Starwood 2012 Annual Report Download - page 168

Download and view the complete annual report

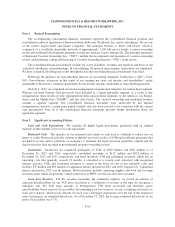

Please find page 168 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

We use the origination of the notes by brand (Sheraton, Westin, and Other) as the primary credit quality

indicator to calculate the loan loss reserve for the vacation ownership notes, as we believe there is a relationship

between the default behavior of borrowers and the brand associated with the vacation ownership property they

have acquired. In addition to quantitatively calculating the loan loss reserve based on our static pool analysis, we

supplement the process by evaluating certain qualitative data, including the aging of the respective receivables,

current default trends by brand and origination year, and the Fair Isaac Corporation (“FICO”) scores of the

buyers.

Given the significance of our pools of VOI notes receivable, a change in the projected default rate can have

a significant impact to our loan loss reserve requirements, with a 0.1% change estimated to have an impact of

approximately $4 million.

We consider a VOI note receivable delinquent when it is more than 30 days outstanding. All delinquent

loans are placed on nonaccrual status, and we do not resume interest accrual until payment is received. Upon

reaching 120 days outstanding, the loan is considered to be in default, and we commence the repossession

process. Uncollectible VOI notes receivable are charged off when title to the unit is returned to us. We generally

do not modify vacation ownership notes upon default or that become delinquent.

For the hotel segments, we measure the impairment of a loan based on the present value of expected future

cash flows, discounted at the loan’s original effective interest rate, or the estimated fair value of the collateral.

For impaired loans, we establish a specific impairment reserve for the difference between the recorded

investment in the loan and the present value of the expected future cash flows or the estimated fair value of the

collateral. We apply the loan impairment policy individually to all loans in the portfolio and do not aggregate

loans for the purpose of applying such policy. For loans that we have determined to be impaired, we recognize

interest income on a cash basis.

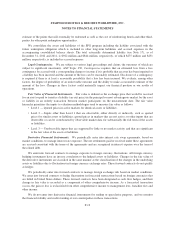

Assets Held for Sale. We consider properties to be assets held for sale when management approves and

commits to a formal plan to actively market a property or group of properties for sale and a signed sales contract

and significant non-refundable deposit or contract break-up fee exists. Upon designation as an asset held for sale,

we record the carrying value of each property or group of properties at the lower of its carrying value which

includes allocable segment goodwill or its estimated fair value, less estimated costs to sell, and we stop recording

depreciation expense. Any gain realized in connection with the sale of a property for which we have significant

continuing involvement (such as through a long-term management agreement) is deferred and recognized over

the initial term of the related agreement (See Note 12). The operations of the properties held for sale prior to the

sale date are recorded in discontinued operations unless we will have significant continuing involvement (such as

through a management or franchise agreement) after the sale.

Investments. Investments in joint ventures are generally accounted for under the equity method of

accounting when we have a 20% to 50% ownership interest or exercise significant influence over the venture. If

our interest exceeds 50% or, if we have the power to direct the economic activities of the entity and the

obligation to absorb losses, then the results of the joint venture are consolidated herein. All other investments are

generally accounted for under the cost method.

The fair market value of investments is based on the market prices for the last day of the period if the

investment trades on quoted exchanges. For non-traded investments, fair value is estimated based on the

underlying value of the investment, which is dependent on the performance of the investment as well as the

volatility inherent in external markets. In assessing potential impairment for an investment, we will consider

these factors as well as the forecasted financial performance of the investment. If the forecast is not met, we may

have to record an impairment charge.

F-11