 million (net of tax) resulted from the favorable

settlement of certain liabilities associated with a former subsidiary of ITT Corporation, which we acquired in

1998. These gains were partially offset by a loss of $5 million (net of tax) related to the loss on the sale of four

wholly-owned hotels and a loss of $5 million (net of tax) for accrued interest related to an uncertain tax position

associated with a previous disposition.

During the year ended December 31, 2011, we recorded a loss of $13 million, including an $18 million

pretax loss from the sale of our interest in a consolidated joint venture, offset by a $10 million income tax benefit

on the sale. Additionally, we recorded a $5 million charge related to interest on an uncertain tax position

associated with a disposition in a prior year.

During the year ended December 31, 2010, we recorded a tax benefit of $134 million related to the final

settlement with the IRS regarding a disposition in a prior year (see Note 14) and a pretax gain of approximately

$3 million ($36 million after tax) related to the sale of one wholly-owned hotel for $78 million. The tax benefit

was related to the realization of a high tax basis in this hotel that was generated through a previous transaction.

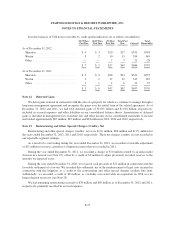

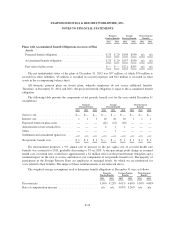

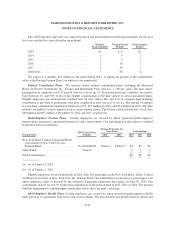

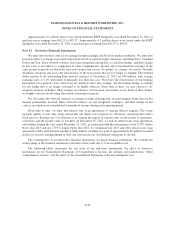

Note 19. Employee Benefit Plan

During the year ended December 31, 2012, we recorded net actuarial losses of $13 million (net of tax)

related to various employee benefit plans. These losses were recorded in other comprehensive income. The

amortization of the net actuarial loss, a component of other comprehensive income, for the year ended

December 31, 2012 was $2 million (net of tax).

Included in accumulated other comprehensive (loss) income at December 31, 2012 are unrecognized net

actuarial losses of $98 million ($86 million, net of tax) that have not yet been recognized in net periodic pension

F-32