Starwood 2012 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

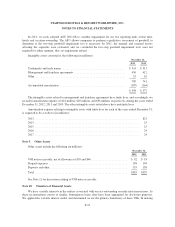

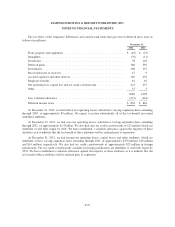

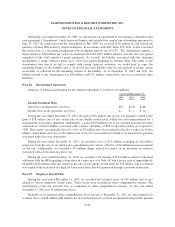

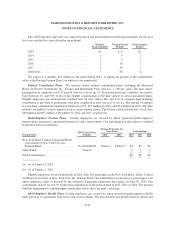

The tax effect of the temporary differences and carryforward items that give rise to deferred taxes were as

follows (in millions):

December 31,

2012 2011

Plant, property and equipment ......................................... $ (43) $ (23)

Intangibles ......................................................... (70) (11)

Inventories ......................................................... 58 118

Deferred gains ...................................................... 366 350

Investments ........................................................ 208 133

Receivables (net of reserves) .......................................... 47 9

Accrued expenses and other reserves .................................... 182 201

Employee benefits ................................................... 81 61

Net operating loss, capital loss and tax credit carryforwards .................. 223 257

Other ............................................................. 37 3

1,089 1,098

Less valuation allowance ............................................. (251) (234)

Deferred income taxes ................................................ $ 838 $ 864

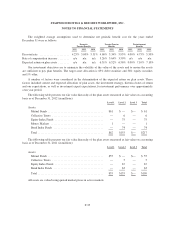

At December 31, 2012, we had federal net operating losses, which have varying expiration dates extending

through 2030, of approximately $9 million. We expect to realize substantially all of the tax benefit associated

with these attributes.

At December 31, 2012, we had state net operating losses, which have varying expiration dates extending

through 2032, of approximately $1.4 billion. We also had state tax credit carryforwards of $22 million which are

indefinite or will fully expire by 2026. We have established a valuation allowance against the majority of these

attributes as it is unlikely that the tax benefit of these attributes will be realized prior to expiration.

At December 31, 2012, we had foreign net operating losses, capital losses and other attributes, which are

indefinite or have varying expiration dates extending through 2031, of approximately $250 million, $19 million

and $14 million, respectively. We also had tax credit carryforwards of approximately $23 million in foreign

jurisdictions. The tax credit carryforwards available in foreign jurisdictions are indefinite or will fully expire by

2031. We have established a valuation allowance against the majority of these attributes as it is unlikely that the

tax benefit of these attributes will be realized prior to expiration.

F-27